Global Functional Foods Market

The Global Functional Foods Market is analyzed in this report across ingredient source, product type, form, distribution channel, and region, highlighting major trends and growth forecasts for each segment.

Let's Get You Started!

Fill out the quick form below and our academic advisor will connect with you shortly.

- 11/09/2025

- FMCG

Introduction

Functional foods are becoming a cornerstone of the global health and wellness movement, offering targeted nutritional benefits that go well beyond basic sustenance. Designed to enhance functions such as digestion, immunity, cardiovascular health, and chronic disease prevention, these products are reshaping consumer expectations of what food can deliver. The rising emphasis on preventive health, coupled with heightened awareness around nutrition, is accelerating global demand for functional foods.

Valued at approximately USD 215.2 billion in 2024, the functional foods market is projected to reach USD 354.5 billion by 2030, growing at a CAGR of 8.5%. This expansion is underpinned by several key drivers: the increasing prevalence of lifestyle-related diseases, an aging global population, rising healthcare costs, and a rapidly growing base of health-conscious consumers. Advances in food science, biotechnology, and the clean-label movement are also playing a pivotal role in shaping market evolution.

Market Dynamics

The functional foods market is undergoing rapid growth, driven by converging economic, demographic, and consumer behavior shifts.

Rising health awareness, the surge in chronic disease incidence, and a pronounced shift toward prevention are reshaping consumer behavior across age groups. As more individuals seek foods that deliver tangible health benefits, manufacturers are responding with enhanced formulations featuring ingredients such as probiotics, omega-3s, prebiotics, antioxidants, and plant-based proteins. The integration of these functional elements into familiar product categories is driving widespread adoption across mainstream food and beverage segments.

The market offers strong growth potential for both incumbents and new entrants. Emerging areas of opportunity include the clean-label and natural ingredient space, personalized nutrition, and health domains such as metabolic function, cognitive performance, and immune support. The plant-based and vegan movement, particularly among younger demographics, is spurring demand for botanical-based innovation and alternative protein formats. Moreover, advances in nutrigenomics are allowing brands to personalize offerings to genetic profiles, increasing both product efficacy and consumer trust.

Several key trends are redefining the market landscape. These include the use of adaptogens and nootropics in functional formulations, the rising popularity of functional beverages for convenient nutrition, and escalating consumer interest in gut-health products built around probiotics and fermentation. Notable recent product developments reflect this trend: Danone’s launch of Oikos protein shakes in May 2025, aimed at GLP-1 users, responds to demand for metabolic health-focused nutrition, while Nestlé’s Vital Pursuit range caters to portion-controlled, high-protein frozen meals. Similarly, Unilever’s reformulations of Magnum and Yasso brands to reduce sugar reflect a wider push toward health-optimized indulgence. Chr. Hansen’s continued investment in targeted probiotic strains underscores the growing demand for science-backed microbiome health solutions.

Sustainability is also becoming central to innovation, with greater focus on ethical sourcing, recyclable packaging, and minimal processing. Functional foods are increasingly designed to support mental wellness, sleep quality, and sustained energy — addressing the full spectrum of lifestyle and well-being needs in a way that aligns with consumer expectations for convenience, transparency, and responsibility.

Segment Highlights and Performance Overview

By Ingredient Source

Natural ingredients dominate the market, comprising approximately 74% to 75% of the ingredient source segment. This leadership reflects growing consumer demand for clean-label, organic, and plant-based formulations. Products made from herbal extracts, fermented components, and whole grains are favored for their perceived safety, nutritional value, and environmental sustainability. The continued push for ingredient transparency and holistic wellness is reinforcing the strength of this segment.

By Product Type

Vitamins and minerals represent the largest share of the product type segment, contributing roughly 30% to 35% of the global functional food ingredient market. Their versatility and effectiveness in supporting immunity, bone health, and metabolic function make them a staple across categories, including fortified dairy, cereals, and beverages. As health education improves globally, these micronutrients remain a cornerstone of functional food innovation.

By Form

The food segment leads in form factor, accounting for approximately 42% to 45% of the market. Consumers gravitate toward functional foods that seamlessly integrate into daily routines—such as fortified dairy, cereals, snack bars, and infant nutrition—without requiring major lifestyle changes. This preference, supported by advances in clean-label formulations and product innovation, cements the dominance of food-based delivery formats.

By Distribution Channel

Supermarkets and hypermarkets command the largest share of distribution, capturing around 44% to 46% of global sales. These outlets offer high visibility, broad assortments, and the convenience modern consumers expect. Retail marketing tactics—ranging from packaging to in-store education—enhance discovery and conversion, making this channel a critical driver of market penetration and brand engagement.

Geographical Analysis

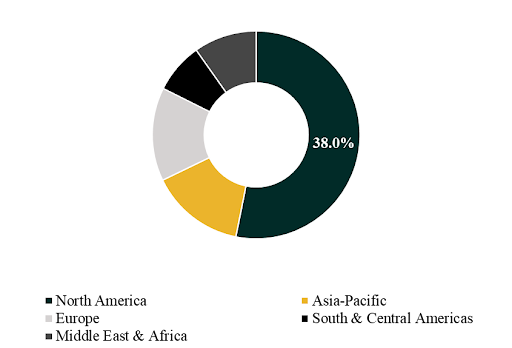

North America leads the global functional foods market, accounting for approximately 38% of total revenues. The region’s dominance is attributed to high health literacy, a mature food and beverage sector, and elevated consumer demand for nutrition-rich, convenience-oriented products. The widespread prevalence of obesity, diabetes, and other chronic conditions has further fueled the adoption of functional food solutions aimed at prevention and long-term wellness.

Asia-Pacific is poised for the fastest growth, with a projected CAGR between 8.5% and 10.5%. Rising disposable incomes, expanding urban populations, and increasing awareness of health and nutrition are key growth enablers across China, India, Japan, and South Korea. The region’s unique blend of traditional nutrition practices and modern health trends—combined with growing organized retail—makes it a high-opportunity frontier for functional food expansion.

Competition Landscape

The competitive landscape is shaped by a mix of global food conglomerates, specialized ingredient suppliers, and emerging wellness brands. Companies are competing through innovation in formulation, clean-label positioning, and partnerships that extend reach and credibility. As consumer demand evolves, the pressure to deliver nutrition-forward, convenient, and science-backed products continues to drive strategic differentiation.

Key players profiled in this report include Nestlé S.A., Danone S.A., Unilever PLC, General Mills, Inc., The Kraft Heinz Company, PepsiCo, Inc., Arla Foods amba, Abbott Laboratories, Meiji Holdings Co., Ltd., Chr. Hansen Holding A/S, Cargill, Incorporated, and BASF SE.

Recent Developments

- In May,, 2024, Nestlé S.A. launched Vital Pursuit, a high-protein frozen meal line specifically targeting users of GLP-1 medications. This initiative marks a strategic entry into personalized functional foods designed for metabolic health, signaling a broader industry shift toward clinically aligned, outcome-focused nutrition.

- In May, 2025, Danone S.A. acquired a majority stake in Kate Farms, enhancing its capabilities in plant-based medical nutrition across North America. This acquisition strengthens Danone’s presence in the medical functional foods segment and reflects growing demand for specialized, plant-based dietary care.

Segmentation:

By Ingredient Source:

- Natural

- Synthetic

By Product Type:

- Probiotics & Prebiotics

- Vitamins & Minerals

- Dietary Fibers

- Proteins & Amino Acids

- Phytochemicals & Plant Extracts

- Others

By Form:

- Food

- Dairy Products

- Bakery & Cereals

- Snack Bars

- Infant Foods

- Others

- Beverages

- Functional Juices

- Sports & Energy Drinks

- Fortified Water

- Tea & Coffee

- Supplements

- Tablets & Capsules

- Powders

- Gummies

- Liquid Drops

By Distribution Channel:

- Supermarkets & Hypermarkets

- Convenience Stores

- Pharmacies/Drug Stores

- Online Retail

- Specialty Stores

- Others

Companies included in the report:

- Nestlé S.A.

- Danone S.A.

- Unilever PLC

- General Mills, Inc.

- The Kraft Heinz Company

- PepsiCo, Inc.

- Arla Foods amba

- Abbott Laboratories

- Meiji Holdings Co., Ltd.

- Chr. Hansen Holding A/S

- Cargill, Incorporated

- BASF SE

Need Deeper Insights or Custom Analysis?

Contact Blackwater Business Consulting to explore how this data can drive your strategic goals.