Global Sustainable Packaging Market

The Global Sustainable Packaging Market is analyzed in this report across material type, packaging type, process, end-use industry, and region, highlighting major trends and growth forecasts for each segment.

Let's Get You Started!

Fill out the quick form below and our academic advisor will connect with you shortly.

- 14/09/2025

- FMCG

Introduction

Sustainable packaging is rapidly evolving into a cornerstone of global industry transformation, driven by mounting environmental concerns and the push for circular economic models. Businesses are rethinking packaging strategies to achieve a dual objective: high performance and environmental responsibility. This shift is fostering innovation across materials science, manufacturing processes, and end-of-life recycling. Emerging approaches include compostable formats, bio-based polymers, post-consumer recycled materials, and minimalist designs that reduce resource consumption without compromising functionality.

The global sustainable packaging market is on a strong growth trajectory, projected to reach USD 256.4 billion by 2030. Key growth factors include stricter environmental regulations, increased consumer awareness, the accelerating pace of e-commerce, and a surge in corporate ESG commitments. Consumer loyalty is increasingly tied to sustainability credentials, reinforcing demand. The market was valued at USD 116.5 billion in 2024 and is expected to grow at a CAGR of 8% through the forecast period.

Market Dynamics

The sustainable packaging sector is undergoing dynamic change, fueled by a convergence of regulatory shifts, consumer expectations, and environmental imperatives.

Primary growth drivers include the global urgency to curb plastic pollution, regulatory enforcement of sustainable packaging practices, and the rising demand for ethically produced products. Businesses are under intensifying pressure to meet sustainability goals and comply with policies such as plastic bans, Extended Producer Responsibility (EPR), and carbon reduction frameworks. In response, industries are shifting toward recyclable, compostable, biodegradable, and reusable materials in alignment with circular economy principles. At the same time, innovations in bio-based polymers, molded fiber, and seaweed-derived packaging are enabling new applications and improving environmental outcomes.

Significant growth opportunities are emerging across key industries, including food and beverage, personal care, e-commerce, pharmaceuticals, and consumer electronics. Innovations in refillable systems, smart packaging, and compostable alternatives are gaining traction. Companies are advancing closed-loop packaging solutions and enhancing supply chain transparency to meet stakeholder expectations and differentiate their brands. For example, Berry Global has invested in a UK-based closed-loop polypropylene recycling facility to scale up post-consumer recycled content, while Tetra Pak is integrating QR-based traceability features into its packaging. Industry trends also point to rising adoption of mono-material and minimalist designs for easier recycling, growing use of digital printing and lifecycle tracking, and integration of AI and IoT to optimize packaging performance. Collaborations across the supply chain — from raw material providers to brand owners and recyclers — are further driving standardization and infrastructure improvements. As these shifts accelerate, sustainable packaging is becoming a strategic lever for innovation, brand equity, and long-term value creation.

Segment Highlights and Performance Overview

By Material Type

Plastic remains the leading material in sustainable packaging, accounting for approximately 43% of the market share. Its continued dominance is attributed to its lightweight nature, cost-effectiveness, and widespread use across industries. While traditional plastics are increasingly scrutinized, the market is being sustained by innovations in recyclable, biodegradable, and bio-based alternatives. The development of post-consumer recycled (PCR) plastics and closed-loop recycling systems is also supporting ongoing demand within this category.

By Packaging Type

Rigid packaging holds the largest share in this segment, representing around 60% of the total market. Its structural durability, protective characteristics, and extensive application in sectors like food, beverages, and personal care make it the preferred choice. Rigid formats are essential for maintaining product integrity during transport and retail display. The growing use of recyclable rigid containers made from materials such as molded fiber, bioplastics, and paperboard is further reinforcing the strength of this segment in the sustainable packaging market.

By Process

Recyclable packaging is the clear leader, comprising nearly 73% of the market by process. It remains the most widely scalable and accepted solution among both manufacturers and consumers. Companies are increasingly opting for recyclable materials like PET, HDPE, paperboard, and aluminum to align with evolving regulations and rising consumer expectations. The expansion of recycling infrastructure and global momentum behind circular economy models continue to drive the prominence of recyclable formats over reusable or biodegradable alternatives.

By End-Use Industry

The food and beverage industry accounts for the largest share of end-use applications, contributing approximately 50% to 56% of the total segment. This dominance stems from the sector’s high packaging volume and growing regulatory and consumer pressure to replace single-use plastics with sustainable alternatives. Whether through compostable, recyclable, or reusable formats, food and beverage companies are prioritizing solutions that maintain product safety and shelf life while aligning with sustainability goals. The segment’s strong position is further reinforced by rising consumer demand for environmentally responsible food and drink packaging.

Geographical Analysis

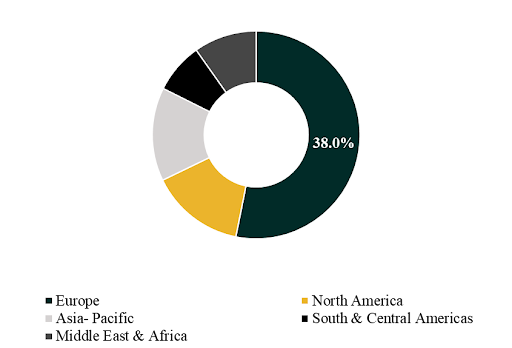

The global sustainable packaging market is assessed across five major regions: North America, Europe, Asia-Pacific, South & Central America, and the Middle East & Africa.

Europe leads the market, accounting for approximately 35%–38% of the global share. Its leadership is underpinned by stringent environmental regulations, high consumer environmental awareness, and robust recycling infrastructure. The region’s proactive policy stance—anchored by the EU Packaging and Packaging Waste Directive—has catalyzed adoption of recyclable, compostable, and reusable packaging formats. Countries such as Germany, France, and the Netherlands are advancing ambitious sustainability targets and supporting infrastructure, reinforcing the region’s market dominance.

Asia-Pacific, meanwhile, is projected to post the highest growth rate, with a forecasted CAGR of 7.5% to 8.5%. This rapid expansion is fueled by increasing environmental awareness, urbanization, and rising consumption of packaged goods in high-growth economies such as China, India, and Indonesia. The region’s booming e-commerce sector, along with growing government investment in sustainable packaging technologies, is accelerating the shift toward eco-conscious materials. Expanding capabilities in biodegradable and bio-based packaging solutions are further positioning the Asia-Pacific as a major growth engine for the global market.

Competition Landscape

The competitive landscape of the sustainable packaging market is defined by a mix of global packaging giants, innovative materials companies, and eco-focused startups. Players are competing through technological advancements in biodegradable and recyclable materials, strategic collaborations, and investment in circular economy infrastructure to meet escalating regulatory and consumer demands.

Key players covered in the report include Amcor plc, Ball Corporation, Sealed Air Corporation, Berry Global Inc., Mondi Group, Smurfit Kappa, Tetra Pak, DS Smith, International Paper, and WestRock Company.

Recent Developments

- On May 7, 2025, Ball Corporation received four EMBANEWS Awards in Brazil for its innovations in sustainable packaging, notably for its ReAl® aluminum alloy, which reduces material use by up to 15%. The company also introduced the first braille-embossed energy drink can, underscoring its commitment to inclusive and resource-efficient design. These developments are boosting demand in Latin America for aluminum-based packaging solutions that are both sustainable and accessible.

- On March 21, 2025, Mondi Group launched its Cradle-to-Cradle certified PERGRAPHICA® premium papers (up to 350 g/m²) at LUXE PACK Shanghai, along with IQ BOARD and IQ GRASS+. This positions Mondi as a frontrunner in sustainable luxury packaging, addressing the rising demand for eco-conscious solutions in the premium consumer goods segment and advancing the adoption of certified sustainable materials.

Segmentation:

By Material Type:

- Plastic

- Paper & Paperboard

- Glass

- Metal

By Packaging Type:

- Rigid

- Flexible

By Process:

- Recyclable

- Reusable

- Biodegradable

By End-Use Industry:

- Food & Beverages

- Personal Care & Cosmetics

- Healthcare

- Others

Companies included in the report:

- Amcor plc

- Ball Corporation

- Sealed Air Corporation

- Berry Global Inc.

- Mondi Group

- Smurfit Kappa

- Tetra Pak

- DS Smith

- International Paper

- WestRock Company

Need Deeper Insights or Custom Analysis?

Contact Blackwater Business Consulting to explore how this data can drive your strategic goals.