Global Unmanned Aerial Vehicles Market

The Global Unmanned Aerial Vehicles Market is analyzed in this report across type, weight, range, mode of operation, applications, end-use industry, and region, highlighting major trends and growth forecasts for each segment.

Let's Get You Started!

Fill out the quick form below and our academic advisor will connect with you shortly.

- 08/01/2024

- Aerospace & Defense

Introduction

Unmanned Aerial Vehicles (UAVs) are rapidly emerging as one of the most transformative segments in both defense and commercial domains. They are redefining how surveillance, logistics, inspection, and tactical operations are conducted across industries worldwide. From military intelligence and agriculture to infrastructure monitoring, disaster response, and last-mile delivery, UAVs are driving a wave of innovation that is reshaping global operations.

The UAV industry is experiencing exceptional growth, with projections placing its value at USD 74.7 billion by 2030. This expansion is being propelled by ongoing defense modernization efforts, surging demand for advanced monitoring solutions, rapid technological progress in autonomy, and the broadening scope of commercial drone applications. Organizations are increasingly turning to UAVs for their cost-efficiency, operational effectiveness, and ability to deliver real-time intelligence. In 2024, the market stood at approximately USD 35.2 billion, with expectations to grow at a CAGR of 13.36% through the forecast period.

Market Dynamics

The UAV sector is undergoing rapid transformation, fueled by a confluence of technological, strategic, and regulatory forces across defense, commercial, and civil landscapes. Market momentum is being driven by growing investments in defense modernization, the rising need for cost-effective surveillance and inspection systems, and major advancements in autonomous flight technologies, sensor integration, and propulsion systems.

UAVs are becoming central to operations in agriculture, logistics, infrastructure inspection, and disaster response by enabling automation, lowering risk, and improving overall efficiency. In the defense space, UAVs are significantly enhancing intelligence, surveillance, and reconnaissance (ISR) capabilities. Commercial sectors are also leveraging UAVs for applications such as last-mile delivery, geospatial mapping, and environmental monitoring. For example, India’s Defence Research and Development Organisation (DRDO) has introduced a range of UAVs—from tactical systems to high-altitude platforms—to elevate national surveillance capabilities.

At the same time, geopolitical and regulatory developments are shaping global dynamics. The U.S. Department of the Treasury has imposed sanctions on entities linked to destabilizing UAV transfers, underscoring the strategic sensitivity of UAV proliferation. Meanwhile, the global shift toward beyond-visual-line-of-sight (BVLOS) operations and improved regulatory clarity is paving the way for broader UAV adoption.

Significant growth opportunities are emerging across logistics, precision agriculture, infrastructure monitoring, and smart city implementations. Defense agencies continue to invest in tactical, MALE, and HALE UAV systems to reinforce operational readiness, while enterprises are scaling drone use for aerial analytics and data acquisition. UAVs are also becoming indispensable in disaster response, medical supply transport, and environmental surveillance, thereby enhancing resilience and sustainability across various industries.

The market is also being shaped by key trends such as the rise of drone-in-a-box solutions, AI-driven autonomous navigation, and hybrid propulsion systems that extend flight duration. Swarm drone technology is gaining ground in both defense and commercial scenarios, enabling synchronized multi-drone operations. The integration of UAVs with IoT and 5G networks is further unlocking capabilities like real-time data transmission, predictive maintenance, and intelligent mobility. These advancements are accelerating the transition from manually piloted drones to highly autonomous, networked, and scalable aerial platforms, driving widespread adoption and creating new business models.

Segment Highlights and Performance Overview

By Type

Rotary-Wing UAVs lead the market, holding approximately 62% share due to their versatility and VTOL (Vertical Take-Off and Landing) capabilities. Their adaptability across military and commercial missions—ranging from surveillance and inspection to logistics—makes them especially valuable for operations in confined or complex environments.

By Weight

UAVs weighing less than 25 kg dominate the weight category, accounting for 43–45% of the market. These lightweight models offer portability, lower operational costs, and greater maneuverability, making them ideal for high-frequency commercial tasks such as crop monitoring, infrastructure inspection, and short-range delivery.

By Range

Long-range UAVs with a coverage of 200 km or more hold the top position in this category, representing a market share of 53–54%. Their extended endurance makes them indispensable for military surveillance and strategic reconnaissance, while also meeting commercial demands for wide-area mapping and long-distance cargo transport.

By Mode of Operation

Remotely Piloted UAVs maintain dominance, with around 61% market share. Their operational reliability, mature control infrastructure, and adaptability across ISR missions and industrial inspections continue to support their widespread use across defense and commercial sectors.

By Applications

Intelligence, Surveillance, and Reconnaissance (ISR) remains the leading application segment, capturing roughly 58% of the market. Defense forces globally rely on ISR UAVs for real-time data gathering, border security, and tactical decision-making, cementing their critical role in mission planning and situational awareness.

By End-Use Industry

The Military & Defense sector holds the largest share at approximately 56%. UAVs are deeply embedded in tactical operations, combat support, and strategic surveillance initiatives. Continuous defense investments and modernization programs are reinforcing the segment’s long-term market leadership.

Geographical Analysis

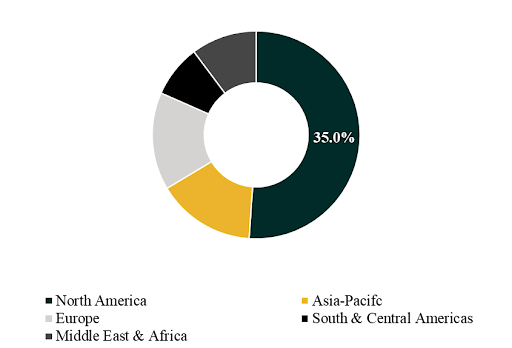

The global UAV market spans five core regions: North America, Europe, Asia-Pacific, South & Central America, and the Middle East & Africa.

North America leads with an estimated 35% share, supported by robust defense programs, a mature UAV manufacturing base, and strong commercial uptake in agriculture, logistics, and infrastructure sectors.

The Asia-Pacific region is projected to post the fastest growth, with a CAGR between 18% and 22%, fueled by strategic investments in UAV technology, supportive regulatory frameworks, and surging adoption across China, India, Japan, and South Korea. Both defense and commercial applications are expanding rapidly across the region.

Competition Landscape

The UAV industry features a competitive mix of established aerospace and defense giants, agile commercial drone firms, and emerging tech startups. Market players are competing through innovation, strategic alliances, and geographic expansion to capture market share and build long-term advantage.

Key companies profiled in the report include:

Baykar Technologies, AeroVironment, Inc., ZALA Aero Group, UAVision Aeronautics, Wingcopter GmbH, Israel Aerospace Industries, Elbit Systems Ltd., Lockheed Martin Corporation, General Atomics Aeronautical Systems, Inc., Boeing, Northrop Grumman Corporation, BAE Systems plc, SAAB AB, Yuneec International, and Autel Robotics.

Recent Developments

- In March 2025, Wingcopter launched a lidar-enabled drone capable of surveying up to 60 km (37 miles) of linear infrastructure in a single mission. This advancement is expanding the market for BVLOS-capable UAVs, particularly in infrastructure inspection and commercial surveying, by enabling more efficient, high-precision operations.

- In July 2025, Israel Aerospace Industries (IAI) unveiled the APUS 25 tactical drone, delivering up to 8 hours of flight time via a hybrid-fuel propulsion system. This innovation is setting new performance standards in tactical UAVs, driving demand for long-endurance platforms optimized for strategic defense and surveillance missions.

Segmentation:

By Type:

- Fixed-Wing UAVs

- Rotary-Wing UAVs

By Weight:

- < 25 kg

- 25 – 150 kg

- >150 kg

By Range:

- 5 – 50 km

- 50 – 200 km

- 200 km+

By Mode of Operation:

- Remotely Piloted UAVs

- Semi-Autonomous UAVs

- Fully Autonomous UAVs

By Applications:

- Intelligence, Surveillance, Reconnaissance (ISR)

- Target simulation & training

- Crop monitoring

- Infrastructure inspection

- Logistics & delivery

- Others

By End-Use Industry:

- Military & Defense

- Commercial & Civil

- Government & Law Enforcement

Companies included in the report:

- Baykar Technologies

- AeroVironment, Inc.

- ZALA Aero Group

- UAVision Aeronautics

- Wingcopter GmbH

- Israel Aerospace Industries

- Elbit Systems Ltd.

- Lockheed Martin Corporation

- General Atomics Aeronautical Systems, Inc.

- Boeing

- Northrop Grumman Corporation

- BAE Systems plc

- SAAB AB

- Yuneec International

- Autel Robotics

Need Deeper Insights or Custom Analysis?

Contact Blackwater Business Consulting to explore how this data can drive your strategic goals.