Global Plant-Based Food & Beverage Market

The Global Plant-Based Food & Beverage Market is analyzed in this report across product type, source, nature, distribution channel, and region, highlighting major trends and growth forecasts for each segment.

Let's Get You Started!

Fill out the quick form below and our academic advisor will connect with you shortly.

- 01/01/2024

- FMCG

Introduction:

The plant-based food & beverage market is rapidly emerging as a transformative force within the global food and beverage industry. These products—derived from plant sources such as nuts, grains, seeds, and legumes—are reshaping consumer preferences by offering dairy-free, vegan, and health-forward alternatives. With rising demand for clean-label, lactose-free, and nutritionally balanced drinks, plant-based beverages are gaining traction across mainstream and niche markets alike. Key applications include non-dairy milks such as almond, oat, soy, and coconut, as well as ready-to-drink functional beverages, protein shakes, smoothies, and more.

The global plant-based food & beverage market is experiencing robust growth and is projected to reach USD 45.8 billion by 2030. This expansion is being driven by rising rates of lactose intolerance, growing awareness around animal welfare, and a global shift toward vegan and flexitarian lifestyles. In parallel, heightened consumer focus on health, wellness, and natural ingredients is accelerating the shift toward plant-based drink alternatives. Valued at approximately USD 22.5 billion in 2024, the market is expected to grow at a CAGR of 9% over the forecast period.

Market Dynamics

The growth of the plant-based food & beverage market is being driven by a powerful convergence of health awareness, environmental responsibility, and evolving lifestyle choices. Core factors accelerating market expansion include the rising incidence of lactose intolerance and dairy sensitivity, increasing demand for functional, clean-label drinks, and a broader global movement toward sustainable consumption. Consumers are seeking beverages that align with their values—nutritionally beneficial, ethically produced, and environmentally sound—prompting brands to innovate across both formulation and format.

This demand is closely linked to the growing popularity of vegan, flexitarian, and plant-forward diets, with high-performing categories including almond milk, oat milk, soy-based drinks, and value-added smoothies. The sustainability credentials of plant-based beverages—featuring lower carbon footprints and reduced water usage—are particularly compelling to environmentally conscious consumers seeking dairy alternatives that support planetary health.

The market presents compelling opportunities for players across both retail and foodservice sectors. Manufacturers are investing in R&D to develop fortified beverages enhanced with proteins, vitamins, probiotics, and other functional ingredients aligned with wellness trends. New formats, including ready-to-drink (RTD) offerings and plant-based lattes, are driving diversification in cafés, QSR chains, and convenience retail. Growth is especially pronounced in emerging markets, where rising urbanization and lifestyle shifts are fueling demand for on-the-go, health-conscious drink options. Meanwhile, the direct-to-consumer (D2C) model is gaining momentum, with personalized subscription offerings and strong digital engagement fostering deeper brand loyalty.

Notable industry trends include the soaring popularity of oat milk, particularly in barista-style beverages. This is exemplified by Oatly’s Barista Edition and its recent partnership with Nespresso to launch oat-milk coffee capsules. There is also increased integration of superfoods such as turmeric, matcha, and adaptogens, driven by consumer interest in functional health benefits. The rise of clean-label and sustainable packaging—as seen in Califia Farms’ recyclable PET bottles and simplified ingredient lists—is further shaping consumer expectations. Brands are increasingly emphasizing ingredient transparency and ethical sourcing to build trust. On the production side, advancements in enzymatic treatment and ultra-filtration technologies are enhancing product quality, nutritional retention, and shelf stability. Collectively, these trends reflect a fast-evolving market centered on delivering functional, eco-conscious beverages with superior taste and convenience.

Segment Highlights and Performance Overview

By Product Type

Beverages dominate the product type segment, accounting for approximately 75% of the plant-based category. This is driven by the widespread adoption of non-dairy milk alternatives such as almond, soy, oat, and coconut, alongside a growing market for RTD smoothies, protein shakes, and plant-based lattes. Consumers are prioritizing functional, health-boosting beverages that also offer convenience—positioning this segment as the core driver of innovation and investment.

By Source

Almond-based products represent the largest share by source, with approximately 37% of the global market. Almond milk’s mild flavor, low calorie content, and consumer perception as a healthy dairy alternative have made it a leading choice. Its versatility, especially in coffee, cereals, and barista-style drinks, continues to support its dominant position in the plant-based beverage landscape.

By Nature

Conventional products account for around 85.5% of the total market, owing to their broad availability, affordability, and strong retail presence. While organic plant-based beverages are gaining attention for their clean-label appeal, conventional options remain the most accessible choice—especially in price-sensitive and emerging markets where cost and distribution reach are key factors.

By Distribution Channel

Supermarkets and hypermarkets lead among distribution channels, contributing approximately 49–50% of global sales. These large-format stores offer extensive shelf space, high product visibility, and the benefit of bulk purchasing and promotions. Their established infrastructure and wide reach make them essential to mainstream consumer adoption across demographic segments.

Geographical Analysis

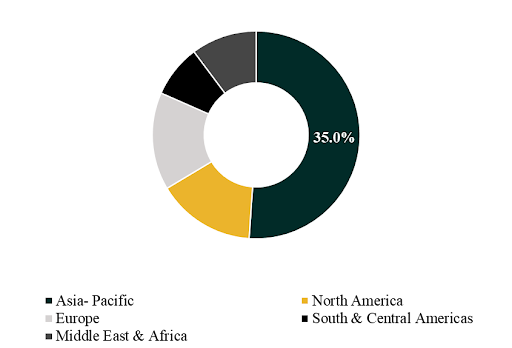

The plant-based food and beverage market is assessed across North America, Europe, Asia-Pacific, South & Central America, and the Middle East & Africa.

Asia-Pacific holds the largest share of the global plant-based food & beverage market, driven by longstanding cultural preferences for plant-based diets, high rates of lactose intolerance, and rising consumption of soy, coconut, and almond drinks. Key markets such as China, India, Japan, and Australia are experiencing significant growth due to urbanization, increasing health consciousness, and rising disposable incomes. Government policies that promote plant-based nutrition and sustainability are further accelerating adoption.

The region is also projected to register the highest CAGR, estimated between 12% and 13%, during the forecast period. Market expansion is being driven by product innovation, diversified distribution strategies, including e-commerce, and targeted marketing to younger, health-conscious demographics. With its leadership in both value and growth, Asia-Pacific is positioned as the global epicenter of the plant-based beverage movement.

Competition Landscape

The global plant-based food & beverage market is highly competitive, with participation from multinational food conglomerates, emerging health-focused brands, and disruptive startups. Companies are competing through functional innovation, fortified product development, sustainable packaging, and strategic collaborations that meet evolving consumer needs.

Key players profiled in the report include: Danone S.A., The Hain Celestial Group, Nestlé S.A., Oatly Group AB, Califia Farms, Ripple Foods, Beyond Meat Inc., Impossible Foods Inc., Unilever, and Monde Nissin.

Recent Developments

- In February 2024, Danone S.A. opened a state-of-the-art oat-based beverage facility in Villecomtal-sur-Arros, France, with a production capacity of 300,000 liters per day, supplying 26 European markets. This investment significantly enhances Danone’s production scalability and regional responsiveness, positioning the company to meet growing demand for oat-based drinks across Europe.

- On January 28, 2025, Oatly Group AB partnered with Nespresso to launch Oatly Barista Edition coffee pods in Canada, offering oat milk–infused capsules tailored for premium coffee drinkers. The collaboration extends plant-based innovation into the single-serve coffee capsule segment, strengthens Oatly’s brand presence in North America, and reinforces its leadership in barista-style oat products.

Segmentation:

By Product Type:

- Food-

- Plant-based Meat

- Plant-based Fish

- Dairy alternatives

- Condiments

- Dressings

- Mayo

- Beverage-

- Milk

- RTD Beverages

- Functional & Nutritional Drinks

- Other Drinks

By Source:

- Soy

- Almond

- Pea

- Wheat

- Coconut

- Cashew

- Others

By Nature:

- Organic

- Conventional

By Distribution Channel:

- Supermarkets/Hypermarkets

- Convenience Stores

- Specialty Stores

- E-Commerce Platforms

- Foodservice (HoReCa)

Companies included in the report:

- Danone S.A.

- The Hain Celestial Group

- Nestlé S.A.

- Oatly Group AB

- Califia Farms

- Ripple Foods

- Beyond Meat Inc.

- Impossible Foods Inc.

- Unilever

- Monde Nissin

Need Deeper Insights or Custom Analysis?

Contact Blackwater Business Consulting to explore how this data can drive your strategic goals.