Global Missile Defense Systems Market: Innovation Highlights, Growth Drivers, and Industry Shifts 2025–2030

The Global Missile Defense Systems Market is analyzed in this report across system type, platform, range, guidance system, application, and region, highlighting major trends and growth forecasts for each segment.

Let's Get You Started!

Fill out the quick form below and our academic advisor will connect with you shortly.

- Aerospace & Defense

The Global Missile Defense Systems Market is analyzed in this report across system type, platform, range, guidance system, application, and region, highlighting major trends and growth forecasts for each segment.

Introduction

Missile Defense Systems (MDS) have emerged as a vital pillar of modern defense architecture, designed to detect, intercept, and neutralize threats such as ballistic missiles, cruise missiles, and hypersonic weapons. These systems play a strategic role in national security by protecting military assets, safeguarding civilian populations, and reinforcing regional deterrence capabilities.

The global MDS market is experiencing strong growth, propelled by rising investment in advanced technologies, including radar systems, interceptors, and directed energy weapons. Escalating geopolitical tensions, territorial disputes, and the rapid evolution of airborne threats are key forces behind growing demand. Government-driven modernization programs, active cross-border conflicts, and the accelerated development of hypersonic missile systems are further fueling global adoption. In 2024, the market was valued at USD 28.44 billion and is projected to reach USD 39.98 billion by 2030, expanding at a CAGR of 5.88% over the forecast period.

Market Dynamics

The global missile defense systems industry is undergoing rapid expansion, shaped by intensifying geopolitical challenges, rising defense budgets, and sustained technological innovation. Key market drivers include the growing prevalence of advanced missile technologies, particularly hypersonic weapons, and an increasing frequency of regional conflicts. Governments are prioritizing the modernization of national defense infrastructures to counter evolving threats and ensure long-term strategic readiness.

Europe has made notable strides through initiatives like the White Paper for European Defence–Readiness 2030, which outlines a framework to address capability shortfalls, promote joint procurement, and increase defense spending across member states. In parallel, India continues to advance its domestic missile defense initiatives via the Defence Research and Development Organisation (DRDO), focusing on systems such as the Advanced Air Defence (AAD) and Prithvi Air Defence (PAD). These developments highlight the strategic urgency in both regions to strengthen national and regional defense ecosystems.

Significant growth opportunities are emerging in multi-layered defense systems, naval and space-based deployment platforms, and next-generation technologies like AI-powered targeting and laser interceptors. Cross-border partnerships for joint development and procurement are expanding the global market footprint.

Key trends include deeper integration of AI and machine learning for autonomous threat identification, adoption of network-centric command architectures, and the prioritization of scalable, cost-effective solutions. Directed energy weapons, such as high-power lasers and particle beam systems, are gaining traction for their rapid response capabilities and low operational cost per engagement. Furthermore, a shift toward multi-domain integration is reshaping MDS strategies, with land, air, sea, and space assets working in coordination. This transition marks a move from reactive interception to a proactive, layered defense framework equipped to counter next-generation threats.

Segment Highlights and Performance Overview

By System Type

Ballistic Missile Defense Systems (BMD) lead this category, accounting for roughly 40%–45% of the market. This dominance is driven by the growing proliferation of ballistic threats and the central role of BMD solutions in national defense strategies. Global investment in these systems continues to rise across both developed and emerging markets.

By Platform

Land-based platforms hold the largest share within the platform segment, contributing approximately 45%–50% of market value. Their widespread deployment, cost-effectiveness, and adaptability across terrain types make them integral to national and regional missile defense frameworks. These systems form the foundation of most multi-layered defense networks.

By Range

Missile defense systems with a range of 300–1000 km represent the leading segment, capturing about 35%–40% of the market. These systems strike a balance between cost and operational coverage, offering effective regional protection. Governments are prioritizing their deployment to shield key infrastructure and urban areas from mid-range threats.

By Guidance System

Radar-guided systems dominate this segment, with an estimated 40%–45% market share. Radar’s ability to deliver reliable detection, tracking, and engagement under various operational conditions makes it indispensable. Enhanced integration with command-and-control infrastructure is further driving global demand.

By Application

Homeland defense remains the top application area, representing 45%–50% of the market. National security priorities, including protection of borders, critical assets, and population centers, are driving robust investment in homeland missile defense. The expansion of integrated, multi-layered systems continues to support growth in this segment.

Geographical Analysis

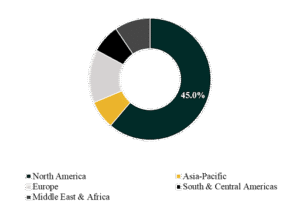

The global missile defense systems market is segmented across North America, Europe, Asia-Pacific, South & Central America, and the Middle East & Africa.

North America maintains the largest regional share, approximately 45%, supported by advanced military infrastructure, sustained investment in system modernization, and leadership in radar and interceptor technologies.

Asia-Pacific is expected to post the highest growth, with a projected CAGR of 6%–8%. This surge is fueled by aggressive military modernization, escalating geopolitical tensions, and growing demand for advanced defense solutions in key nations such as China, India, Japan, and South Korea.

Competition Landscape

The missile defense systems market is defined by intense competition among leading defense contractors, innovation-driven tech companies, and specialized solution providers. Firms are vying for leadership through cutting-edge technologies, long-term defense contracts, and cross-border strategic alliances.

Major players profiled in this report include Lockheed Martin Corporation, RTX Corporation, Northrop Grumman Corporation, The Boeing Company, General Dynamics Corporation, BAE Systems plc, MBDA, Thales Group, Israel Aerospace Industries, Rafael Advanced Defense Systems, and Kongsberg Gruppen ASA.

Recent Developments

- In April 2024, Lockheed Martin announced a contract with the U.S. Missile Defense Agency (MDA) to develop the Next Generation Interceptor (NGI), a key enhancement to U.S. homeland missile defense capabilities. This initiative is expected to accelerate global innovation and strengthen demand for high-performance interceptor technologies.

- In September 2025, Raytheon secured a $1.7 billion contract to develop the Lower Tier Air and Missile Defense Sensor (LTAMDS), a next-generation radar system for the U.S. Army. This advancement underscores growing interest in cutting-edge radar technologies and is set to drive further demand for integrated air and missile defense solutions.

Segmentation:

By System Type:

- Ballistic Missile Defense Systems (BMD)

- Cruise Missile Defense Systems

- Anti-Ship Missile Defense Systems

- Hypersonic Missile Defense Systems

- Others

By Platform:

- Land-Based

- Naval-Based

- Airborne-Based

- Space-Based

By Range:

- Below 300 km

- 300–1000 km

- 1000–3500 km

- Above 3500 km

By Guidance System:

- Radar-Guided Systems

- Thermal-Guided Systems

- Laser-Guided Systems

- GPS-Guided Systems

- Multi-Sensor Guided Systems

By Application:

- Homeland Defense

- Tactical Battlefield Defense

- Naval Defense Operations

- Airspace Protection

- Advanced Threat Defense

Companies included in the report:

- Lockheed Martin Corporation

- RTX Corporation

- Northrop Grumman Corporation

- The Boeing Company

- General Dynamics Corporation

- BAE Systems plc

- MBDA

- Thales Group

- Israel Aerospace Industries

- Rafael Advanced Defense Systems

- Kongsberg Gruppen ASA

Need Deeper Insights or Custom Analysis?

Contact Blackwater Business Consulting to explore how this data can drive your strategic goals.