Global Satellite NTN Market: Innovative Developments, Future Growth Avenues, and Industry Landscape 2025–2030

The Global Satellite NTN Market is analyzed in this report across orbit, component, application, end-use industry, and region, highlighting major trends and growth forecasts for each segment

Let's Get You Started!

Fill out the quick form below and our academic advisor will connect with you shortly.

- Aerospace & Defense

The Global Satellite NTN Market is analyzed in this report across orbit, component, application, end-use industry, and region, highlighting major trends and growth forecasts for each segment

Introduction

Satellite Non-Terrestrial Networks (NTNs) are redefining global connectivity by extending network access to regions beyond the reach of traditional terrestrial infrastructure. Through the integration of satellite systems across Low Earth Orbit (LEO), Medium Earth Orbit (MEO), and Geostationary Orbit (GEO), NTNs enable expansive coverage, low-latency communication, and enhanced reliability. These systems support a broad spectrum of applications, including broadband delivery in underserved areas, direct-to-device connectivity, Internet of Things (IoT) integration, and secure communications for sectors such as defense, aviation, maritime, and emergency response.

The global Satellite NTN market is experiencing unprecedented growth, with projections indicating it will reach USD 89.26 billion by 2030. This surge is driven by escalating demand for high-speed, ubiquitous internet access, the rapid expansion of IoT ecosystems, and the growing need for resilient and mission-critical connectivity. Further acceleration is fueled by digital inclusion initiatives, increased real-time data requirements, and government-backed programs aimed at ensuring universal network coverage. With a 2024 market value of approximately USD 16.2 billion, the industry is expected to grow at a CAGR of 32.9%, underscoring its transformative role in the future of global communications.

Market Dynamics

The Satellite NTN market is undergoing rapid transformation, propelled by a confluence of technological and strategic factors reshaping the global connectivity landscape. Key growth drivers include soaring demand for always-on broadband access, integration of satellite systems into 5G and future 6G networks, and continuous advancements in satellite miniaturization, payload design, and cost-effective launch solutions. The merging of terrestrial and non-terrestrial networks is enabling seamless, low-latency, and reliable communication essential for remote, mobile, and underserved environments.

NTNs are increasingly being adopted for applications such as direct-to-device connectivity, maritime and aviation communication, and disaster resilience—making them foundational infrastructure for global digital inclusion. The market presents substantial opportunities, particularly in expanding satellite-enabled smartphone services, scaling IoT and M2M applications, and supporting secure government and defense communication systems. Companies are also leveraging cloud integration, edge computing, and software-defined networking to deliver flexible, scalable NTN services. Strategic collaborations among satellite operators, telecom providers, and tech vendors are unlocking hybrid deployment models and accelerating commercialization.

Policy and regulatory frameworks are also evolving in support of NTN growth. For example, the Broadband India Forum (BIF) highlighted in its 2021 whitepaper the critical role of NTNs in extending 5G beyond terrestrial limits. Likewise, a 2020 report from the Information Technology and Innovation Foundation (ITIF), in partnership with the U.S. NTIA, emphasized the importance of spectrum access and policy support for successful satellite-5G convergence.

Several key trends are shaping the market’s evolution. These include the deployment of large-scale LEO constellations, increasing focus on reconfigurable, software-defined payloads, and the adoption of 3GPP NTN standards to unify satellite-terrestrial integration. Direct-to-device (D2D) services are gaining traction, enabling smartphones to connect directly to satellites without modification. NTNs are also being positioned as critical tools for public safety, emergency response, and disaster recovery. Industry momentum is accelerating as public-private partnerships, telecom alliances, and satellite mega-constellation projects move from pilot stages to full-scale commercial rollouts.

Segment Highlights and Performance Overview

By Orbit

Low Earth Orbit (LEO) satellites lead the market with over 49% share of the orbit segment. Their dominance is attributed to advantages such as lower latency, high data throughput, and cost-effective deployment compared to MEO and GEO alternatives. The rise of LEO mega-constellations aimed at global broadband and direct-to-device services continues to reinforce their market position.

By Component

Earth Infrastructure & Hardware accounts for approximately 43% to 50% of the market, making it the largest component segment. The growing deployment of satellite constellations is driving demand for supporting infrastructure such as ground stations, gateways, terminals, and antennas. Additionally, integration with terrestrial 5G networks is fueling the need for advanced, interoperable hardware solutions.

By Application

Enhanced Mobile Broadband (eMBB) represents the largest application area, reflecting the surging need for high-speed connectivity across remote and underserved locations. eMBB is central to 5G NTN initiatives, supporting data-heavy applications such as video streaming, cloud computing, and mobile broadband—particularly in regions with limited terrestrial coverage.

By End-Use Industry

Government & Defense leads the end-use segment, contributing approximately 25–35% of total market demand. NTNs are being deployed for secure communications, real-time surveillance, disaster management, and military operations. Continued focus on national security and the need for resilient infrastructure are driving strong uptake within defense and strategic government programs.

Geographical Analysis

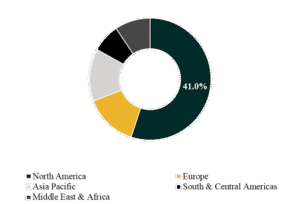

The Satellite NTN market is assessed across five key regions: North America, Europe, Asia-Pacific, South & Central America, and the Middle East & Africa.

North America holds the largest share—approximately 41%—supported by early adoption of satellite-5G integration, strong defense and government investment, and the presence of major satellite and telecom players. Meanwhile, the Asia-Pacific region is forecast to achieve the highest CAGR, estimated between 40% and 48%. This growth is being driven by the urgent demand for broadband in underserved areas, increased adoption of satellite communication in industrial sectors, and major government-led initiatives in countries like China, India, and Japan.

Competition Landscape

The global Satellite NTN market is marked by intense competition among established satellite operators, telecom carriers, and next-generation technology firms. Companies are competing through satellite constellation launches, deep-tech innovation, and cross-industry partnerships focused on 5G and direct-to-device services.

Key players profiled in this report include SpaceX, AST SpaceMobile, OneWeb, SES, Inmarsat, Iridium Communications, Globalstar, Telesat, Rivada Networks, and Spire Global. These companies are advancing global coverage strategies, pioneering new use cases, and investing heavily in scalable satellite architectures to secure market leadership.

Key Developments

- In June 2025, SpaceX launched a significant batch of satellites, including 806 Starlink v2 Minis, 104 Direct-to-Cell (DTC) units, and 44 Starshield satellites. This brought its DTC constellation to 674 satellites, positioning the company to exit beta and begin U.S. service rollout with T-Mobile. This aggressive deployment is accelerating Direct-to-Cell market readiness and intensifying pressure on competitors to expedite their own launches and partnerships.

- In July 2025, AST SpaceMobile formed a joint venture, SatCo, with Vodafone to build a Europe-wide direct-to-device mobile network. Headquartered in Luxembourg, the initiative is scheduled to begin rollout in 2026. This strategic alliance enhances AST’s competitive edge in the European NTN space and signals a broader industry shift as telecom operators pursue satellite integration to expand their service footprints.

Segmentations

By Orbit:

- Low Earth Orbit (LEO)

- Medium Earth Orbit (MEO)

- Geostationary Orbit (GEO)

By Component:

- In-Orbit Infrastructure

- Satellites

- Payloads

- Launch Services

- Earth Infrastructure & Hardware

- User Equipment

- Gateways & Terminals

- Network Management Systems

- Services

- Connectivity Services

- Managed Services

- Others

By Application:

- Enhanced Mobile Broadband (eMBB)

- Massive Machine-Type Communications (mMTC)

- Ultra-Reliable Low-Latency Communication (URLLC)

- Direct-to-Device (D2D)

- Broadcasting & Content Delivery

- Government & Defense Communications

By End-Use Industry:

- Telecommunication Operators

- Government & Defense

- Maritime & Aviation

- Automotive & Transportation

- Energy & Utilities

- Agriculture & Environment

- Public Safety & Disaster Management

Companies:

- SpaceX

- AST SpaceMobile

- OneWeb

- SES

- Inmarsat

- Iridium Communications

- Globalstar

- Telesat

- Rivada Networks

- Spire Global

Need Deeper Insights or Custom Analysis?

Contact Blackwater Business Consulting to explore how this data can drive your strategic goals.