Global Space Defense Market: Innovative Developments, Future Growth Avenues, and Industry Landscape 2025–2030

The Global Space Defense Market is analyzed in this report across system architecture, function, layer of operation, business model, end-user, and region, highlighting major trends and growth forecasts for each segment.

Let's Get You Started!

Fill out the quick form below and our academic advisor will connect with you shortly.

- Aerospace & Defense

The Global Space Defense Market is analyzed in this report across system architecture, function, layer of operation, business model, end-user, and region, highlighting major trends and growth forecasts for each segment.

Introduction

The space defense market has become a cornerstone of modern national security strategies, underpinning resilience in an increasingly contested domain. It enables governments and defense agencies to safeguard critical assets while supporting advanced surveillance, secure communications, navigation, and intelligence functions. Core applications include missile detection and warning, secure satellite communications, intelligence gathering, space situational awareness (SSA), and counterspace defense measures.

The industry is on a strong growth trajectory, projected to reach USD 429.4 billion by 2030, up from USD 277.87 billion in 2024, at a CAGR of 7.5%. Rising geopolitical tensions, greater reliance on satellite-enabled services, and the urgent need to defend against space-based threats are accelerating investment. Higher defense budgets, the expansion of multi-orbit constellations, and rapid adoption of on-orbit servicing and debris management solutions are further reinforcing the sector’s importance to global security frameworks.

Market Dynamics

The space defense industry is evolving rapidly, driven by a combination of geopolitical, strategic, and technological forces.

Key growth drivers include escalating international tensions, rising investments in satellite-enabled defense infrastructure, and the growing dependency on space-based systems for navigation, communications, and intelligence. The integration of AI, machine learning, and autonomous technologies has enhanced real-time threat detection, predictive surveillance, and resilient communications. In parallel, space situational awareness (SSA) and space domain awareness (SDA) programs are strengthening defense capabilities to monitor orbital activities and protect national assets. Growing demand for missile early warning systems, cyber-hardened networks, and secure satellite communications continues to shape procurement priorities.

The market presents significant opportunities across several fronts. Expanding multi-orbit constellations for ISR and secure communications, increasing demand for on-orbit servicing and debris management, and the development of counterspace technologies represent major growth avenues. U.S. Congressional reviews have highlighted the importance of resilient architectures and multi-orbit deployments to mitigate space security risks. Similarly, Japan’s space defense initiatives underscore the need for regional partnerships and enhanced resilience against adversarial threats, further elevating the Asia-Pacific’s role. Commercial space players are also collaborating with defense agencies, offering data-as-a-service, responsive launch, and advanced imagery capabilities — creating new business models and reinforcing public-private collaboration.

Notable trends shaping the industry include the militarization of low Earth orbit (LEO), adoption of AI-enabled SSA platforms for predictive threat analysis, and increased international cooperation for space security. Small satellites and responsive launch systems are enabling rapid deployment and operational flexibility, while advancements in directed-energy weapons, electronic warfare, and satellite hardening are redefining counterspace strategies. With nations shifting from reactive to proactive security postures, the global space defense market is positioned for long-term structural growth.

Segment Highlights and Performance Overview

By System Architecture

Space-based systems lead the market, representing nearly 45% of the system architecture segment. Satellites remain central to space defense, enabling ISR, secure communications, and missile detection. Investments in resilient LEO and GEO constellations are reinforcing this dominance.

By Function

Intelligence, Surveillance & Reconnaissance (ISR) is the largest function segment, with approximately 35% share. Persistent surveillance and real-time intelligence are critical for defense agencies seeking to monitor adversary activities and strengthen battlefield awareness.

By Layer of Operation

Low Earth Orbit (LEO) accounts for around 55% of the market, driven by its suitability for large constellations, ISR missions, and rapid launch capabilities. The proliferation of small satellites and mega-constellations has made LEO the most dynamic and strategically vital operational layer.

By Business Model

Prime defense contractor contracts dominate with about a 50% share. Leading firms such as Lockheed Martin, Northrop Grumman, and Airbus remain the primary suppliers of integrated systems — spanning satellites, launch services, and defense-grade solutions — ensuring strong positioning in government procurement pipelines.

By End-User

National governments hold nearly 60% of the end-user segment. Defense ministries and space forces are the largest buyers of ISR, missile defense, and secure communication systems, with their steady funding streams underpinning the sector’s growth.

Geographical Analysis

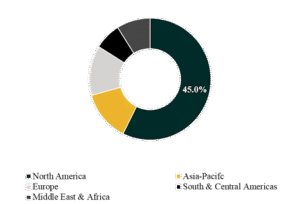

The global space defense market is studied across North America, Europe, Asia-Pacific, South & Central America, and the Middle East & Africa.

North America leads the global market with around 45% share, underpinned by substantial U.S. Department of Defense investments, the establishment of the U.S. Space Force, and the dominance of leading aerospace and defense contractors.

Asia-Pacific is forecast to post the fastest growth, with an estimated CAGR between 8% and 10%. Rising militarization of space in China, India, and Japan, coupled with government-led initiatives to enhance SSA, satellite defense, and counterspace capabilities, is driving expansion. The region’s rapidly advancing space programs are making it an increasingly critical node in the global defense ecosystem.

Competition Landscape

The competitive environment is defined by a mix of leading defense contractors, aerospace manufacturers, and emerging space-tech companies. Competition is centered on advanced innovation, partnerships with defense agencies, and government-backed programs. Major players continue to invest in next-generation satellite systems, resilient architectures, and integrated defense platforms to strengthen their market positions.

Key players profiled in this report include Lockheed Martin, Northrop Grumman, Boeing Defense, Space & Security, Airbus Defence and Space, Thales Alenia Space, OHB SE, Israel Aerospace Industries, SpaceX, L3Harris Technologies, and General Dynamics Mission Systems.

Recent Developments

- February 2025: Development of 18 Tranche-2 Tracking Layer small satellites under the SDA’s Proliferated Warfighter Space Architecture was initiated, designed to enhance missile detection, including hypersonic threats. This project strengthens global missile defense capabilities and accelerates demand for resilient satellite constellations.

- December 18, 2024: Northrop Grumman secured a USD 3.46 billion contract to engineer and develop the E-130J TACAMO Weapon System, advancing strategic communications for the U.S. Navy. This program enhances command-and-control resilience, driving further adoption of advanced airborne space-defense systems.

Segmentation:

By System Architecture:

- Space-Based Systems

- Ground-Based Systems

- Launch Systems

- Orbital Defense Vehicles / Spacecraft

- Support Infrastructure & Enablers

By Function:

- Intelligence, Surveillance & Reconnaissance (ISR)

- Early Warning & Missile Launch Detection

- Communications & Connectivity

- Space Situational Awareness (SSA) & Space Traffic Management (STM)

- Anti-Satellite (ASAT) & Counterspace Operations

- Cyber & EW Operations

- Others

By Layer of Operation:

- Low Earth Orbit (LEO)

- Medium Earth Orbit (MEO)

- Geostationary Orbit (GEO)

- High Earth Orbit

- Others

By Business Model:

- Government-to-Government (G2G) Programs

- Prime Defense Contractor Contracts

- Commercial Vendors

- On-demand Services

- Others

By End-User:

- National Governments

- Defense Contractors & System Integrators

- Multinational Defense Collaborations

- Others

Companies included in the report:

- Lockheed Martin

- Northrop Grumman

- Boeing Defense, Space & Security

- Airbus Defence and Space

- Thales Alenia Space

- OHB SE

- Israel Aerospace Industries

- SpaceX

- L3Harris Technologies

- General Dynamics Mission Systems

Need Deeper Insights or Custom Analysis?

Contact Blackwater Business Consulting to explore how this data can drive your strategic goals.