Global Unmanned Systems Market: Technology Advancements, Growth Opportunities, and Industry Trends 2025–2030

The Global Unmanned Systems Market is analyzed in this report across type, mode of operation, end-use, and region, highlighting major trends and growth forecasts for each segment.

Let's Get You Started!

Fill out the quick form below and our academic advisor will connect with you shortly.

- Aerospace & Defense

The Global Unmanned Systems Market is analyzed in this report across type, mode of operation, end-use, and region, highlighting major trends and growth forecasts for each segment.

Introduction

Unmanned systems are rapidly becoming a cornerstone of modern defense, industrial, and commercial operations worldwide. Spanning aerial, ground, maritime, and space domains, these systems are redefining how organizations execute critical missions—offering enhanced efficiency, precision, and safety while reducing human exposure and operational costs. Adoption is accelerating across diverse sectors, from military surveillance and logistics to agriculture, disaster response, and environmental monitoring.

Valued at approximately USD 26.8 billion in 2024, the global unmanned systems market is projected to reach USD 49.4 billion by 2030, growing at a CAGR of 9.7%. This expansion is driven by defense modernization, breakthroughs in autonomous technologies, and a growing demand for intelligent unmanned capabilities in both developed and emerging markets—underscoring their rising strategic importance in a digitized and security-conscious world.

Market Dynamics

The unmanned systems market is undergoing rapid transformation, fueled by a convergence of technological innovation, operational necessity, and evolving global security demands.

Key drivers include the growing need for autonomous surveillance and reconnaissance, rising investments in military capability upgrades, and increasing deployment in high-risk or inaccessible environments. Advances in AI, machine learning, edge computing, and sensor technologies are significantly enhancing the autonomy, responsiveness, and mission adaptability of these platforms. Government agencies and enterprises are leveraging unmanned systems for border monitoring, disaster relief, infrastructure inspection, and more—gaining efficiency while minimizing human risk.

The market presents broad growth opportunities across both defense and civilian sectors. In commercial applications, unmanned platforms are gaining traction in logistics, agriculture, mining, and smart city initiatives. In defense, expanding use cases include swarming drones, unmanned combat systems, and integrated multi-domain operations. The dual-use nature of these technologies is opening new applications—from maritime surveillance and wildfire monitoring to search and rescue—further extending the addressable market.

Notable trends are accelerating the shift toward intelligent, autonomous operations. These include AI integration, swarm intelligence for coordinated missions, and growing adoption of manned-unmanned teaming (MUM-T). In 2024, QinetiQ demonstrated jet-to-jet MUM-T capabilities, showcasing real-time human-machine collaboration. Similarly, Northrop Grumman’s 2025 launch of its “Beacon” autonomy testbed using the Model 437 aircraft reflects the push toward AI-enabled autonomous mission planning.

There is also a growing emphasis on lightweight and energy-efficient design, alongside enhanced cybersecurity to protect unmanned systems from emerging threats. With public and private sector investment in fully autonomous platforms continuing to rise, unmanned systems are transitioning from remote-controlled tools into intelligent assets reshaping global operational strategies.

Segment Highlights and Performance Overview

By Type

Unmanned Aerial Systems (UAS) lead the platform segment with approximately 65% market share. Their dominance is fueled by widespread adoption across defense and commercial sectors for applications such as surveillance, precision agriculture, mapping, and delivery. The rapid evolution of flight autonomy, sensor miniaturization, and ease of deployment further solidify their position as the most versatile and scalable unmanned solution.

By Mode of Operation

Remotely operated systems account for about 52% of the market, owing to their reliability and human oversight. These systems are particularly valued in military and industrial contexts where control and situational adaptability are essential. Their continued preference highlights the importance of human-in-the-loop control in high-stakes environments.

By End-Use

Defense remains the dominant end-use segment, contributing roughly 60% of total market revenue. Armed forces around the world are increasingly deploying unmanned systems for ISR, electronic warfare, logistics support, and precision strike missions. As defense strategies evolve toward more agile and tech-enabled force structures, unmanned platforms are becoming integral to modern military operations.

Geographical Analysis

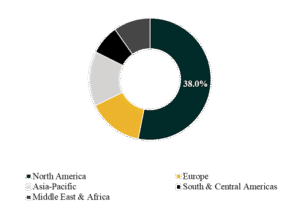

The global unmanned systems market is examined across key regions, including North America, Europe, Asia-Pacific, South & Central America, and the Middle East & Africa.

North America leads the global unmanned systems market with a share of 35% to 38%, supported by substantial defense budgets, strong R&D ecosystems, and early integration of autonomous technologies. The presence of key players such as Lockheed Martin, Northrop Grumman, and General Atomics further reinforces the region’s dominance.

Asia-Pacific is projected to register the highest CAGR, estimated between 11% and 13%, driven by significant defense modernization, industrial automation, and public sector adoption in countries like China, India, and Japan. Government-backed innovation programs and growing domestic manufacturing capabilities are accelerating regional deployment across both civilian and military domains.

Competition Landscape

The global unmanned systems market is highly competitive, with major defense contractors, robotics firms, and autonomous technology providers vying for market leadership. Key players are prioritizing innovation, platform integration, and global partnerships to expand their operational footprint and enhance technical capabilities.

Notable companies profiled include DJI, General Atomics Aeronautical Systems, Northrop Grumman, Elbit Systems, Israel Aerospace Industries (IAI), AeroVironment Inc., Baykar, Leonardo S.p.A., Saab AB, QinetiQ, and Rheinmetall AG.

Key Developments

- June 18, 2025 – Northrop Grumman launched its “Beacon” autonomy testbed using the Model 437 Vanguard aircraft in collaboration with Shield AI and other autonomy leaders. This initiative positions Northrop at the forefront of next-gen unmanned aerial warfare, setting a new standard for AI-driven autonomous operations and intensifying competitive innovation across the sector.

- June 27, 2025 – Saab AB and General Atomics announced a strategic partnership to develop an Unmanned Airborne Early Warning (UAEW) system based on the MQ-9B platform. This collaboration expands the role of high-endurance UAVs into advanced surveillance, driving demand for multi-role unmanned platforms and accelerating adoption of autonomous ISR capabilities worldwide.

Segmentations

By Type:

- Unmanned Aerial Systems (UAS)

- Unmanned Ground Systems (UGS)

- Unmanned Maritime Systems (UMS)

By Mode of Operation:

- Remotely Operated

- Semi-Autonomous

- Fully Autonomous

By End-Use:

- Defense

- Government & Law Enforcement

- Commercial

- Others

Companies:

- DJI

- General Atomics Aeronautical Systems

- Northrop Grumman

- Elbit Systems

- Israel Aerospace Industries (IAI)

- AeroVironment Inc.

- Baykar

- Leonardo S.p.A.

- Saab AB

- QinetiQ

- Northrop Grumman

- Rheinmetall AG

Need Deeper Insights or Custom Analysis?

Contact Blackwater Business Consulting to explore how this data can drive your strategic goals.