Global Low/No Alcohol Beverages Market

Low/No Alcohol Beverages—defined as drinks containing zero alcohol (0.0% ABV) or significantly reduced alcohol levels (typically under 1.2%–2.5% ABV)—are rapidly reshaping global beverage consumption.

Let's Get You Started!

Fill out the quick form below and our academic advisor will connect with you shortly.

- FMCG

Introduction:

Low/No Alcohol Beverages—defined as drinks containing zero alcohol (0.0% ABV) or significantly reduced alcohol levels (typically under 1.2%–2.5% ABV)—are rapidly reshaping global beverage consumption. These products cater to health-conscious consumers seeking the taste and experience of traditional alcoholic drinks without the adverse effects of alcohol. Categories such as alcohol-free beer, low-alcohol wine, non-alcoholic spirits, and functional mocktails are gaining widespread traction across demographic segments.

Valued at approximately USD 27.5 billion in 2024, the global market is expected to reach USD 40.8 billion by 2030, expanding at a CAGR of 6.8%. This growth is fueled by shifting lifestyle preferences, increased health awareness, and the rise of mindful drinking and the sober-curious movement. Ongoing innovation in taste, format, and branding is deepening consumer engagement and expanding market reach across traditional and emerging channels.

Market Dynamics

The Low/No Alcohol Beverages market is evolving at a fast pace, shaped by intersecting health, cultural, and regulatory shifts.

Consumer interest in moderation and wellness is a key growth catalyst, particularly among millennials and Gen Z. The “sober-curious” trend continues to gain momentum globally. In the U.S., a 2025 Beer Institute and Morning Consult survey revealed that 60% of Dry January participants used low/no-alcohol beer to moderate their intake—up from 58% the previous year. Non-alcoholic beer ranked as the top choice among consumers (22%), ahead of wine (13%) and spirits (10%). Correspondingly, U.S. non-alcoholic beer sales rose 30% in 2024.

Globally, non-alcoholic beer now makes up 86% of all low/no alcohol beverage sales and has tripled in size over five years, crossing 1% of total beer market volume. This surge reflects growing consumer openness, improved product quality, and expanding availability.

Public health bodies are playing a growing role in this transition. According to the World Health Organization’s 2023 Global Status Report on Alcohol and Health, harmful alcohol use causes over 3 million deaths annually and contributes to 5.1% of the global disease burden. Regional initiatives, such as the European Commission’s “Healthier Together” NCDs strategy, are supporting alcohol harm reduction via consumer education, alcohol-free environments, and clearer labeling—further accelerating the shift toward low/no alcohol choices.

Manufacturers are responding with investment in advanced brewing and distillation technologies that replicate the complexity of traditional alcoholic beverages. These efforts are driving product credibility and consumer satisfaction, especially in premium segments.

The market also presents several growth avenues: expanding premium offerings in non-alcoholic spirits and wines, fostering collaborations between startups and established players, and tapping into wellness trends through ingredients like botanicals, adaptogens, and clean-label formulations.

Emerging trends include ready-to-drink non-alcoholic cocktails, functional infusions with nootropics and electrolytes, and premium branding tailored for e-commerce-savvy consumers. As mindful consumption becomes mainstream, the momentum behind low/no alcohol alternatives is set to accelerate further.

Segment Highlights and Performance Overview

By Type:

No-alcohol beverages dominate the category, representing approximately 60% of the market. Their appeal lies in regulatory ease and broader market accessibility, particularly among health-conscious and sober-curious consumers. These beverages are increasingly positioned as everyday lifestyle options.

By Product Type:

Beer leads the segment by volume, accounting for roughly 75% of global low/no alcohol beverage consumption. Backed by established brewers and improved flavor profiles, alcohol-free and low-alcohol beer continues to gain ground across both developed and emerging markets due to its familiarity, affordability, and broad availability.

By Packaging:

Bottles hold the largest share in packaging, capturing around 45% of the market. PET bottles are favored for their cost-efficiency and portability, while glass bottles continue to serve premium offerings, valued for their perceived quality and ability to preserve flavor integrity.

By Distribution Channel:

Offline retail remains dominant, accounting for nearly 65% of sales. Supermarkets, hypermarkets, and convenience stores provide a wide product range and in-person comparison opportunities, supported by in-store promotions and sampling. While online sales are growing, physical retail maintains a strong foothold due to accessibility and consumer trust.

Geographical Analysis

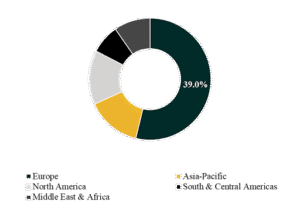

The global low/no alcohol beverage market is assessed across North America, Europe, Asia-Pacific, South & Central America, and the Middle East & Africa.

Europe leads the global market, accounting for approximately 35% to 39% of revenue. This position is driven by longstanding cultural acceptance of alcohol-free beer and wine, favorable regulatory environments, and early adoption of premium non-alcoholic products—particularly in Germany, the UK, and Spain.

Asia-Pacific is poised to record the fastest growth, with a projected CAGR of 7.5% to 10%. Rising health consciousness, evolving social norms, and rapid urbanization across China, India, Japan, and South Korea are driving demand. The region’s expanding middle class and interest in low-alcohol lifestyle products are further fueling adoption, particularly in functional beverage categories.

Competition Landscape

The global Low/No Alcohol Beverages market features a competitive mix of major beverage conglomerates, emerging alcohol-free brands, and innovation-led startups. Players are competing through differentiated flavor offerings, premium product development, and strategic partnerships aimed at capturing a growing consumer base seeking healthier, mindful drinking options.

Key companies profiled in this report include:

Heineken N.V., Anheuser-Busch InBev, Carlsberg Group, Molson Coors Beverage Company, Diageo plc, Pernod Ricard, Seedlip, Lyre’s Spirits Co., Monday Distillery, and Ritual Zero Proof.

Recent Developments

- In January 2025, Heineken N.V. launched its global “Zero Reasons Needed” campaign, aiming to challenge social stigma around abstaining. The campaign positions Heineken 0.0® as a lifestyle choice for year-round consumption, normalizing no-alcohol beer as a mainstream option and expanding demand beyond seasonally driven events like Dry January.

- In March 2025, Molson Coors Beverage Company introduced Madrí Excepcional 0% ABV, a non-alcoholic lager brewed in Yorkshire. This launch strengthens the company’s footprint in the premium no-alcohol beer category and aligns with rising demand for flavorful, locally brewed alcohol-free products in the UK and broader European market.

Segmentation:

By Type:

- No-Alcohol Beverages

- Low-Alcohol Beverages

By Product Type:

- Beer

- Wine

- Spirits

- RTD & Mixers

- Functional Beverages

- Others

By Packaging:

- Bottles

- Cans

- Tetra packs

- Kegs

- Others

By Distribution Channel:

- Offline

- Supermarkets/Hypermarkets

- Convenience Stores

- Specialty Stores

- Bars & Restaurants

- Online

- E-commerce platforms

- Direct-to-consumer (DTC) brand websites

Companies included in the report:

- Heineken N.V.

- Anheuser-Busch InBev

- Carlsberg Group

- Molson Coors Beverage Company

- Diageo plc

- Pernod Ricard

- Seedlip

- Lyre’s Spirits Co.

- Monday Distillery

- Ritual Zero Proof

Need Deeper Insights or Custom Analysis?

Contact Blackwater Business Consulting to explore how this data can drive your strategic goals.