Global Personal Care Products Market

The Global Personal Care Products Market is analyzed in this report across types, ingredients, price, distribution channel, and region, highlighting major trends and growth forecasts for each segment.

Let's Get You Started!

Fill out the quick form below and our academic advisor will connect with you shortly.

- FMCG

The Global Personal Care Products Market is analyzed in this report across types, ingredients, price, distribution channel, and region, highlighting major trends and growth forecasts for each segment.

Introduction:

Personal care products encompass a wide range of consumer goods used for hygiene, grooming, and enhancing appearance. Applied to the body or hair for cleansing, moisturizing, protection, or fragrance, these products have become integral to daily routines. The category includes skincare, haircare, oral care, body care, cosmetics, and grooming products, each evolving rapidly with advances in ingredients, functionality, and sustainability to meet the diverse demands of today’s consumers.

The global personal care products market is experiencing strong growth and is projected to reach USD 835.27 billion by 2030. This expansion is being driven by rising awareness of personal hygiene, increasing disposable incomes, and the pervasive influence of beauty and wellness trends across social media and digital platforms. Demand for clean-label, natural, and gender-inclusive products is also redefining industry standards, prompting innovation in formulation and branding. The market stood at approximately USD 502.66 billion in 2024 and is expected to grow at a CAGR of 6.1% over the forecast period.

Market Dynamics

The personal care sector is evolving rapidly, shaped by economic shifts, social behavior, and technology-driven personalization.

Key growth drivers include increasing consumer focus on health, hygiene, and self-care, alongside rising disposable incomes and the influence of beauty influencers and social media trends. Consumers are actively seeking high-quality skincare, grooming, and wellness products that align with their values—whether clean-label, cruelty-free, or sustainably sourced. Innovations in ingredients, packaging, and delivery formats continue to expand product offerings across all categories.

Digital transformation is also playing a central role. E-commerce penetration, subscription models, and AI-driven platforms are enhancing product accessibility, personalization, and brand engagement globally. Consumers now expect seamless online experiences coupled with expert recommendations and convenience.

The market presents significant opportunities for incumbents and emerging brands alike. Demand for organic, vegan, and plant-based formulations is growing rapidly, along with interest in AI-powered beauty tech and customized skincare solutions. Brands are investing in skin diagnostics, virtual try-ons, and connected devices to deliver tailored product experiences. Male grooming awareness and the expansion of gender-neutral product lines are also unlocking new growth areas. In parallel, sustainable packaging, refillable systems, and clean-label certifications are becoming competitive differentiators. Regulatory frameworks—such as the CDSCO in India—are reinforcing compliance, ensuring product safety, and encouraging more transparent labeling and formulation standards.

Emerging trends include the rise of dermocosmetics, smart skincare integrations, and sustainability-led innovation across the supply chain. Ingredient transparency is now a key consumer expectation, with demand increasing for certified “clean,” “organic,” and “non-toxic” products. Brands are leveraging machine learning and AI to deliver hyper-personalized recommendations and skincare routines. The shift toward preventive self-care is also fueling demand for multifunctional products—such as SPF-infused cosmetics, anti-pollution skincare, and microbiome-friendly formulations. Regulatory guidance, including the U.S. FDA’s Cosmetics Labeling Guide and sunscreen use protocols, is further reinforcing the importance of functional and safety-compliant product development.

Segment Highlights and Performance Overview

By Type:

Skincare is the leading product segment, contributing approximately 40% to 45% of total market share. Daily use of facial care products, sun protection, and anti-aging solutions continues to drive demand. Moisturizers, cleansers, and serums remain essential to both hygiene and beauty routines, solidifying skincare’s position as the top-performing category.

By Ingredients:

Synthetic ingredients dominate the ingredient segment, accounting for 80% to 85% of the market. These compounds—such as parabens, sulfates, and silicones—offer cost-efficiency, formulation stability, and wide usability across mass-market products. Despite the growth of natural and clean-label alternatives, synthetic formulations remain the backbone of conventional personal care due to their scalability and performance consistency.

By Price Range:

Economy-tier products lead by price, comprising approximately 45% to 50% of market share. Affordability, strong brand loyalty, and mass availability drive demand—particularly in emerging and price-sensitive markets. This segment continues to thrive due to extensive retail distribution and consistent product accessibility in both urban and rural areas.

By Distribution Channel:

Specialty stores are the leading distribution channel, representing roughly 30% to 35% of the market. These outlets offer curated product assortments, exclusive brands, and personalized consultation, making them a key destination for consumers seeking expert-driven experiences. While specialty stores remain dominant, e-commerce continues to disrupt traditional channels with convenience, dynamic pricing, and personalized engagement.

Geographical Analysis

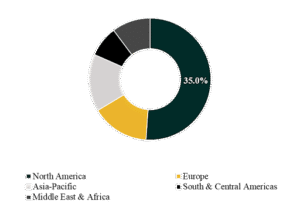

The global personal care products market is segmented across North America, Europe, Asia-Pacific, South & Central America, and the Middle East & Africa.

North America holds the largest market share, approximately 35%, supported by high consumer spending on skincare, cosmetics, and wellness. A mature retail ecosystem, strong brand presence, and continuous innovation in ingredient science and product performance contribute to the region’s sustained growth. Consumers in the U.S. and Canada continue to favor natural, premium, and tech-enabled personal care solutions.

Asia-Pacific is expected to record the highest CAGR, around 7.5%, during the forecast period. Rising disposable incomes, urbanization, and heightened beauty consciousness, especially in China, India, South Korea, and Japan, are fueling demand across product categories. The region’s strong e-commerce infrastructure, rising demand for K-beauty, and clean-label preferences are accelerating its ascent as a global growth engine for personal care.

Competition Landscape

The global personal care products market features a competitive mix of multinational consumer goods corporations, regional manufacturers, and fast-scaling niche brands. Players compete on innovation, brand equity, and omnichannel distribution strategies to capture evolving consumer preferences.

Key companies profiled in this report include Procter & Gamble (P&G), Unilever, Johnson & Johnson, L’Oréal Group, Colgate-Palmolive, The Estée Lauder Companies Inc., Beiersdorf AG, Kao Corporation, Reckitt Benckiser, and Shiseido Company, Limited. These firms are investing in R&D, sustainability, and digital transformation to maintain a competitive advantage in an increasingly crowded and conscious market.

Key Developments

- In March 2025, L’Oréal Group acquired Korean dermocosmetics brand Dr.G, bolstering its presence in the Asia-Pacific’s fast-growing skin health segment. This strategic move enhances L’Oréal’s science-based skincare offerings and intensifies competition in the region’s dermocosmetic space.

- In June 2025, Kao Corporation announced the launch of two new Curél carbonated foam skincare products in Japan, set for release in September 2025. This innovation reflects rising demand for texture-driven and sensitive-skin formulations and is expected to strengthen Kao’s position in Japan’s premium skincare market.

Segmentation:

By Type:

- Skin

- Moisturizers

- Cleansers & face washes

- Anti-aging creams

- Body Oils & Serums

- Lotions

- Face Masks

- Others

- Hair

- Shampoos

- Conditioners

- Hair oils & serums

- Scalp and Hair Masks

- Others

- Oral

- Toothpaste

- Toothbrushes

- Mouthwash

- Dental floss

- Baby Care

- Men Grooming-

- Razors

- Blade

- Shaving/Foaming creams

- Others

- Female Hygiene

- Sanitary pads

- Tampons

- Intimate wash

- Others

- Others-

By Ingredients:

- Synthetic

- Parabens

- Sulfates

- Alcohols

- Others

- Natural

- Aloe vera

- Coconut oil

- Rose Water

- Essential Oils

- Others

By Price Range:

- Economy

- Mid-Range

- Premium

By Distribution Channel:

- Hypermarkets & Supermarkets

- Specialty Stores

- E-commerce

- Others

Companies included in the report:

- Procter & Gamble (P&G)

- Unilever

- Johnson & Johnson

- L’Oréal Group

- Colgate-Palmolive

- The Estée Lauder Companies Inc.

- Beiersdorf AG

- Kao Corporation

- Reckitt Benckiser

- Shiseido Company, Limited

Need Deeper Insights or Custom Analysis?

Contact Blackwater Business Consulting to explore how this data can drive your strategic goals.