Global Personalised Skincare Market: Innovative Developments, Future Growth Avenues, and Industry Landscape 2025–2030

The Global Personalised Skincare Market is analyzed in this report across product type, customization method, formulation base, distribution channel, and region, highlighting major trends and growth forecasts for each segment.

Let's Get You Started!

Fill out the quick form below and our academic advisor will connect with you shortly.

- FMCG

The Global Personalised Skincare Market is analyzed in this report across product type, customization method, formulation base, distribution channel, and region, highlighting major trends and growth forecasts for each segment.

Introduction:

Personalized skincare is transforming the beauty industry by delivering tailored solutions that address individual skin needs with greater precision, efficacy, and user satisfaction. Through technologies such as AI-powered diagnostics, DNA and microbiome-based formulations, and customization driven by lifestyle or environmental factors, brands can offer hyper-targeted skincare regimens.

The global market for personalized skincare is on a strong growth trajectory, with a projected value of approximately USD 44.8 billion by 2030. This expansion is being driven by heightened consumer awareness around specific skin concerns, rising demand for safe and effective products, increasing disposable incomes, and the rapid adoption of digital and direct-to-consumer platforms. Moreover, growing consumer preference for ingredient transparency, eco-conscious formulations, and sustainable packaging continues to strengthen market penetration. In 2024, the market was valued at around USD 26.88 billion and is expected to grow at a CAGR of 8.89% over the forecast period.

Market Dynamics:

The personalized skincare market is experiencing rapid growth, fueled by shifting consumer expectations and continued technological advancement. Key growth drivers include heightened awareness of individualized skin needs, increasing demand for safe and clinically effective solutions, and the proliferation of digital-first, direct-to-consumer business models. Advanced tools—such as AI diagnostics, genetic testing, and microbiome analysis—are enabling brands to deliver highly personalized formulations, significantly improving both performance outcomes and user satisfaction.

This level of precision has redefined core product categories, including anti-aging, acne care, and hydration, making skincare regimens more results-driven. Additionally, regulatory developments, such as India’s Cosmetics Rules, 2020, which emphasize safety and full ingredient disclosure, are encouraging industry-wide transparency and higher compliance standards. These shifts are pushing brands toward clean-label formulations, sustainable production, and eco-conscious packaging.

The market offers considerable opportunities for innovation and expansion. Areas of high potential include AI- and app-based diagnostic tools, DNA- and microbiome-informed customization, and the rise of subscription and on-demand skincare services. Companies are increasingly leveraging data analytics, ingredient transparency, and flexible formulations to deliver personalized routines that meet evolving consumer expectations. Integrating dermatology expertise, hybrid service-product models, and sustainable practices is helping brands build consumer trust while expanding reach.

Emerging trends are further accelerating market evolution. Wearable and at-home diagnostic tools are making personalization more accessible, while AI-powered skin analysis is gaining traction across both retail and e-commerce channels. Advances in biotechnology—such as lab-grown natural actives and bioengineered ingredients—are driving a new wave of product development. At the same time, consumer data is being used not only to personalize current regimens but also to forecast future needs, factoring in variables like climate exposure and long-term skin health. Rising concern over allergens, prompted by updated U.S. FDA guidance, is also pushing brands to improve ingredient clarity and safety within their personalization strategies.

Segment Highlights and Performance Overview

By Product Type

Custom-formulated topicals lead the product type segment, contributing around 55% of global market revenue in 2024. These include essential skincare formats such as moisturizers, serums, and creams that address everyday concerns like hydration, acne, and aging. Their broad usage, combined with consumers’ growing demand for formulations tailored to individual skin profiles, reinforces this segment’s dominant market position and high repurchase rates.

By Customization Method

DNA and genetic testing–based personalization accounts for the largest share, with approximately 51.2% of the customization method segment. This approach enables precision-level customization by analyzing genetic markers related to skin sensitivity, pigmentation, and aging. Scientific credibility and the long-term efficacy associated with genetic testing have made this method increasingly popular among consumers seeking validated, high-performance skincare.

By Formulation Base

Water-based emulsions dominate the formulation base category, holding roughly 60% of the market share in 2024. Their versatility makes them a foundation for a wide array of products, from moisturizers to serums and lotions. Consumers favor these emulsions for their lightweight feel, fast absorption, and effectiveness in delivering active ingredients—qualities that have cemented their role in both mass and premium personalized skincare products.

By Distribution Channel

Offline distribution remains the leading channel, accounting for about 66.2% of total market share in 2024. Consumer preference for in-store consultations, live product trials, and professional skin analysis has sustained the strength of physical retail. The presence of dermatologists and trained consultants, coupled with diagnostic tools in offline environments, continues to build trust and drive adoption among a broad consumer base.

Geographical Analysis

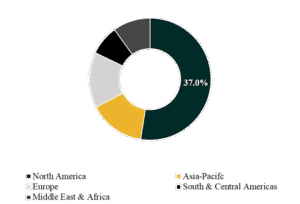

The global personalized skincare market spans key regions including North America, Europe, Asia-Pacific, South & Central America, and the Middle East & Africa.

North America holds the largest share, contributing around 37% of global revenue. This leadership is driven by high consumer spending on beauty products, the presence of leading skincare brands, and advanced adoption of AI-powered diagnostics. Meanwhile, Asia-Pacific is positioned as the fastest-growing region, with a projected CAGR of 12% to 13%. Growth in this region is propelled by rising disposable incomes, increasing awareness of personalized beauty solutions, and strong demand in emerging markets such as China, India, and South Korea.

Competition Landscape

The competitive landscape is shaped by a diverse mix of established beauty conglomerates, tech-forward startups, and digital service providers—all vying for market share through innovation, AI integration, and strategic partnerships.

Prominent players include L’Oréal, Estée Lauder, Procter & Gamble, Shiseido, Beiersdorf, and Coty Inc., alongside disruptive entrants like Atolla, Curology, Function of Beauty, Proven Skincare, Skin Inc., and EpigenCare Inc. Technology providers such as Perfect Corp and biotech innovators like BIOeffect and Skin Authority are also driving personalization through advanced analytics and ingredient innovation. These companies continue to refine their offerings by merging scientific research, digital tools, and consumer insights to differentiate in a competitive market.

Key Developments

- In January 2025, At CES, L’Oréal unveiled Cell BioPrint, a consumer-facing tabletop device leveraging proteomics to assess skin aging and recommend personalized ingredients. This innovation brings biotech-enabled diagnostics into the hands of consumers, reinforcing L’Oréal’s leadership in science-backed personalization and advancing trust in AI- and biotech-driven skincare.

- In February 2025. Perfect Corp announced a strategic partnership with French skincare brand Holidermie to integrate its Skincare Pro AI analysis across flagship Paris stores, including Le Bon Marché. This move strengthens the presence of AI diagnostics in premium retail, enhancing in-store customer experiences and boosting demand for customized facial treatments.

Segmentation:

By Product Type:

- Custom-formulated Topicals

- Mix-at-home Kits & Boosters

- Diagnostic & Treatment Devices

- Professional/Clinic Treatments

- Others

By Customization Method:

- AI & Skin Diagnostic Tools

- DNA / Genetic Testing–based

- Lifestyle & Environment-based

- Questionnaire / Survey-based

- Others

By Formulation Base:

- Water-based emulsions

- Anhydrous/oil-based

- Gels & essences

- Balms/ointments

- Sticks/bars

- Powder-to-liquid concentrates

By Distribution Channel:

- Online

- Brand websites

- Marketplaces

- Others

- Offline

- Specialty stores

- Pharmacies & beauty stores

- Others

Companies included in the report:

- L’Oréal

- Estée Lauder

- Procter & Gamble

- Shiseido

- Beiersdorf

- Coty Inc.

- Atolla

- Curology, Inc.

- Function of Beauty

- Proven Skincare

- Skin Inc.

- BareMinerals

- EpigenCare Inc.

- Perfect Corp

- BIOeffect

- Skin Authority

Need Deeper Insights or Custom Analysis?

Contact Blackwater Business Consulting to explore how this data can drive your strategic goals.