Global Quick Service Restaurants Market: Innovations, Growth Avenues, and Industry Dynamics 2025–2030

The Global Quick Service Restaurants Market is analyzed in this report across service type, type, ownership, category, sales channel, and region, highlighting major trends and growth forecasts for each segment

Let's Get You Started!

Fill out the quick form below and our academic advisor will connect with you shortly.

- FMCG

The Global Quick Service Restaurants Market is analyzed in this report across service type, type, ownership, category, sales channel, and region, highlighting major trends and growth forecasts for each segment

Introduction

The Quick Service Restaurants (QSR) industry is one of the most dynamic and fast-evolving segments within the global food service sector. Defined by speed, convenience, and affordability, the QSR model has fundamentally changed how modern consumers access meals amid increasingly busy lifestyles. Urbanization, the rise of dual-income households, and the proliferation of digital ordering platforms have positioned QSRs as a preferred dining solution for millions worldwide. Innovation continues to drive the sector, with evolving menu offerings, expanded service formats—including drive-thru, takeaway, and delivery—and increased investment in digital customer engagement channels.

The global QSR market is on a strong growth trajectory and is projected to reach USD 2,205 billion by 2030. This momentum is being fueled by shifting consumer preferences for fast and affordable dining experiences, growing adoption of technologies such as mobile ordering and contactless payments, and rising demand for global and regional cuisines. Valued at approximately USD 980.5 billion in 2024, the market is expected to expand at a CAGR of 9.8% during the forecast period.

Market Dynamics

The QSR market is experiencing accelerated growth, shaped by evolving consumer behaviors, technological advancements, and changing socioeconomic dynamics. Central to this expansion is the increasing demand for convenient, cost-effective dining—driven by growing urban populations, a rising number of working professionals, and higher disposable incomes. As consumers prioritize time-saving meal options, the QSR segment continues to benefit from its ability to offer consistent quality and speed at an accessible price point.

Technology is playing a transformative role across the QSR value chain. Digital ordering apps, self-service kiosks, and contactless payment systems are improving operational efficiency and enhancing the customer experience. The widespread use of third-party delivery platforms and the rise of cloud kitchens are allowing QSR brands to expand quickly and cost-effectively—often without the need for full-service brick-and-mortar outlets.

Significant growth opportunities lie ahead. These include the growing popularity of plant-based and health-conscious menu offerings, increased demand for global and regional flavors, and the continued expansion of franchise models into untapped emerging markets. QSR brands are also leveraging omnichannel strategies to drive customer engagement across physical stores, mobile apps, online platforms, and drive-thru lanes—unlocking new revenue streams and building stronger loyalty.

Emerging industry trends are reshaping operations and consumer expectations. Sustainability has become a top priority, with brands adopting eco-friendly packaging, energy-efficient equipment, and waste reduction initiatives. For example, McDonald’s aims to use 100% renewable or recycled packaging by 2025, while Starbucks is testing reusable cup programs globally. Automation and contactless service are also gaining traction, from robotic food prep to AI-powered drive-thru assistants. Transparency, nutritional labeling, and allergen-free menu options are becoming standard, as consumers demand greater control over their dining choices.

As digital transformation and culinary innovation converge, the QSR sector is redefining how quick service is delivered—and how it’s experienced—on a global scale.

Segment Highlights and Performance Overview

By Service Type:

Self-service formats lead the service type segment, accounting for approximately 55% of the global QSR market. This dominance reflects growing consumer demand for autonomy, speed, and minimal wait times. Digital kiosks, mobile ordering apps, and app-based payments are accelerating this shift, offering operational efficiencies for restaurants and convenience for guests.

By Type:

Chain restaurants hold the largest share of the type segment, comprising approximately 66% of global market value. Strong brand recognition, standardized service quality, and widespread geographic presence make chains a go-to option for consumers. Chain operators also benefit from centralized marketing, supply chain integration, and tech-driven scale advantages that support rapid growth and profitability.

By Ownership:

Franchised models dominate the ownership segment, representing nearly 95% of all QSR outlets worldwide. This structure enables rapid global expansion while minimizing capital risk for parent brands. Leading players such as McDonald’s, Subway, and KFC have successfully leveraged franchising to build expansive, resilient global networks.

By Category:

Non-vegetarian menu offerings lead the category segment, holding an estimated 38% share in key markets like the U.S. Burgers, chicken, and seafood remain mainstays on QSR menus, with ongoing innovation in protein formats and flavor profiles ensuring continued consumer demand across regions.

By Sales Channel:

On-premises dining remains the largest sales channel, accounting for approximately 65% of global QSR revenue. Despite the growth of delivery and takeaway formats, in-store dining retains its appeal—particularly in high-density urban areas and emerging markets. It also allows for stronger brand immersion, upselling opportunities, and improved customer retention through face-to-face engagement.

Geographical Analysis

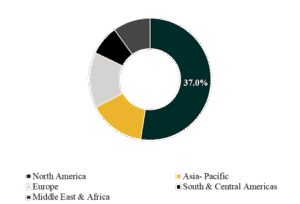

The global QSR market is segmented across North America, Europe, Asia-Pacific, South & Central America, and the Middle East & Africa.

North America holds the largest market share, contributing approximately 35% to 37% of global QSR revenue. The region benefits from a mature foodservice infrastructure, deep-rooted consumer preference for fast food, and widespread presence of leading QSR chains such as McDonald’s, Wendy’s, and Burger King. Early adoption of drive-thru technology, mobile ordering, and loyalty platforms continues to support regional leadership.

Asia-Pacific is expected to record the highest growth rate, with a projected CAGR of 9% to 9.1%. Urbanization, rising income levels, and a young, digitally connected consumer base are driving rapid QSR expansion across countries like China, India, Indonesia, and the Philippines. The fusion of Western brands with local flavors, combined with widespread use of delivery apps and digital ordering platforms, is accelerating penetration across both urban and semi-urban areas.

Competition Landscape

The QSR market is highly competitive, defined by the presence of global powerhouses, strong regional players, and a new wave of digital-first food startups. Market leaders are investing in menu innovation, digital infrastructure, and franchising to expand reach and build brand loyalty. The race to enhance speed, convenience, and personalization is driving aggressive competition and rapid innovation across the industry.

Key players profiled in this report include:

McDonald’s Corporation, Yum! Brands, Inc., Restaurant Brands International Inc., The Wendy’s Company, Domino’s Pizza, Inc., Starbucks Corporation, Subway IP LLC, Chipotle Mexican Grill, Inc., Dunkin, Inspire Brands, Inc., Papa John’s International, Inc., and Little Caesars Enterprises Inc.

Key Developments

- In March 2025, Yum! Brands entered into a strategic collaboration with NVIDIA to implement AI-powered voice ordering and automation across 500+ outlets of Taco Bell, Pizza Hut, KFC, and Habit Burger. This move is streamlining service, improving order accuracy, and positioning Yum! as a digital leader in the evolving QSR landscape.

- On November 12, 2024, Subway IP LLC began the global rollout of its “Fresh Forward 2.0” store design, aimed at modernizing guest experience and deepening digital integration. The refreshed layout supports faster service, enhances in-store and mobile ordering workflows, and helps franchisees stay competitive in an increasingly tech-driven market.

Segmentations:

By Service Type:

- Self-serviced

- Assisted self-service

- Fully serviced

By Type:

- Standalone Restaurants

- Chain Restaurants

By Ownership:

- Franchised

- Company-Owned

By Category:

- Vegetarian

- Non-Vegetarian

By Sales Channel:

- On-Premises

- Off-Premises

Companies:

- McDonald’s Corporation

- Yum! Brands, Inc.

- Restaurant Brands International Inc.

- The Wendy’s Company

- Domino’s Pizza, Inc.

- Starbucks Corporation

- Subway IP LLC

- Chipotle Mexican Grill, Inc.

- Dunkin

- Inspire Brands, Inc.

- Papa John’s International, Inc.

- Little Caesars Enterprises Inc.

Need Deeper Insights or Custom Analysis?

Contact Blackwater Business Consulting to explore how this data can drive your strategic goals.