Global Generative AI Chip Market: Technology Advancements, Growth Opportunities, and Industry Trends 2025–2030

The Global Generative AI Chip Market is analyzed in this report across chipset type, application, end-use, and region, highlighting major trends and growth forecasts for each segment

Let's Get You Started!

Fill out the quick form below and our academic advisor will connect with you shortly.

- ICT & Semiconductors

The Global Generative AI Chip Market is analyzed in this report across chipset type, application, end-use, and region, highlighting major trends and growth forecasts for each segment

Introduction

5G chipsets are the foundation of next-generation wireless communications, delivering ultra-fast connectivity, low latency, and real-time responsiveness across a wide range of use cases. These chipsets power critical applications across smartphones, IoT networks, autonomous vehicles, and industrial automation, making them central to the global digital transformation. As the demand for high-speed internet intensifies and the number of connected devices surges, 5G chipsets are emerging as core enablers of the smart economy. Innovations in System-on-Chip (SoC) architectures, RF front-end components, and AI-integrated chipsets are further accelerating advancements in this space.

The global 5G chipsets market is expanding rapidly and is projected to reach USD 284.9 billion by 2030. This growth is being driven by substantial investments in 5G infrastructure, surging demand for smart devices, and the ongoing deployment of standalone (SA) and non-standalone (NSA) 5G networks. Valued at approximately USD 55.8 billion in 2024, the market is expected to grow at a CAGR of 22% over the forecast period.

Market Dynamics

The 5G chipsets market is experiencing robust growth, underpinned by a convergence of technological innovation, global infrastructure expansion, and rising demand for high-performance connectivity. As telecom operators scale up 5G rollouts, chipset manufacturers are seeing heightened demand for advanced silicon solutions capable of supporting ultra-low latency, high bandwidth, and multi-device environments.

Key growth drivers include the widespread adoption of 5G-enabled smartphones, the expansion of edge computing, and the proliferation of IoT devices requiring fast, reliable wireless communication. The accelerating shift toward Industry 4.0 is also pushing adoption in sectors such as manufacturing, logistics, and autonomous systems, where real-time responsiveness is essential.

Innovation in chipset design is playing a critical role. Manufacturers are developing increasingly sophisticated solutions—including AI-enhanced SoCs, mmWave-compatible modems, and power-efficient architectures—that can support complex use cases across both consumer and enterprise domains. Additionally, the growing demand for private 5G networks in smart factories, campuses, and defense applications is opening new avenues for chipset deployment.

The competitive landscape is being reshaped by ongoing R&D investment, strategic partnerships, and vertical integration efforts aimed at optimizing performance, power consumption, and cost. As 5G becomes a baseline connectivity standard, the ability to deliver scalable, future-ready chipset solutions will be central to long-term success in the sector.

Segment Highlights and Performance Overview

By Chipset Type:

Graphics Processing Units (GPUs) account for the largest share of the chipset type segment, comprising approximately 45% of the market. GPUs provide the parallel processing capabilities essential for training and deploying AI models within 5G environments, particularly for edge computing and smart infrastructure applications. Their ability to manage high-throughput workloads makes them the chipset of choice for deep learning and generative AI use cases, especially among cloud service providers and research institutions.

By Application:

Deep learning leads the application segment, contributing around 50% of market demand. As the backbone of applications such as speech recognition, image analysis, and natural language processing, deep learning requires immense computational power—driving the uptake of high-performance, AI-optimized chipsets. The rise of transformer-based models and generative AI has only reinforced the need for specialized hardware capable of supporting intensive neural network workloads.

By End-Use:

Cloud service providers represent the largest end-use segment, holding approximately 40% of market share. These hyperscale companies are investing heavily in AI infrastructure to offer scalable generative AI capabilities across sectors. The rise of AI-as-a-Service (AIaaS) models is further driving demand for powerful chipsets that support high-volume model training, inference, and fine-tuning in real time.

Geographical Analysis

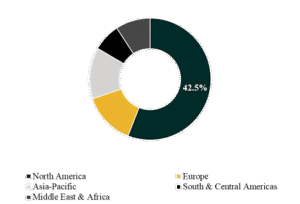

The global 5G chipsets market is segmented into North America, Europe, Asia-Pacific, South & Central America, and the Middle East & Africa.

North America holds the largest market share, estimated between 38% and 42%, driven by the presence of leading cloud providers, advanced AI research ecosystems, and key semiconductor players such as NVIDIA, AMD, and Intel. The region benefits from early enterprise adoption of generative AI, a mature 5G infrastructure, and sustained venture capital investment in AI hardware startups.

Asia-Pacific is projected to register the highest CAGR, between 42% and 50%, during the forecast period. Significant investments in AI and 5G infrastructure, strong government support, and rapid digital adoption in countries like China, India, Japan, and South Korea are fueling demand. The region’s diverse and fast-growing tech ecosystem, combined with an increasing appetite for localized AI solutions, is accelerating uptake across consumer and industrial applications.

Competition Landscape

The 5G chipset market is defined by intense competition among established semiconductor firms, major cloud providers, and next-generation AI hardware innovators. Market leaders are prioritizing custom chip development, platform integration, and strategic alliances to maintain a competitive edge in a rapidly evolving ecosystem.

Key players profiled in this report include:

NVIDIA, AMD, Intel, Google, Apple, Qualcomm, Cerebras Systems, Graphcore, Groq, and Tenstorrent.

Key Developments

- On June 12, 2025, AMD announced its Instinct MI350 and MI400 series, along with the introduction of the “Helios” rack-scale AI server. The MI350 chips are expected in the second half of 2025, with Helios to follow in 2026. CEO Lisa Su highlighted active collaborations with OpenAI, Meta, and Microsoft, marking a major push into enterprise AI infrastructure. These developments are boosting AMD’s competitiveness in high-performance AI computing and accelerating enterprise-scale adoption of its chipsets.

- On July 30, 2025, Qualcomm will host its inaugural “Snapdragon Auto Day” in India, unveiling AI-integrated automotive platforms designed for V2X, ADAS, digital cockpit systems, and cloud-connected mobility. This move deepens Qualcomm’s presence in the smart mobility sector, reinforcing its role in driving AI adoption across next-generation vehicle ecosystems and expanding demand for automotive-grade 5G chipsets.

Segmentations:

By Chipset Type:

- GPU

- ASIC

- FPGA

- CPU

- Others

By Application:

- Deep Learning

- Generative Adversarial Networks (GANs)

- Natural Language Understanding (NLU)

- Traffic Prediction & Classification

- Others

By End-Use:

- Consumer Electronics

- Cloud Service Providers

- Telecom & Managed Services

- Automotive

- Others

Companies:

- NVIDIA

- AMD

- Intel

- Apple

- Qualcomm

- Cerebras Systems

- Graphcore

- Groq

- Tenstorrent

Need Deeper Insights or Custom Analysis?

Contact Blackwater Business Consulting to explore how this data can drive your strategic goals.