Global AI Assistants Market

The Global AI Assistants Market is analyzed in this report across types, deployment modes, end-use industries, and regions, highlighting major trends and growth forecasts for each segment.

Let's Get You Started!

Fill out the quick form below and our academic advisor will connect with you shortly.

- ICT & Semiconductors

The Global AI Assistants Market is analyzed in this report across types, deployment modes, end-use industries, and regions, highlighting major trends and growth forecasts for each segment.

Introduction:

Artificial Intelligence (AI) assistants are fundamentally reshaping how individuals and organizations interact with technology. These intelligent systems are embedded across a wide spectrum of applications, from personal voice assistants in smartphones and smart homes to enterprise-grade conversational agents that streamline business processes and elevate customer experiences.

The global AI assistants market is undergoing exponential growth, projected to reach USD 64.30 billion by 2030. This surge is driven by increasing automation needs, growing digital fluency, and rising consumer preference for real-time, personalized interactions via voice and text. The integration of generative AI, rapid enterprise adoption, and demand for always-on support are accelerating market momentum. Valued at approximately USD 5.83 billion in 2024, the market is set to expand at a CAGR of 46% over the forecast period.

Market Dynamics

The AI assistants market is advancing at a transformative pace, fueled by the convergence of automation demand, user behavior shifts, and breakthroughs in natural language processing (NLP), machine learning, and generative AI. These assistants are revolutionizing workflows by automating repetitive tasks, providing real-time insights, and enhancing service interactions across sectors.

Cloud infrastructure and open APIs have lowered barriers to deployment, enabling scalable rollout of AI assistants across industries and user bases. From healthcare and finance to education and retail, organizations are leveraging AI assistants to improve efficiency, responsiveness, and operational resilience.

Government-backed AI strategies are further accelerating market development. The U.S. national AI strategy emphasizes trustworthy, human-centric AI deployment, while India’s recently launched IndiaAI Mission promotes a full-stack ecosystem for innovation, talent development, and research. These initiatives are catalyzing public-private investments and enhancing global competitiveness in AI assistant technologies.

Significant growth opportunities lie in the deployment of enterprise assistants for IT support, HR automation, customer service, and sales enablement. As voice and multimodal AI assistants expand into automotive, smart home, and wearable tech ecosystems, new consumer touchpoints are opening across industries. Emerging agentic AI systems, capable of autonomous, multi-step decision-making, are redefining productivity by supporting complex workflows such as content generation, research, and data analysis.

Key trends shaping the market include the evolution of generative and emotionally intelligent assistants, growing demand for AI co-pilots in knowledge work, and heightened focus on AI ethics, privacy, and explainability. Generative AI is enabling assistants to synthesize content, reason dynamically, and adapt fluidly to user intent. Enterprises are increasingly turning to customizable, privacy-respecting models that deliver intelligent automation while maintaining data control.

Segment Highlights and Performance Overview

- By Type – Voice Assistants

Voice Assistants account for the largest share of the AI assistants market, comprising approximately 40% to 50% of the segment. Their dominance is propelled by widespread adoption through smartphones, smart speakers, and automotive infotainment systems. As voice becomes the preferred interface for search, productivity, and home automation, integration in enterprise workflows and global deployments continues to accelerate, driven by improvements in NLP accuracy and multilingual capabilities. - By Deployment Mode – Cloud-Based

Cloud-based deployment leads the market with a 65% to 70% share, favored for its scalability, flexibility, and seamless integration with enterprise systems. The rise of AI-as-a-Service (AIaaS) and low-code/no-code platforms is enabling organizations to deploy assistants faster and at lower operational cost. Cloud architecture also facilitates cross-platform compatibility and real-time updates, making it the go-to deployment model across verticals. - By End-User Industry – BFSI

The Banking, Financial Services, and Insurance (BFSI) sector holds the largest industry share at 28% to 30%, driven by the deployment of AI assistants for customer support, fraud detection, virtual advisory, and internal automation. As financial institutions prioritize 24/7 service, compliance, and cost-efficiency, AI assistants are emerging as critical enablers of digital transformation within this highly regulated domain.

Geographical Analysis

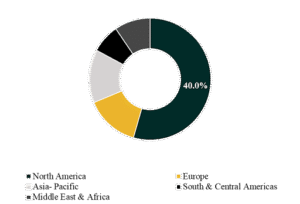

The global AI assistants market is examined across key regions, including North America, Europe, Asia-Pacific, South & Central America, and the Middle East & Africa.

North America leads the global AI assistants market with a 40% share, underpinned by robust digital infrastructure, strong enterprise adoption, and the presence of leading AI technology firms. Early investments in cloud computing, NLP, and conversational AI platforms have positioned the region at the forefront of innovation and deployment.

Asia-Pacific is expected to record the highest compound annual growth rate, ranging between 16% and 31%. This growth is fueled by rapid digitalization, government-backed AI programs, and mass adoption of smartphones and smart assistants in countries like China, India, and Japan. The region’s thriving tech ecosystem and consumer openness to voice and generative AI solutions are propelling it into a leadership position in global AI assistant adoption.

Competition Landscape

The competitive landscape is shaped by a mix of global technology leaders, enterprise software firms, and fast-scaling AI startups. Companies are differentiating through large-scale language model integration, vertical-specific assistant platforms, and seamless ecosystem partnerships.

Key players profiled in this report include: Google, Apple, Microsoft, Amazon, Meta, Salesforce, SAP, Zoom, SoundHound AI, and LivePerson.

These firms are investing heavily in generative AI, real-time agentic systems, and domain-specific assistants, competing to redefine the future of AI-powered interaction across enterprise and consumer markets.

Key Developments

- May 20, 2025 – Google Launches “AI Mode” in Search

Google introduced a transformative “AI Mode” in Google Search, featuring chatbot-style responses, multimodal input, and Project Mariner agent task capabilities. This strategic shift marks Google’s move toward agentic AI, positioning it as a leader in next-generation conversational interfaces and raising competitive pressure across the AI assistants space. - May 8, 2025 – SoundHound AI Unveils Amelia 7.0

SoundHound AI launched Amelia 7.0, a voice-first conversational AI agent platform tailored for enterprise deployment in sectors like healthcare and retail. Paired with key client wins such as Allina Health, Amelia 7.0 enables scalable automation via voice-enabled agentic systems. This innovation strengthens SoundHound’s leadership in enterprise voice AI and signals growing demand for autonomous AI agents across verticals.

Segmentation:

By Type:

- Voice Assistants

- Text-Based Assistants

- AI Agents / Agentic AI

- Virtual Customer Assistants

- Multimodal Assistants

By Deployment Mode:

- Cloud-Based

- On-Premise

- Hybrid

By End-User Industry:

- IT & Telecom

- Healthcare

- Retail / eCommerce

- BFSI

- Travel & Hospitality

- Education

- Government

- Media & Entertainment

Companies included in the report:

- Apple

- Microsoft

- Amazon

- Meta

- Salesforce

- SAP

- Zoom

- SoundHound AI

- LivePerson

Need Deeper Insights or Custom Analysis?

Contact Blackwater Business Consulting to explore how this data can drive your strategic goals.