Global Analog IC Market: Innovative Developments, Future Growth Avenues, and Industry Landscape 2025–2030

The Global Analog IC Market is analyzed in this report across type, technology, end-use industry, and region, highlighting major trends and growth forecasts for each segment.

Let's Get You Started!

Fill out the quick form below and our academic advisor will connect with you shortly.

- ICT & Semiconductors

The Global Analog IC Market is analyzed in this report across type, technology, end-use industry, and region, highlighting major trends and growth forecasts for each segment.

Introduction

An analog integrated circuit (IC) is a semiconductor device designed to process continuous electrical signals, translating real-world variations in amplitude into usable outputs. These circuits serve as the vital bridge between physical signals—such as sound, light, temperature, and pressure—and digital devices, making them indispensable across modern electronics. From consumer gadgets and industrial automation to automotive systems and healthcare equipment, analog ICs power critical functions including signal amplification, power regulation, and conversion.

The global analog IC market is experiencing strong momentum, valued at approximately USD 85.8 billion in 2024 and projected to reach USD 147.54 billion by 2030, growing at a CAGR of 7.7%. Growth is being fueled by rising adoption of advanced driver-assistance systems (ADAS), increasing demand for power-efficient electronics, and the rapid proliferation of smart consumer devices. Expanding renewable energy systems and industrial IoT infrastructure are further broadening the scope and application of analog ICs across industries.

Market Dynamics

The analog IC market has entered a phase of accelerated growth, shaped by the convergence of technological advancements and rising global demand for efficient electronics.

Key growth drivers include the widespread use of consumer electronics, the increasing electrification of vehicles and deployment of ADAS, and heightened investment in industrial automation and smart infrastructure. Analog ICs underpin critical functions in power management, signal conditioning, and data conversion, making them integral to nearly every sector. For example, the U.S. Department of Transportation’s Rural EV Infrastructure Toolkit is supporting EV adoption in underserved regions, directly boosting demand for analog ICs in battery management and power systems. In Asia-Pacific, Japan continues to lead in analog and power IC innovation, as highlighted by the EU-Japan Centre’s assessment of the region’s electronics sector. This, combined with the scale of electronics production across China, Taiwan, and South Korea, has intensified demand for high-performance, thermally efficient analog devices.

Looking ahead, the market presents substantial opportunities. Application-specific analog ICs are seeing heightened demand in automotive electrification, smart wearables, medical technology, and renewable energy. The expansion of 5G networks and edge computing is spurring adoption of RF analog components and analog front-end modules to enable faster data transmission and real-time signal processing. Analog ICs tailored for industrial IoT applications are gaining traction, offering enhanced accuracy, energy efficiency, and durability in mission-critical environments. Miniaturization trends are also accelerating innovation in power analog and mixed-signal ICs, particularly in compact, multifunctional devices.

The industry is also being reshaped by structural and design trends. Mature process nodes such as 180 nm and 90 nm remain in demand due to their analog-friendly characteristics. At the same time, integration of analog and digital functionalities into system-on-chip (SoC) designs is expanding. AI-assisted chip design tools are emerging as a game-changer, streamlining analog layout processes and shortening development cycles. Sustainability considerations are rising in importance, with energy-efficient analog ICs helping reduce power consumption across industrial and consumer applications. As analog ICs continue to form the backbone of modern electronics, their role in enabling next-generation digital transformation remains essential.

Segment Highlights and Performance Overview

By Type

Application-specific analog ICs dominate the market, holding approximately 58% share. Purpose-built for targeted functions such as battery management, motor control, and sensor interfacing, these ICs deliver optimized performance, reliability, and cost-effectiveness. Their role in ADAS, medical imaging, and renewable energy systems is driving sustained demand across automotive, healthcare, and industrial sectors.

By Technology

CMOS analog ICs lead with roughly 45% share, favored for their scalability, low power consumption, and seamless integration with digital logic. Widely adopted in smartphones, portable electronics, and consumer devices, CMOS analog ICs also support mixed-signal processing, enabling cost-effective production and high-volume deployment across commercial and industrial markets.

By End-Use Industry

The automotive sector represents the largest end-use category, accounting for around 30% of total demand. Analog ICs are indispensable in managing high-voltage systems, inverters, battery monitoring, and real-time sensor processing for electric vehicles and ADAS platforms. The electrification of transport and advancements in autonomous driving are reinforcing the automotive industry’s reliance on analog ICs.

Geographical Analysis

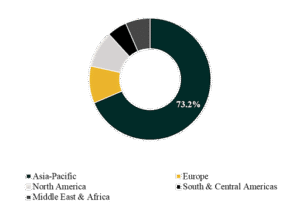

The global analog IC market is examined across key regions, including North America, Europe, Asia-Pacific, South & Central America, and the Middle East & Africa.

The Asia-Pacific region dominates the global analog IC market, contributing approximately 73.2% of total revenue. Its leadership is supported by a vast electronics manufacturing ecosystem, robust consumer and automotive demand, and the presence of leading semiconductor foundries across China, Taiwan, Japan, and South Korea. Asia-Pacific is also expected to post the highest growth rate, with a forecast CAGR of around 7.5%. Rising EV adoption, accelerated industrial automation, and significant investment in semiconductor infrastructure are key growth enablers. Strong domestic policies promoting chip self-sufficiency and digital transformation further reinforce the region’s position as the global hub for analog IC innovation and production.

Competition Landscape

The analog IC market is defined by the presence of established semiconductor leaders, specialized analog players, and nimble fabless firms. Competition is centered on technological innovation, M&A activity, and expanded application-specific product portfolios, particularly across automotive, industrial, and consumer markets.

Key players profiled in this report include NXP Semiconductors, Texas Instruments, Infineon Technologies, STMicroelectronics, Renesas Electronics, Richtek Technology Corp., ROHM Semiconductor, Silicon Labs, MaxLinear, and Torex Semiconductor Ltd. These companies are leveraging design expertise, ecosystem partnerships, and global scale to capture opportunities across both established and emerging applications.

Key Developments

- March 17, 2025 – NXP Semiconductors launched the NAFE33352 analog AIO front-end for Industry 4.0 factory automation. With high-precision, machine-learning-ready input/output capabilities, this product strengthens NXP’s position in industrial analog ICs and supports AI-driven sensing and real-time control.

- May 14, 2025 – STMicroelectronics introduced the MxL86252S/82S web-smart 2.5 GbE switch SoCs with integrated CPUs for advanced PoE switch management. This development highlights the growing convergence of analog and digital systems in smart infrastructure, accelerating demand for integrated analog-digital solutions in enterprise and industrial networking.

Segmentations

By Type:

- General-Purpose IC

- Application-Specific IC

By Technology:

- CMOS Analog ICs

- Bipolar Analog ICs

- RF Analog ICs

- Power Analog ICs

- Mixed-Signal Analog ICs

By End-Use Industry:

- Automotive

- Healthcare

- Consumer Electronics

- Information Technology Telecommunication

- Others

Company:

- NXP Semiconductors

- Texas Instruments

- Infineon Technologies

- STMicroelectronics

- Renesas Electronics

- Richtek Technology Corp.

- ROHM Semiconductor

- Silicon Labs

- MaxLinear

- Torex Semiconductor Ltd.

Need Deeper Insights or Custom Analysis?

Contact Blackwater Business Consulting to explore how this data can drive your strategic goals.