Global Field Programmable Gate Array (FPGA) Market: Transformations, Emerging Growth Avenues, and Competitive Trends 2025–2030

The Global Field Programmable Gate Array (FPGA) Market is analyzed in this report across various segments, including configuration, node size, technology, application, end-use industry, and region, highlighting major trends and growth forecasts for each segment.

Let's Get You Started!

Fill out the quick form below and our academic advisor will connect with you shortly.

- ICT & Semiconductors

The Global Field Programmable Gate Array (FPGA) Market is analyzed in this report across various segments, including configuration, node size, technology, application, end-use industry, and region, highlighting major trends and growth forecasts for each segment.

Introduction:

Field-Programmable Gate Arrays (FPGAs) are increasingly positioned as critical enablers of high-performance, reconfigurable computing across a wide range of industries. These programmable semiconductor devices allow hardware functionality to be customized post-manufacturing, making them ideal for applications demanding flexibility, low latency, and efficient processing. FPGAs are transforming sectors including telecommunications, automotive, defense, industrial automation, and data centers by supporting real-time signal processing, adaptive AI workloads, and rapid prototyping capabilities.

The global FPGA market is experiencing strong momentum and is projected to reach USD 17.58 billion by 2030. Growth is being driven by rising demand for low-power edge computing, the growing adoption of autonomous systems, and the rapid deployment of AI and 5G technologies. Additionally, the increasing need for hardware acceleration in data-intensive applications and the integration of embedded FPGA IP in ASIC designs are accelerating market adoption. Valued at approximately USD 9.4 billion in 2024, the market is anticipated to expand at a CAGR of 11% over the forecast period.

Market Dynamics

The FPGA market is growing rapidly, propelled by technological advances and increasing industry demand for flexible, high-performance computing hardware.

Key market drivers include the rising complexity of electronic systems, increased demand for low-latency processing, and the expansion of FPGA adoption in AI, 5G, and edge computing. FPGAs provide parallelism, real-time processing, and post-manufacturing reconfigurability—attributes that make them critical in applications ranging from automotive autonomy to hyperscale data centers. Their integration into industrial automation, software-defined networking, and defense electronics has grown significantly as industries prioritize scalable, adaptive hardware.

The market presents significant opportunities for FPGA vendors, IP providers, and system integrators. Growth areas include autonomous vehicle platforms, smart manufacturing under Industry 4.0, and FPGA-based acceleration in cloud and hyperscale environments. FPGAs are also enabling next-generation solutions in low-latency trading, secure military systems, and AI-enhanced healthcare. In response, vendors are investing in AI-optimized architectures, application-specific platforms, and high-level synthesis tools to streamline development and meet emerging demands.

Global policy initiatives are reinforcing this momentum. The European Union’s European Chip Act aims to strengthen regional semiconductor capabilities, with a focus on advanced logic technologies like FPGAs. Japan’s Semiconductor and Digital Industry Strategy is similarly channeling R&D and infrastructure investment toward future semiconductor innovation. These efforts are designed to foster regional self-sufficiency and advance critical hardware innovation.

Several market trends are reshaping the landscape. Open-source FPGA toolchains, adoption of RISC-V soft processors, and convergence with heterogeneous computing platforms are gaining traction. FPGAs are widely used for RISC-V prototyping, hardware-software co-design, and custom processor development. As open instruction set architectures like RISC-V gain global support, FPGA platforms are evolving to support faster innovation and broader application reach.

Packaging innovation is another catalyst. Chiplet-based architectures and energy-efficient logic designs are enabling modular, scalable FPGA solutions. As the market matures, there’s a growing emphasis on design interoperability, improved programmability, and compliance with evolving security and reliability standards—particularly for mission-critical systems.

National strategies also reflect this shift. India’s Semiconductor Mission has approved several fabrication and assembly units in Gujarat, Assam, and Sanand to build a resilient domestic chip ecosystem. Tata Electronics’ approved facility in Dholera, Gujarat—developed in partnership with Powerchip Semiconductor Manufacturing Corp (PSMC)—marks a pivotal step in India’s push toward semiconductor leadership and innovation in programmable logic technologies.

Segment Highlights and Performance Overview

By Configuration

Low-end FPGAs lead the market with a share of approximately 52% to 63%, driven by their affordability, low power consumption, and broad applicability in consumer electronics, industrial control, and basic embedded systems. Their compact size and programmability make them well-suited for cost-sensitive applications across multiple sectors.

By Node Size

FPGAs fabricated using 28–90 nm node sizes account for the largest share, around 49% to 50%. These nodes offer an optimal trade-off between performance, power efficiency, and cost, making them a reliable choice for telecom, industrial, and mid-range computing applications. Their maturity and yield rates continue to support widespread adoption.

By Technology

SRAM-based FPGAs dominate the technology segment with an estimated 44% to 55% share. Their reprogrammability, high performance, and compatibility with modern development tools make them essential for iterative design processes, especially in data centers, aerospace, and defense systems. Broad vendor support further cements their position in the market.

By Application

The communication segment leads in application share, comprising approximately 32% to 33% of the market. FPGAs play a central role in enabling high-speed data transmission, low-latency communication, and adaptive processing in 5G infrastructure, optical networks, and software-defined radios.

By End-Use Industry

Telecommunications is the top end-use segment, contributing around 29% to 32% of total market demand. The sector’s shift to 5G, NFV, and programmable infrastructure has elevated demand for FPGA-enabled acceleration in packet processing, network routing, and signal integrity management.

Geographical Analysis

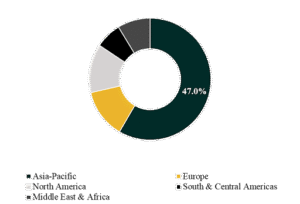

The global FPGA market is segmented into North America, Europe, Asia-Pacific, South & Central America, and the Middle East & Africa.

Asia-Pacific holds the largest share, approximately 47%, supported by its dominant semiconductor manufacturing base, large-scale electronics production, and strong investments in 5G, AI, and industrial automation. Demand is particularly strong in China, Taiwan, South Korea, India, and Japan, where FPGAs are integral to telecom infrastructure, consumer electronics, and automotive systems.

North America is expected to post the highest CAGR, estimated between 8% and 10.5%, driven by the rapid adoption of FPGA-based acceleration in data centers, robust R&D in defense and AI, and the presence of leading FPGA suppliers and cloud hyperscalers. The region’s focus on technological leadership continues to spur demand for reconfigurable, high-performance computing hardware.

Competition Landscape

The global FPGA market is highly competitive, featuring major semiconductor firms, specialty programmable logic vendors, and IP core providers. Key players are investing in power-efficient architectures, AI-ready platforms, and next-gen development ecosystems to maintain a competitive edge and expand market share across strategic verticals.

Key players profiled include:

AMD, Intel, Microchip Technology, Lattice Semiconductor, Achronix Semiconductor, QuickLogic Corporation, Efinix Inc., GOWIN Semiconductor, ChipCraft, and Anlogic.

Recent Developments

- In March 2024, Intel announced the launch of its Agilex 3 FPGA family, optimized for low-power edge AI and embedded applications. With full software support, the Agilex 3 platform strengthens Intel’s position in the mid-range segment, targeting smart devices, industrial IoT, and edge compute workloads.

- In October 2024, Achronix announced the introduction of the Speedster AC7t800, a mid-range FPGA with 12 Tbps fabric and PCIe Gen5 support. The new device is designed for AI acceleration, networking infrastructure, and high-throughput data center applications—further intensifying competition in the performance-driven FPGA segment.

Segmentation:

By Configuration:

- Low-end FPGA

- Mid-range FPGA

- High-end FPGA

By Node Size:

- Less than 28 nm

- 28–90 nm

- More than 90 nm

By Technology:

- SRAM-based FPGA

- Antifuse-based FPGA

- Flash-based FPGA

- EEPROM-based FPGA

- Hybrid FPGA

- System-on-chip FPGA

- Others

By Application:

- Data Processing

- Security

- Image Processing

- Communication

- Others

By End-Use Industry

- Telecommunications

- Consumer Electronics

- Automotive

- Aerospace & Defense

- Industrial

- Others

Companies included in the report:

- AMD

- Intel

- Microchip Technology

- Lattice Semiconductor

- Achronix Semiconductor

- QuickLogic Corporation

- Efinix Inc.

- GOWIN Semiconductor

- ChipCraft

- Anlogic

Need Deeper Insights or Custom Analysis?

Contact Blackwater Business Consulting to explore how this data can drive your strategic goals.