India’s Semiconductor Revolution: Can It Become the Next Global Chip Hub?

India has long been known for its curry, cricket, and code. But lately, there’s another “C” that’s sparking global curiosity—chips. No, not the fried potato kind that accompany a masala chai session, but the tiny silicon brains that power everything from your smartphone to your car’s AI assistant. The India semiconductor industry is finally stepping into the spotlight, and policymakers, investors, and global tech giants are suddenly asking: Can India realistically become the next global chip hub, or is this just another slogan in the long parade of “Make in India” dreams?

At Blackwater, we’ve been watching this space with hawk-eyed curiosity (and let’s be honest, mild obsession). As a leading market research company, we thrive on decoding fast-moving industries, and the semiconductor story unfolding in India is as spicy as a plate of Gujarati dhokla with extra chili. The stakes are huge: semiconductors aren’t just another sector; they’re the foundation of the 21st-century digital economy. Whoever controls chips controls the future.

The Current State of the India Semiconductor Industry

Let’s start with a reality check. India doesn’t yet have a semiconductor manufacturing ecosystem that matches Taiwan’s TSMC, Korea’s Samsung, or the U.S.’s Intel. For decades, India’s role in the semiconductor value chain has been mostly limited to chip design and back-end services. Bengaluru, Hyderabad, and Noida already boast impressive chip design hubs, where engineers create blueprints for some of the world’s most advanced semiconductors. The chip design ecosystem in India is robust, employing tens of thousands of highly skilled engineers who contribute to chips powering everything from iPhones to fighter jets.

But here’s the catch: India designs chips; it doesn’t always build them—at least not until very recently. When it comes to semiconductor manufacturing in India, the story has always been more about missed buses than success rides. The reasons? Astronomical capital costs, supply chain gaps, power infrastructure woes, and the kind of red tape that makes you want to cry into your PCB. Building a fab (semiconductor fabrication plant) isn’t like opening a startup with a beanbag and free Wi-Fi—it’s a multi-billion-dollar, ultra-clean-room, water-guzzling, precision-driven beast.

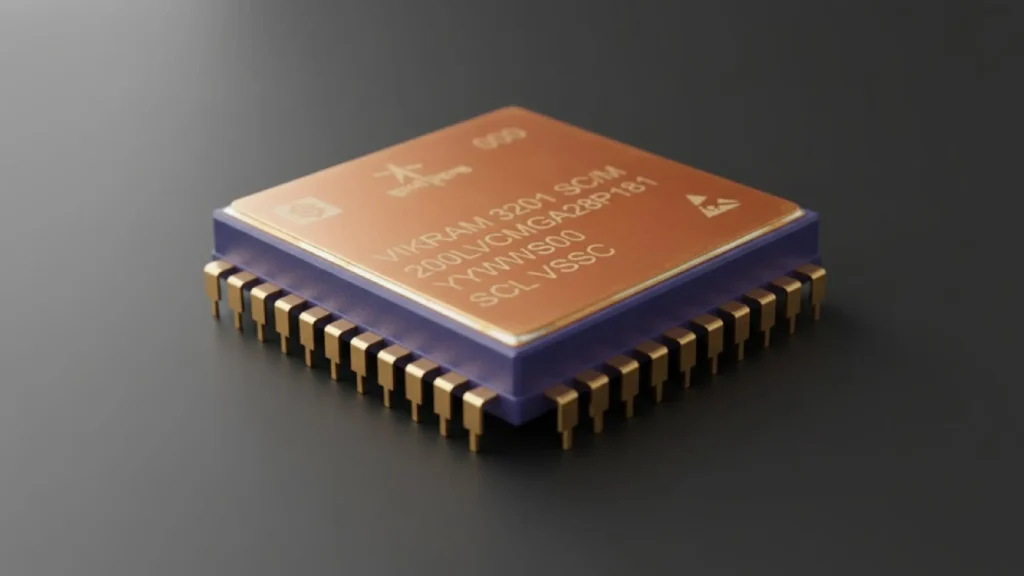

The Game-Changer: Vikram 3201 / Vikram-32 — India’s Indigenous 32-Bit Space-Grade Processor

Here’s where things get genuinely exciting. As of September 2025, India has unveiled its first fully indigenous 32-bit microprocessor, dubbed Vikram 3201 (also “Vikram-32”), developed by ISRO’s Semiconductor Laboratory (SCL) in Chandigarh and designed by ISRO’s Vikram Sarabhai Space Centre (VSSC).

Key Technical Specifications & Features

- Architecture: 32-bit processor, with a custom instruction set architecture.

- Fabrication process: Manufactured using an 180 nm CMOS process at SCL’s facility.

- Reliability / Ruggedization: Space-grade, capable of withstanding extreme temperatures (−55°C to +125°C), high shock, vibrations, and cosmic radiation.

- Programming support: Designed to run Ada (used widely in aerospace & defense), with support for C compilers underway.

- Validation: Successfully validated in space during the PSLV-C60 mission, proving its readiness for real-world deployment.

Intended / Actual End Users & Application Domains

- Space / Aerospace: ISRO will use it in launch vehicle avionics, satellites, and other mission-critical applications.

- Defense: Ideal for defense electronics, telemetry, and guided systems where failure is not an option.

- Other Strategic Sectors: Automotive, telecommunications, and energy systems where harsh environments demand reliability.

How Vikram 3201 Affects India’s Semiconductor Industry

This is more than just a chip unveiling; it’s a statement of capability. For the India semiconductor industry, Vikram-32 marks a tangible milestone. Here’s how this chip changes the landscape:

- Proof of Indigenous Manufacturing: Up until now, much of the “design” work was done in India, but reliance on foreign fabs and imports for critical chips was the norm. Vikram 3201 shows that India can design and manufacture a chip that meets space-grade standards.

- Strengthening the Chip Design Ecosystem India: With Vikram’s development, the chip design ecosystem gets a real, functioning flagship. Engineers, startups, and universities now have a home-grown benchmark, which helps attract talent, funding, and collaborations.

- Reducing Mission Critical Import Dependence: For space missions and defense, reliance on imported processors was costly and risky. An indigenous option like Vikram reduces vulnerability and supply chain risks.

- Acceleration of Semiconductor Market Growth India: This development adds momentum to the semiconductor market growth in India, proving that the country is more than just a design destination—it can deliver in manufacturing too.

- Policy Validation and Momentum: Vikram validates government efforts like the India Semiconductor Mission, encouraging more investment, incentives, and long-term policy continuity.

- Realistic Perspective: Of course, Vikram 3201 is built on a mature 180 nm node, not cutting-edge 5 nm or 7 nm technologies. It’s not meant for consumer smartphones but for strategic, high-reliability sectors where endurance matters more than raw performance.

India’s Big Push: From Policy to Pitches

The government isn’t just watching this revolution from the sidelines—it’s diving in headfirst with billions in incentives. Under the “India Semiconductor Mission,” New Delhi has pledged financial support for both design and manufacturing. We’re talking about subsidies covering up to 50 % of project costs, special packages for compound semiconductors, and policy tailwinds designed to attract global giants.

Micron has already announced a massive assembly and testing facility in Gujarat, while Vedanta-Foxconn (despite its shaky start) is still circling the fab dream. The semiconductor manufacturing in India story is no longer hypothetical—it’s happening, brick by brick, wafer by wafer.

But as any seasoned market researcher will tell you (cue Blackwater smug grin), policy enthusiasm is one thing; actual silicon rolling off wafers is another. Building a chip design ecosystem in India is easier than building fabs, because fabs demand uninterrupted power, industrial water, rare gases, ultra-pure chemicals, and a hyper-disciplined supply chain. You can’t just plug-and-play semiconductors like you do with IT parks. This is a marathon, not a sprint.

Global Context: Why Chips Are Suddenly The Talk Of the Town

If semiconductors sound like a nerdy industry topic, 2020 proved otherwise. The COVID-19 pandemic unleashed a global chip shortage that slowed car production, inflated smartphone prices, and left gamers refreshing GPU websites like desperate stock traders. Suddenly, governments realized chips aren’t just tech—they’re national security. The U.S. passed the CHIPS Act, Europe launched its Chips Act, and Japan, Korea, and Taiwan doubled down on subsidies.

This context is critical for understanding semiconductor market growth in India. The global chip ecosystem is in a geopolitical reshuffle. Nations want alternatives to reduce dependency on Taiwan (which, let’s be honest, sits uncomfortably close to China). Enter India, with its booming digital economy, engineering talent pool, and geopolitical sweet spot as a “neutral-ish” democracy. Global majors like Foxconn, Micron, and Applied Materials are already sniffing around, exploring partnerships, and setting up shop.

Why the World is Betting on the India Semiconductor Industry

So, why the global hype? For starters, India’s demographics are a goldmine. With a young, skilled engineering workforce, the India semiconductor industry already has deep expertise in design. Companies like Texas Instruments, Qualcomm, and Intel have had design centers here for decades. That means the talent base exists—it just needs the infrastructure to match.

Second, India is the world’s fastest-growing digital economy. From UPI payments to 5G rollouts to AI startups, domestic demand for chips is only going to skyrocket. The semiconductor market growth in India isn’t just export-driven—it’s fueled by local consumption. Think of every smartphone, EV, smart fridge, and drone that Indians will buy in the next decade. Each one is a chip-hungry beast.

Third, geopolitics is working in India’s favor. With U.S.-China tensions rising, companies are actively scouting “China+1” strategies. Vietnam, Malaysia, and Mexico are contenders, but none offer India’s unique cocktail of market size, democracy, and IT prowess. The semiconductor manufacturing in India opportunity is suddenly very real.

The Roadblocks: Not All That Glitters is Silicon

Before we get carried away, let’s address the elephant in the fab. The challenges are monumental.

One, cost and scale: Setting up a single advanced fab can cost upwards of $10 billion. Even with subsidies, that’s a staggering ask. Two, ecosystem gaps: From raw wafers to rare chemicals, India currently imports most of the supply chain. Building local suppliers will take years. Three, infrastructure hiccups: Consistent electricity, industrial water, and logistics are non-negotiables for fabs. India is improving, but the reliability has to reach world-class. Four, skilled manufacturing talent: While design engineers abound, fab technicians, process engineers, and materials scientists are scarcer. Training them takes time.

Even Vikram 3201, as an achievement, underscores both the progress and the distance yet to be travelled. Its 180 nm node is dependable but far from cutting-edge, so India needs to climb the node ladder, improve yield, packaging, testing, heat dissipation, and power efficiency if it wants to compete in consumer SoCs, AI accelerators, and mobile processors.

Chip Design Ecosystem in India: The Secret Sauce

If fabs are the shiny new headline, the chip design ecosystem in India is the underrated hero. Design, verification, and testing have quietly made India a global player long before “semiconductor” became a political buzzword. Companies like Wipro, HCL, and TCS already work on semiconductor R&D projects for global clients. Add to this the startups emerging in AI chips, automotive chips, and IoT semiconductors, and you’ve got a thriving ecosystem.

What’s exciting is the possibility of vertical integration. Imagine an India where chips are not just designed here but also manufactured, assembled, and tested. With the Vikram 3201 example, that becomes less theoretical and more plausible. This creates traction for more investments, more fabs, and more downstream ecosystem growth in packaging, testing, and specialty materials.

Semiconductor Market Growth India: A Billion-Dollar Future

According to projections, the semiconductor market growth in India could hit $64 billion by 2026, up from around $23 billion in 2019. That’s almost triple in less than a decade. Much of this growth will come from consumer electronics, EVs, renewable energy, and industrial automation. Add to that the government’s push for domestic production, and the runway looks long and promising.

The Vikram chip adds a strategic boost: it injects credibility into space, defense, and other high-reliability sectors, which tend to command higher margins, longer lifecycles, and strategic importance rather than mere commoditization. These sectors often pay a premium for quality, reliability, and assurance—which India may now increasingly provide domestically rather than through imports.

Can India Really Become the Next Global Chip Hub?

Now, the billion-dollar question (or should we say, trillion-dollar given the stakes): Can India truly become a global semiconductor hub? The honest answer: It depends on how you define “hub.” If we’re talking about overtaking Taiwan’s TSMC in five years, that’s as likely as Virat Kohli opening a roadside dosa stall. But if we’re talking about becoming a credible, competitive, and growing player in the global semiconductor ecosystem—absolutely yes.

With Vikram-32, India has shown that it can build mission-critical chips. With sustained investment, strategic partnerships, and policy continuity, India can deepen its position in the global value chain: in chip design, in space/aerospace/defense manufacturing, in packaging and testing, and even in consumer electronics. Being a hub doesn’t mean being the cheapest or the most advanced in every node; it means being reliable, scalable, specialized, and globally relevant.

Blackwater’s Take: Navigating the Silicon Road Ahead

At Blackwater, we don’t just track trends; we decode them. Our deep-dive reports on semiconductor manufacturing in India, supply chain opportunities, and talent mapping give businesses clarity in a sector clouded by both hype and hope. The arrival of Vikram 3201 is one of those turning points: it shifts semiconductors in India from being largely aspirational to being demonstrably real.

For investors, it marks a more stable signal that India is not only talking big but delivering in strategic niches. For companies considering setting up fabs, or offering packaging, testing, or deployment services in space, aerospace, defense, or automotive, this is a proof-point. For startups designing chips, this provides a benchmark and path forward. And for policymakers, this gives more ground to demand continuity of incentives, regulation, and infrastructure build-out.

Blackwater’s ongoing forecasts suggest that, with developments like Vikram 3201 plus increasing foreign and domestic investments in fabs, design, and materials, India’s semiconductor market could breach $100-150 billion in value within the next 5-7 years—if execution remains steady.

Conclusion: From Curry to Chips—India’s Next Big Leap

India has given the world yoga, Bollywood, and software engineers who fix bugs at 3 a.m. The next export? Chips that power the world’s gadgets, rockets, and grids. The India semiconductor industry is at an inflection point. With the unveiling of Vikram 3201, India has crossed a symbolic and technical milestone: the nation is now designing and manufacturing its own space-grade, mission-critical microprocessor. The chip design ecosystem in India is already strong, the semiconductor manufacturing in India is gaining credibility, and the semiconductor market growth in India is no longer just numbers—it’s trajectories with momentum.

Can India become the next global chip hub? The answer is: why not? With sustained effort, strategic focus, and the right partners, India’s semiconductor journey could very well be the blockbuster sequel the world is waiting for. And if you want the inside scoop on how this saga unfolds, you know where to turn—Blackwater, your research partner in decoding the silicon future.