Global 5G Chipsets Market: Technology Advancements, Growth Opportunities, and Industry Trends 2025–2030

The Global 5G Chipsets Market is analyzed in this report across chipset type, process node, industry vertical, and region, highlighting major trends and growth forecasts for each segment

Let's Get You Started!

Fill out the quick form below and our academic advisor will connect with you shortly.

- ICT & Semiconductors

The Global 5G Chipsets Market is analyzed in this report across chipset type, process node, industry vertical, and region, highlighting major trends and growth forecasts for each segment

Introduction

Generative Artificial Intelligence (AI) is rapidly emerging as a transformative force, redefining how digital content is created, processed, and interpreted across a wide range of industries. At the core of this transformation are generative AI chipsets—specialized hardware designed to execute the complex computations required by large-scale AI models. These chipsets, including GPUs, ASICs, and AI accelerators, are critical to training and deploying advanced models used in tasks such as natural language generation, image and video synthesis, and intelligent decision-making.

The global generative AI chipset market is on a steep growth trajectory and is projected to reach USD 280.8 billion by 2030. This expansion is being fueled by the widespread adoption of generative AI across sectors such as healthcare, automotive, finance, and media & entertainment. Rising demand for high-performance compute infrastructure, the proliferation of AI-as-a-Service (AIaaS) models, and continuous advancements in semiconductor technologies are accelerating market momentum. Valued at approximately USD 50.2 billion in 2024, the market is expected to grow at a CAGR of 23% over the forecast period.

Market Dynamics

The generative AI chipset market is undergoing rapid evolution, driven by the exponential rise of large language models (LLMs), generative adversarial networks (GANs), and other deep learning architectures that demand massive parallel processing and energy efficiency. These workloads require advanced chipsets capable of delivering real-time performance while optimizing for cost and power consumption.

Key drivers include the growing need for high-throughput, low-latency hardware to support both inference and training, and the widespread integration of generative AI in enterprise and consumer applications. Chipsets such as GPUs, ASICs, and NPUs are becoming foundational in enabling advanced capabilities like real-time translation, automated content creation, and generative design. Advancements in process node miniaturization, on-chip memory, and architecture-level optimizations are significantly improving processing speeds, thermal management, and scalability—making next-gen AI workloads more commercially viable.

The market presents significant opportunities for semiconductor manufacturers, hyperscale cloud providers, and emerging AI hardware startups. High-growth areas include the development of custom AI accelerators tailored for inference, edge deployment, and vertical-specific models. Demand is also surging for AI-optimized data center infrastructure and on-device chipsets for mobile, automotive, and industrial use cases. Edge applications, in particular, are driving demand for compact, energy-efficient solutions capable of running generative AI models in real time. Partnerships between chipmakers and AI developers are fostering vertically integrated systems that reduce total cost of ownership (TCO) while enhancing performance.

Several transformative trends are shaping the competitive landscape. These include the rising penetration of AI-dedicated chipsets in consumer devices, the integration of generative AI into cloud-native infrastructure, and the emergence of open and modular AI hardware ecosystems. For instance, Apple’s A18 Pro chipset introduces a powerful neural engine enabling real-time on-device generative processing in the iPhone 16 lineup. Likewise, AMD’s MI350 and MI400 series accelerators have been engineered for high-performance model training in enterprise-grade data centers.

Generative AI chipsets are also driving innovation in applications such as 3D content generation, AI-assisted design, and virtual environments. Simultaneously, sustainability is becoming a key differentiator, with industry leaders investing in energy-efficient architecture to address the growing carbon footprint of AI. As enterprises scale their AI capabilities, the demand for flexible, high-performance, and cost-effective chipsets is set to intensify—driving innovation, competition, and new market leadership across the semiconductor landscape.

Segment Highlights and Performance Overview

By Chipset Type

System-on-Chip (SoC) leads the chipset type segment, accounting for approximately 35% to 40% of the market. SoCs integrate processing, memory, and connectivity components on a single platform, making them highly efficient for compact, power-constrained applications. Their dominance is driven by widespread adoption in 5G smartphones, connected devices, and edge AI deployments, where space and energy efficiency are paramount.

By Process Node

Chipsets manufactured using process nodes smaller than 10nm hold the largest share—approximately 45%—of the processing node segment. These advanced nodes enable faster data throughput, reduced power consumption, and higher transistor density, making them ideal for flagship devices and AI-intensive 5G infrastructure. Foundries such as TSMC and Samsung are leveraging 5nm and 7nm technologies to deliver cutting-edge chip performance.

By Industry Vertical

Consumer electronics represent the largest vertical, accounting for roughly 38% to 42% of market demand. The rapid adoption of 5G-enabled smartphones, tablets, and wearables has significantly boosted demand for mobile AI and connectivity chipsets. Additionally, the rise of smart home devices, AR/VR headsets, and high-resolution media streaming is accelerating chipset adoption in consumer-driven applications.

Geographical Analysis

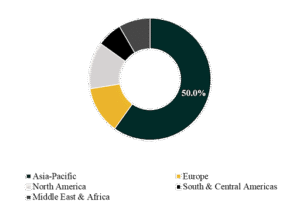

The generative AI chipset market is evaluated across five major regions: North America, Europe, Asia-Pacific, South & Central America, and the Middle East & Africa.

Asia-Pacific leads globally, contributing approximately 45% to 50% of total market share. This dominance is underpinned by rapid 5G infrastructure rollout, high-volume smartphone production, and the presence of leading semiconductor manufacturers such as Samsung, MediaTek, and Huawei. Countries like China, South Korea, and Japan are spearheading early adoption, supported by strong public and private sector investments in digital transformation.

The Middle East & Africa is expected to register the fastest CAGR, estimated between 35% and 38%. Growth is driven by increased investment in smart cities, digital infrastructure, and emerging 5G use cases in sectors such as public safety, logistics, and utilities. Initiatives like Saudi Arabia’s NEOM project and broader national transformation agendas are accelerating demand for advanced connectivity and AI-enabling chipsets across the region.

Competition Landscape

The global 5G and generative AI chipset market is highly competitive, defined by the presence of global semiconductor giants, telecom equipment leaders, and a new wave of fabless startups. Companies are focusing on advanced process nodes, custom silicon development, and strategic collaborations with OEMs, cloud providers, and AI platforms to secure long-term market share.

Key players profiled in this report include:

Qualcomm Technologies, Inc., MediaTek Inc., Intel Corporation, Samsung Electronics Co., Ltd., Huawei Technologies Co., Ltd., Analog Devices, Inc., Skyworks Solutions, Inc., UNISOC, Nokia Corporation, and Keysight Technologies.

Key Developments

- On May 15, 2025, Qualcomm Technologies, Inc. launched the Snapdragon 7 Gen 4 SoC, built on TSMC’s 4nm process. This next-generation chipset brings premium-grade AI and 5G features to mid-range smartphones, significantly enhancing on-device intelligence and connectivity. The move is expected to accelerate 5G chipset adoption in budget-friendly segments, especially across high-growth markets.

- On February 27, 2025, MediaTek Inc., in partnership with Keysight, achieved near 12 Gbps throughput using its NR-DC 5G device. This performance milestone underscores the technical maturity of New Radio Dual Connectivity (NR-DC) and further solidifies MediaTek’s position in the premium 5G chipset space, especially for advanced mobile and infrastructure applications.

Segmentations:

By Chipset Type:

- Application-Specific Integrated Circuits (ASIC)

- Radio Frequency Integrated Circuits (RFIC)

- Millimeter Wave (mmWave) Chips

- Field-Programmable Gate Arrays (FPGA)

- System-on-Chip (SoC)

- Cellular Integrated Circuits (Cellular ICs)

- Modem Chips

By Process Node:

- >10nm

- 10-28nm

- >28nm

By Industry Vertical:

- Consumer Electronics

- Automotive

- Healthcare

- Energy & Utilities

- Manufacturing

- Media & Entertainment

- Telecommunications

- Government & Defense

Companies:

- Qualcomm Technologies, Inc.

- MediaTek Inc.

- Intel Corporation

- Samsung Electronics Co., Ltd.

- Huawei Technologies Co., Ltd.

- Analog Devices, Inc.

- Skyworks Solutions, Inc.

- UNISOC

- Nokia Corporation

- Keysight Technologies

Need Deeper Insights or Custom Analysis?

Contact Blackwater Business Consulting to explore how this data can drive your strategic goals.