Global Chiplet Market

The Global Chiplet Market is analyzed in this report across type, packaging technology, process node, end-use industry, and region, highlighting major trends and growth forecasts for each segment.

Let's Get You Started!

Fill out the quick form below and our academic advisor will connect with you shortly.

- ICT & Semiconductors

The Global Chiplet Market is analyzed in this report across type, packaging technology, process node, end-use industry, and region, highlighting major trends and growth forecasts for each segment.

Introduction:

Chiplet technology is redefining the semiconductor landscape by enabling the creation of high-performance, energy-efficient, and cost-optimized integrated circuits through modular design. By deconstructing traditional monolithic system-on-chip architectures into smaller, function-specific blocks, chiplets allow manufacturers to mix and match components with greater design flexibility. This shift is unlocking major improvements in computing scalability, performance, and manufacturing efficiency across a wide range of industries. Key applications include powering next-generation AI accelerators, optimizing high-performance computing systems, enhancing data center interconnects, and enabling advanced driver-assistance systems (ADAS) in automotive platforms.

The global chiplet market is undergoing a period of exponential growth and is projected to reach USD 134.5 billion by 2030. This momentum is driven by escalating demand for AI workloads, cloud infrastructure, and 5G/6G technologies, alongside an increasing push for modular architectures and faster development cycles. As semiconductor designs grow more complex and advanced nodes become more challenging to scale, chiplets offer a compelling solution through heterogeneous integration. With a market value of USD 18.50 billion in 2024, the sector is set to expand at a robust CAGR of 39.2% over the forecast period.

Market Dynamics

The chiplet market is expanding rapidly, powered by both technical innovation and strategic imperatives. Core growth drivers include the industry-wide push toward heterogeneous integration, rising complexity in chip design, and the demand for cost-efficient, scalable manufacturing approaches. By enabling the integration of multiple specialized dies into a single package, chiplets help reduce design cycles, improve yields, and accelerate product timelines—particularly for high-performance computing and AI-intensive applications.

Public and private sector initiatives are accelerating innovation in this space. For example, the European Commission-backed Innovation Radar is advancing chiplet packaging, architecture, and interconnect standards, fostering a more collaborative semiconductor ecosystem. At the same time, government-backed programs like India’s Semiconductor Mission are focused on developing domestic fabrication capabilities and strengthening the supply chain for high-performance computing—factors that directly support chiplet adoption in emerging markets.

The chiplet opportunity spans diverse verticals, from hyperscale data centers and AI accelerators to high-performance computing platforms and automotive systems. The adoption of universal interconnect standards like UCIe is making it possible to integrate chiplets from multiple vendors seamlessly, catalyzing broader ecosystem growth. Meanwhile, market dynamics are evolving through advancements in 2.5D/3D packaging, AI-powered chip design tools, and new manufacturing partnerships that emphasize modularity and scale. These trends are rapidly reshaping the competitive landscape and setting the stage for sustained innovation across the semiconductor value chain.

Segment Highlights and Performance Overview

By Type

Logic chiplets command the largest share of the type segment, representing approximately 45% of the market. These chiplets serve as the central compute engines in chiplet-based systems, powering CPUs, GPUs, AI accelerators, and FPGAs. Their critical role in high-performance computing, AI model training, gaming, and premium consumer electronics underpins their market dominance. The ongoing transition to heterogeneous and modular architectures continues to reinforce demand for logic chiplets across high-growth sectors.

By Packaging Technology

2.5D IC packaging leads the packaging segment with around 40% market share. Known for its maturity and high bandwidth capabilities, this packaging method uses silicon interposers to enable efficient integration of logic and memory chiplets, essential for data center processors, GPUs, and AI hardware. As demand for compute-intensive applications grows, the scalability and thermal performance of 2.5D packaging continue to make it the preferred choice among semiconductor designers.

By Process Node

Advanced nodes below 10nm account for the largest share of the process node segment, comprising roughly 55% of the market. These cutting-edge nodes are pivotal for enabling the power efficiency and high-density computing required in next-gen chiplets, especially those used in AI, 5G, and HPC environments. As workloads become more compute-heavy and power-sensitive, the shift to sub-10nm nodes is accelerating across the chiplet landscape.

By End-Use Industry

Enterprise and data center applications dominate the end-use segment, capturing about 35% of market share. Hyperscale operators such as AWS, Microsoft, and Google are increasingly deploying chiplet-based processors to handle growing demands in cloud computing, AI inference, and data analytics. The modularity and scalability of chiplets allow for optimized performance per watt, making them essential to modern data center infrastructure strategies.

Geographical Analysis

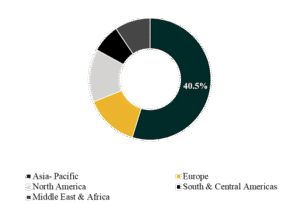

The chiplet market is evaluated across major global regions: North America, Europe, Asia-Pacific, South & Central America, and the Middle East & Africa.

Asia-Pacific holds the largest market share, contributing approximately 40.5% of global revenue. This leadership is anchored by a mature semiconductor manufacturing ecosystem, a dense network of foundries, and increasing adoption of chiplet-based solutions in consumer electronics and automotive technologies.

North America, on the other hand, is expected to register the fastest growth, with a projected CAGR of 43.9% from 2024 to 2032. This growth is fueled by significant investments in R&D, strong momentum in advanced packaging innovation, and the presence of leading chiplet developers and fabless design houses. The region’s strategic focus on supply chain resilience and domestic semiconductor production is further reinforcing its upward trajectory.

Competition Landscape

The global chiplet market is marked by intense competition among established semiconductor giants, packaging technology leaders, and agile startups. Market players are advancing their positions through technological differentiation, strategic collaborations, and rapid product innovation. Key focus areas include enhancing interconnect protocols, optimizing thermal and power efficiency, and accelerating design-to-silicon cycles.

Leading companies in the space include Intel Corporation, Advanced Micro Devices (AMD), IBM, Marvell Technology, Inc., MediaTek Inc., NVIDIA Corporation, Achronix Semiconductor Corporation, Ranovus, ASE Technology Holding Co., Ltd., and Tenstorrent Inc.

Key Developments

- In April 2025, Intel announced new strategic ecosystem partnerships and unveiled innovations in process technology and packaging during the Intel Foundry Direct Connect event. These initiatives are designed to strengthen chiplet collaboration across the industry, accelerate adoption of advanced packaging, and enhance scalability and time-to-market advantages—supporting overall market growth.

- On April 14, 2025, NVIDIA began producing its Blackwell AI chips at a new U.S.-based fabrication facility in Arizona. This move marks a pivotal step in reshoring semiconductor manufacturing and enhancing domestic AI infrastructure. By reducing reliance on offshore supply chains, NVIDIA is positioning itself to meet surging demand for high-performance chiplet-enabled AI hardware while reinforcing the U.S. semiconductor value chain.

Segmentation:

By Type:

- Logic Chiplets

- CPUs

- GPUs

- AI Accelerators

- FPGAs

- Memory Chiplets

- DRAM

- SRAM

- HBM (High Bandwidth Memory)

- Interface/IO Chiplets

- SerDes

- PHYs

- Network Controllers

- Analog & Mixed-Signal Chiplets

- Security Chiplets

- Others

By Packaging Technology:

- 2.5D IC Packaging

- 3D IC Packaging

- System-in-Package

- Fan-out Wafer Level Packaging

- Embedded Die Packaging

- UCIe-based Modular Packaging

- Others

By Process Node:

- Advanced Nodes (<10nm)

- Mainstream Nodes (10–28nm)

- Mature Nodes (>28nm)

By End-Use Industry:

- Consumer Electronics

- IDMs (Integrated Device Manufacturers)

- Enterprise & Data Centers

- Automotive

- Telecommunication

- Defense & Aerospace

- Others

Companies included in the report:

- Intel Corporation

- Advanced Micro Devices (AMD)

- IBM

- Marvell Technology, Inc.

- MediaTek Inc.

- NVIDIA Corporation

- Achronix Semiconductor Corporation

- Ranovus

- ASE Technology Holding Co., Ltd.

- Tenstorrent Inc.

Need Deeper Insights or Custom Analysis?

Contact Blackwater Business Consulting to explore how this data can drive your strategic goals.