Global Digitalized Supply Chain Market

The Global Digitalized Supply Chain Market is analyzed in this report across component, deployment mode, enterprise size, end-use industry, and region, highlighting major trends and growth forecasts for each segment.

Let's Get You Started!

Fill out the quick form below and our academic advisor will connect with you shortly.

- 05/01/2024

- FMCG

Introduction

The Digitalized Supply Chain Market is undergoing a fundamental transformation as advanced technologies integrate with traditional supply chain operations. This evolution is enabling organizations to significantly improve efficiency, transparency, and responsiveness across procurement, production, logistics, and distribution. Applications such as real-time inventory tracking, predictive demand forecasting, route optimization, warehouse automation, and blockchain-based traceability are becoming standard across industries.

The market is expanding rapidly, with global valuation expected to reach USD 21.3 billion by 2030. Key growth drivers include rising global trade volumes, heightened demand for operational efficiency, and the widespread adoption of IoT and AI technologies. The increasing need for end-to-end visibility and smarter compliance is further accelerating the shift toward digitalization. As of 2024, the market stood at USD 11.29 billion, and is projected to grow at a CAGR of 11.13% through the forecast period.

Market Dynamics

The digitalized supply chain market is advancing quickly, driven by the convergence of digital innovation and growing pressure to improve performance across global supply networks. Demand for real-time visibility, automation, and intelligent decision-making is fueling the adoption of technologies such as AI, IoT, blockchain, and cloud computing. These tools are reshaping inventory control, logistics management, and warehouse optimization—leading to reduced costs, faster delivery cycles, and stronger customer satisfaction.

Enterprises are leveraging connected devices, smart sensors, and scalable cloud platforms to build agile and intelligent supply chains. Industries including manufacturing, retail, logistics, and healthcare are at the forefront of this transformation. For example, in India, the government’s National Logistics Portal was launched to unify logistics services on a single digital platform. Likewise, the EU and ASEAN held collaborative workshops to strengthen digital trade, promote interoperability, and enhance supply chain resilience through technology.

The market offers a wide array of opportunities. AI-driven forecasting, predictive maintenance, and blockchain-enabled transparency are reshaping operational models. The deployment of IoT-based monitoring systems and advanced analytics tools—such as digital twins—is enabling organizations to reduce disruptions, cut emissions, and respond dynamically to market fluctuations. The broader shift toward sustainability and resiliency is further encouraging investments in digital tools that minimize waste and optimize resource allocation.

Several trends are shaping the next phase of the market. Generative AI is increasingly being applied for scenario simulation, supply chain design, and demand modeling. Predictive analytics is helping companies mitigate risks, enhance supplier relationships, and streamline lead times. Meanwhile, growing emphasis on interoperability and cybersecurity is ensuring that digital supply chain ecosystems remain secure, trusted, and scalable. These innovations are transforming traditional linear supply chains into highly adaptive, data-driven networks capable of navigating today’s complex global environment.

Segment Highlights and Performance Overview

By Component

Software holds the leading position, accounting for 40%–45% of the market. It forms the core of digital supply chain infrastructure, enabling functions like planning, warehouse management (WMS), transportation optimization (TMS), and predictive analytics. The increasing preference for cloud-based platforms and AI-integrated solutions continues to drive demand in this segment.

By Deployment Mode

Cloud-based solutions dominate the deployment landscape with a 50%–55% share. These platforms offer cost-efficiency, scalability, and ease of remote access—making them especially attractive for enterprises navigating dynamic operational demands. The ongoing shift to SaaS models and the integration of IoT and AI features are further accelerating cloud adoption across the supply chain space.

By Enterprise Size

Large enterprises command the majority share, contributing approximately 65%–70% to the market. These organizations typically manage complex, global operations and require robust digital solutions for predictive analytics, inventory optimization, and logistics coordination. Their ability to invest in comprehensive platforms sustains their market dominance.

By End-Use Industry

Manufacturing is the largest end-user segment, representing 20%–25% of the market. Manufacturers are increasingly leveraging digital supply chain tools to optimize production schedules, reduce waste, and enhance operational efficiency. The integration of AI, IoT, and data analytics is driving the continued adoption of smart supply chain technologies across this sector.

Geographical Analysis

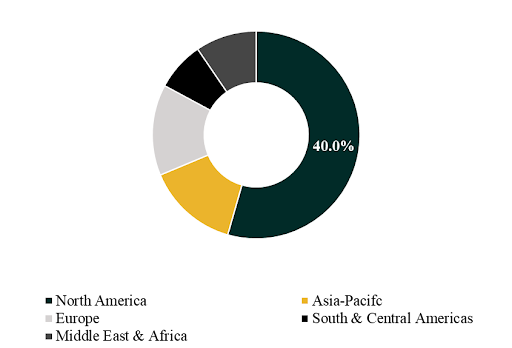

The global digitalized supply chain market is analyzed across North America, Europe, Asia-Pacific, South & Central America, and the Middle East & Africa.

North America leads the market, accounting for approximately 40% of the global share. The region benefits from a highly developed IT infrastructure, a strong concentration of large enterprises, and early adoption of AI, IoT, and cloud-based solutions across supply chain operations.

Asia-Pacific is expected to record the highest CAGR, estimated between 15% and 16%. This growth is fueled by rapid industrialization, expanding manufacturing hubs, e-commerce growth, and proactive government support in countries such as China, India, and across Southeast Asia.

Competition Landscape

The competitive landscape is defined by the presence of global technology giants, specialized supply chain solution providers, and a growing base of innovative startups. Players are competing on the basis of technological leadership, strategic partnerships, and the ability to offer scalable, data-centric solutions.

Key market participants include:

Blue Yonder, SAP, Oracle, IBM, Microsoft, Accenture, VeChain, OriginTrail, Te-FOOD, CargoX, OpenSC, Peer Ledger, Acsis, Inc., CommerceHub, and E2open (WiseTech).

Recent Developments

- In August 2024, SAP announced the introduction of a new strategic vision, focusing on evolving supply chains from digital to adaptive and eventually autonomous. This initiative highlights the significance of predictive intelligence, system-generated recommendations, and contextual decision-making, aiming to hasten the adoption of next-generation supply chain platforms by encouraging businesses to implement AI-powered, automated operations.

- In May 2025, WiseTech announced the acquisition of E2open in a USD 3.25 billion deal. This acquisition expanded WiseTech’s network to over 500,000 connected enterprises and significantly strengthened its capabilities in AI-powered automation. The move enhances operational optimization across global logistics and increases competitive pressure among digital supply chain providers, contributing to accelerated market growth.

Segmentation:

By Component:

- Software

- Supply Chain Planning & Optimization

- Procurement & Sourcing Software

- Inventory Management

- Warehouse & Transportation Management Systems

- Others

- Hardware

- IoT Sensors & RFID

- Tracking Devices

- Smart Tags

- Others

- Services

- Consulting & Advisory

- System Integration & Implementation

- Managed Services

- Support & Maintenance

By Deployment Mode:

- Cloud-based

- On-premises

- Hybrid

By Enterprise Size:

- Large Enterprises

- Small & Medium Enterprises (SMEs)

By End-Use Industry:

- Manufacturing

- Retail & E-commerce

- Logistics & Transportation

- Healthcare & Pharmaceuticals

- Food & Beverages

- Energy & Utilities

- Consumer Goods

- Others

Companies included in the report:

- Blue Yonder

- SAP

- Oracle

- IBM

- Microsoft

- Accenture

- VeChain

- OriginTrail

- Te-FOOD

- CargoX

- OpenSC

- Peer Ledger

- Acsis, Inc.

- CommerceHub

- E2open (WiseTech)

Need Deeper Insights or Custom Analysis?

Contact Blackwater Business Consulting to explore how this data can drive your strategic goals.