Global Meat Alternatives Market

Meat alternatives—also referred to as meat substitutes, meat analogs, or plant-based meats—are designed to replicate the taste, texture, appearance, and nutritional profile of traditional animal meat using non-animal ingredients.

Let's Get You Started!

Fill out the quick form below and our academic advisor will connect with you shortly.

- FMCG

Introduction

Meat alternatives—also referred to as meat substitutes, meat analogs, or plant-based meats—are designed to replicate the taste, texture, appearance, and nutritional profile of traditional animal meat using non-animal ingredients. As health, environmental, and ethical concerns reshape global consumption habits, the meat alternatives industry is undergoing rapid transformation. These products, formulated using plant-based proteins, fungi, microbial fermentation, or cultured animal cells, are gaining prominence across retail, foodservice, and institutional channels. Applications range from burger patties and sausages to deli slices, nuggets, and seafood analogs.

Valued at approximately USD 10.6 billion in 2024, the global meat alternatives market is projected to reach USD 31.64 billion by 2030, growing at a CAGR of 22.36%. Rising flexitarian and vegetarian lifestyles, awareness around food sustainability, and innovation in alternative protein technologies are all fueling this accelerated growth.

Market Dynamics

The global meat alternatives market is being shaped by a convergence of sustainability, health, and technological trends influencing both consumer behavior and industry strategy.

Key growth drivers include rising awareness of the environmental toll of conventional meat production, growing demand for cholesterol-free and protein-rich diets, and the widespread adoption of flexitarian and plant-forward lifestyles. As concerns over greenhouse gas emissions, water use, and animal welfare intensify, both consumers and policymakers are leaning into sustainable food systems. Health considerations are equally pivotal. The World Health Organization’s 2021 report emphasized the need to reduce red and processed meat intake to mitigate noncommunicable disease burdens in Europe. Parallel data from The Vegan Society indicated that over one-third of UK consumers reduced meat intake in 2021, and 20% cut back on dairy—highlighting a meaningful shift toward plant-based consumption.

Scientific and technological progress is accelerating adoption. Innovations such as high-moisture extrusion and precision fermentation are enabling products that closely mimic the sensory experience of meat, boosting consumer acceptance and repeat purchases. Advances in microbial fermentation and cultured protein are also pushing the boundaries of what meat alternatives can deliver.

The market presents expansive opportunities across the value chain. These include scaling plant-based offerings in retail and foodservice, investing in precision fermentation and cultivated meat, and developing region-specific formulations tailored to local taste preferences. Companies are leveraging food science, mycoprotein cultivation, and biotechnology to create innovative products with wide appeal. The European Investment Bank (EIB) has actively supported this sector, including a €20 million venture debt agreement with Matr Foods to expand its fermented meat alternative operations—signaling strong institutional backing for the industry.

Emerging trends include the rise of fungi-based whole cuts, AI-driven ingredient optimization, and increased demand for clean-label, allergen-free formulations. Consumer expectations are shifting toward transparency, minimal processing, and functional nutrition. At the same time, regulatory support—including clearer labeling standards and funding for protein research—is facilitating scale and legitimacy. As companies continue to expand capacity and diversify offerings, the meat alternatives sector is moving from niche to mainstream—poised to play a pivotal role in sustainable food systems and public health outcomes globally.

Segment Highlights and Performance Overview

By Source:

Plant-based proteins dominate the category, accounting for approximately 65%–70% of the global market. Their widespread availability—particularly soy, wheat, and pea protein—and commercial maturity have established them as the leading source in the space. Strong consumer familiarity, extensive distribution, and clean-label appeal continue to support this segment’s dominance.

By Product:

Burger patties lead the product segment, representing around 32%–35% of global sales. Their success is driven by high consumer recognition and adaptability across both home cooking and foodservice. Flagship products like Beyond Burger and Impossible Burger have elevated patties as the category’s most visible and widely adopted format.

By Shelf Life:

Frozen products hold the largest share in this segment, comprising 39%–55% of the market. The category benefits from extended shelf life, fewer preservatives, and logistical efficiencies. Common frozen SKUs—such as sausages, nuggets, and patties—are easy to store and prepare, with cold-chain expansion further strengthening distribution.

By Distribution Channel:

Retail distribution is the leading sales channel, accounting for approximately 49%–63% of global volume. Supermarkets and hypermarkets drive growth through prominent shelf placement, competitive pricing, and active promotion. Growing consumer demand has led major chains to expand plant-based sections and launch private-label offerings, cementing retail’s leadership in market access.

Geographical Analysis

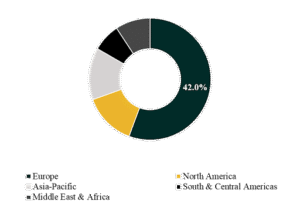

The global meat alternatives market is segmented across five key regions: North America, Europe, Asia-Pacific, South & Central America, and the Middle East & Africa.

Europe holds the largest share, contributing approximately 42% of the total market value. The region benefits from high consumer awareness around sustainability and animal welfare, mainstream adoption of flexitarian diets, and favorable regulatory frameworks supporting alternative protein innovation. Availability of clean-label and allergen-free options in retail has further strengthened market penetration.

Asia-Pacific is set to register the highest CAGR, estimated between 45% and 48%. This exceptional growth is driven by rising health awareness, a growing middle class, and demand for sustainable protein sources in densely populated nations like China, India, and Japan. Cultural openness to plant-based ingredients, combined with food-tech investment and startup activity, is accelerating market development across the region.

Competition Landscape

The global meat alternatives market is highly dynamic, featuring a mix of legacy food manufacturers, innovative startups, and plant-based protein specialists. Companies are differentiating through clean-label formulations, regional adaptation, culinary innovation, and strategic partnerships with retailers and foodservice operators.

Key players profiled in this report include:

Beyond Meat, Impossible Foods, Kellogg Company, Maple Leaf Foods, Nestlé, Unilever, Tyson Foods, JBS, Hormel Foods, and Believer Meats.

Recent Developments

- In January 2025, Beyond Meat expanded its international foodservice portfolio with the launch of Beyond Steak in French restaurants. This move strengthens the brand’s presence in Europe and supports product diversification beyond burger formats, reinforcing consumer trial and adoption of premium plant-based offerings.

- In October 2024, Believer Meats entered a strategic partnership with German engineering firm GEA to scale up cultivated meat production. This collaboration marks a critical step toward the company’s 2025 commercialization goals and supports the broader advancement of cultivated meat within the global protein landscape.

Segmentation:

By Source:

- Plant-based

- Soy-based

- Wheat-based

- Rice & Grain-based

- Others

- Fungi & Algae-Based

- Mycoprotein-based

- Mushroom-based

- Algae/Seaweed-based

- Fruit & Vegetable-Based

- Cultivated Meat

- Others

By Product:

- Burger Patties

- Sausages & Hot Dogs

- Nuggets, Tenders & Strips

- Ready Meals/Meal Kits

- Others

By Shelf Life:

- Frozen

- Refrigerated

- Shelf Table

By Distribution Channel:

- Retail

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Retailers

- Specialty Health Stores

- Foodservice

- Quick Service Restaurants (QSRs)

- Full-Service Restaurants

- Institutional Catering

Companies included in the report:

- Beyond Meat

- Impossible Foods

- Kellogg Company

- Maple Leaf Foods

- Nestlé

- Unilever

- Tyson Foods

- JBS

- Hormel Foods

- Believer Meats

Need Deeper Insights or Custom Analysis?

Contact Blackwater Business Consulting to explore how this data can drive your strategic goals.