Global Naval Combat Systems Market: Transformations, Emerging Growth Avenues, and Competitive Trends 2025–2030

The Global Naval Combat Systems Market is analyzed in this report across system type, machine type, operation mode, end-user, and region, highlighting major trends and growth forecasts for each segment.

Let's Get You Started!

Fill out the quick form below and our academic advisor will connect with you shortly.

- Aerospace & Defense

The Global Naval Combat Systems Market is analyzed in this report across system type, machine type, operation mode, end-user, and region, highlighting major trends and growth forecasts for each segment.

Introduction:

A Naval Combat System is a seamlessly integrated suite of weapons, sensors, communication networks, and command-and-control (C2) technologies deployed on naval platforms such as warships and submarines. These systems are engineered to detect, track, engage, and neutralize threats in maritime environments, enhancing mission efficiency and ensuring maritime superiority. Core components like radar, sonar, electronic warfare, and combat management systems function cohesively to secure naval assets and counter evolving threats.

The global naval combat systems market is expanding rapidly, with projections estimating a value of USD 54.55 billion by 2030. This surge is being driven by heightened geopolitical tensions, accelerated naval modernization efforts, and a growing emphasis on coastal and offshore defense. Additionally, the increasing demand for unmanned systems and network-centric warfare capabilities is propelling the adoption of advanced combat technologies. The market, valued at approximately USD 9.34 billion in 2024, is expected to grow at a CAGR of 7% throughout the forecast period.

Market Dynamics:

The naval combat systems market is gaining momentum, fueled by a mix of strategic, technological, and geopolitical forces. Primary drivers include rising maritime territorial disputes, the growing urgency for fleet modernization, and a global focus on enhancing naval deterrence capabilities. For instance, the United States has formalized more than 30 maritime boundaries to define exclusive economic zones (EEZs), supporting national security and maritime law enforcement—thereby catalyzing investment in naval surveillance and combat systems.

Worldwide, naval forces are adopting integrated systems that improve situational awareness, automate threat detection, and enable real-time decision-making in high-stakes environments. With multi-domain operations, network-centric warfare, and interoperability becoming strategic priorities, there has been significant investment in advanced radar, sonar, electronic warfare, and combat management platforms. At the same time, the emergence of next-generation missiles and unmanned vessels is driving demand for scalable, modular combat systems. A key example is India’s commissioning of the INS Arihant, its first indigenously built nuclear-powered ballistic missile submarine—underscoring the country’s strategic deterrence ambitions and advanced underwater warfare capabilities.

The market also presents significant growth opportunities for defense contractors and system integrators. Demand is rising for AI-enabled combat management, cyber-resilient naval platforms, and autonomous surface and subsurface vehicles. As navies shift toward data-centric architectures, interest is accelerating in predictive maintenance, autonomous threat engagement, and sensor fusion technologies. Moreover, fleet expansion in emerging economies and the rise of indigenous shipbuilding initiatives are opening new channels for suppliers of high-performance systems and components.

Key industry trends include a strong pivot toward open architecture designs, greater use of electronic warfare and decoy technologies, and heightened investment in layered defense solutions. The integration of artificial intelligence and big data into naval operations is enabling real-time combat simulations and actionable intelligence. Modular, upgrade-friendly platforms are gaining traction, allowing forces to keep pace with evolving threats without replacing entire systems. Additionally, cybersecurity, cross-fleet interoperability, and smart ship innovations are becoming central to modern naval strategy—reshaping the operational landscape of maritime warfare.

Segment Highlights and Performance Overview

By System Type

Weapon systems represent the dominant segment in the global naval combat systems market, accounting for approximately 34% of the total share. These systems form the backbone of both offensive and defensive maritime operations, encompassing technologies such as missile launchers, naval guns, and torpedo tubes. The continued development of precision-guided munitions, hypersonic missiles, and long-range strike capabilities has further reinforced the critical role of weapon systems. Their integration into multi-layered defense architectures ensures superior lethality and operational readiness, making them indispensable in modern naval strategy.

By Machine Type

Destroyers lead the market by platform type, contributing around 28% of the global share. These versatile surface combatants serve as the core of modern naval fleets, equipped with cutting-edge radar, sonar, and missile systems. Their adaptability across a range of missions—including anti-air, anti-submarine, and land-attack operations—makes them essential to maritime force projection and fleet defense.

By Operation Mode

Manned systems continue to dominate, with an estimated 69% share of the operation mode segment. Despite growing interest in unmanned and autonomous platforms, traditional manned vessels remain central to naval operations due to their advanced command flexibility, situational judgment, and ability to execute complex missions under dynamic conditions. Their enduring relevance is further supported by established infrastructure and longer operational lifespans.

By End-User

The military and defense sector constitutes the vast majority of end-user demand, with a commanding 82% share. National navies remain the primary customers for combat systems, driven by the imperative to secure territorial waters, enhance power projection, and maintain strategic deterrence. Increasing global defense budgets, ongoing maritime tensions, and widespread modernization initiatives are accelerating investments in next-generation combat technologies. Additionally, the shift toward multi-domain operations and joint-force integration is reinforcing demand for interoperable systems tailored to the evolving needs of defense forces.

Geographical Analysis

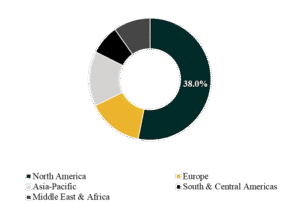

The global naval combat systems market is segmented by key regions, including North America, Europe, Asia-Pacific, South & Central America, and the Middle East & Africa.

North America currently leads, capturing around 38% of the market. This dominance is driven by advanced naval capabilities, high defense spending, and ongoing modernization efforts—particularly in the United States. The region’s strategic focus on integrated warfare systems, missile defense, and digital command networks has solidified its leadership in global naval innovation.

Meanwhile, the Asia-Pacific region is set to experience the fastest growth, with a projected CAGR between 7.5% and 8.2%. This is largely attributed to escalating regional tensions, rising naval budgets, and accelerated fleet modernization across countries such as China, India, Japan, and South Korea. The region’s push for maritime security and indigenous naval manufacturing is further propelling demand for advanced combat technologies.

Competition Landscape

The competitive environment in the naval combat systems market is shaped by a strong presence of global defense leaders, system integrators, and technology providers. These firms are actively competing through innovation, strategic alliances, and multinational contracts. The focus is increasingly on delivering integrated, modular, and AI-enhanced systems to secure long-term partnerships with defense agencies.

Major players profiled in this space include BAE Systems, Raytheon Technologies, Lockheed Martin Corporation, Thales Group, Northrop Grumman Corporation, Saab AB, Leonardo S.p.A., Naval Group, General Dynamics Mission Systems, and Elbit Systems Ltd. These companies are investing in next-generation technologies and aligning their portfolios with evolving naval doctrines to maintain strategic advantage.

Recent Developments

- In June 2025, BAE Systems opened a state-of-the-art shipbuilding facility in Glasgow, enhancing the UK’s capacity to develop and test next-generation naval platforms. This initiative boosts Europe’s defense manufacturing capabilities and accelerates the deployment of integrated combat systems across new warship programs.

- On July 14, 2025, Raytheon Technologies (RTX) secured a USD 74 million contract from the U.S. Navy for RAM Guided Missile Launching Systems—the largest single order in more than 20 years. This milestone reinforces the Navy’s ongoing efforts to modernize missile defense and highlights a strong commitment to enhancing close-range threat interception capabilities.

Segmentation:

By System Type:

- Weapon Systems

- Radar Systems

- Sonar Systems

- Combat Management Systems

- Electronic Warfare (EW) Systems

- Others

By Machine Type:

- Destroyers

- Frigates

- Corvettes

- Amphibious Ships

- Submarines

- Aircraft Carriers

- Patrol Vessels

By Operation Mode:

- Manned Systems

- Unmanned Systems

- Autonomous Systems

By End-User:

- Military/Defense

- Coast Guard

- Special Maritime Forces

Companies included in the report:

- BAE Systems

- Raytheon Technologies

- Lockheed Martin Corporation

- Thales Group

- Northrop Grumman Corporation

- Saab AB

- Leonardo S.p.A

- Naval Group

- General Dynamics Mission Systems

- Elbit Systems Ltd.

Need Deeper Insights or Custom Analysis?

Contact Blackwater Business Consulting to explore how this data can drive your strategic goals.