Global Personal Care Products Market

Personal care products encompass a wide array of consumer goods designed to support hygiene, grooming, and aesthetic enhancement.

Let's Get You Started!

Fill out the quick form below and our academic advisor will connect with you shortly.

- FMCG

Introduction:

Personal care products encompass a wide array of consumer goods designed to support hygiene, grooming, and aesthetic enhancement. These items—ranging from skincare and haircare to oral care, body care, cosmetics, and grooming products—are essential to daily routines and increasingly tailored to evolving consumer preferences. Whether for cleansing, moisturizing, beautifying, or protection, these products play a central role in self-care and wellness. Innovation across ingredients, functionality, and sustainability continues to reshape how consumers engage with the category.

Valued at approximately USD 502.66 billion in 2024, the global personal care products market is projected to reach USD 835.27 billion by 2030, expanding at a CAGR of 6.1%. Growth is being driven by heightened hygiene awareness, rising disposable incomes, and the influence of beauty and wellness trends amplified by digital media and e-commerce. Meanwhile, demand for clean-label, natural, and gender-inclusive offerings is redefining product development and consumer expectations worldwide.

Market Dynamics

The personal care products market is undergoing rapid evolution, influenced by shifting cultural norms, technological advancement, and increasing consumer sophistication.

Core drivers of growth include rising awareness around hygiene and wellness, growing disposable incomes, and the accelerating impact of social media and digital influencers. Consumers are seeking high-performance skincare, grooming, and wellness solutions that align with their values and lifestyles. As a result, companies are innovating across formulations, packaging, and sourcing—emphasizing plant-based, cruelty-free, and dermatologically tested ingredients. The rise of e-commerce and subscription-based models is also transforming how consumers discover and purchase products, enhancing both access and loyalty on a global scale.

Opportunities abound for both legacy brands and emerging players. Demand for natural, vegan, and organic products is rising in tandem with interest in hyper-personalized skincare and AI-driven beauty tech. Brands are increasingly integrating smart diagnostic tools, virtual try-ons, and data-driven personalization to deliver tailored consumer experiences. Growth in the male grooming segment, the rise of gender-neutral product lines, and expanding consumption in emerging markets further reflect shifting consumer dynamics. Companies are also investing in sustainable packaging and refillable systems to reduce environmental impact, while adhering to evolving global regulations. In India, for example, the Central Drugs Standard Control Organization (CDSCO) oversees cosmetic safety and labeling—reinforcing standards that support safe, responsible product innovation.

Emerging trends include the rise of dermocosmetics, the adoption of wearable skin tech for optimized routines, and the deeper integration of sustainability across the value chain. Consumers are becoming more ingredient-conscious, actively seeking transparency through certifications like “clean,” “organic,” or “non-toxic.” AI and machine learning are enabling personalized product recommendations, while demand for multifunctional and preventive care products—such as SPF-infused cosmetics, anti-pollution creams, and microbiome-friendly skincare—is steadily increasing. Regulatory bodies like the U.S. FDA continue to guide product labeling and safety, while its specific guidance on sunscreen use is pushing further innovation in UV-protective personal care.

Segment Highlights and Performance Overview

By Type:

Skincare leads the product category, accounting for approximately 40%–45% of the market. Consistent demand for facial care, sun protection, and anti-aging solutions has made skincare the cornerstone of personal hygiene and beauty routines. Key products include moisturizers, cleansers, and serums that address daily care and long-term skin health.

By Ingredients:

Synthetic ingredients dominate, comprising around 80%–85% of formulations. Their prevalence is due to cost-efficiency, stability, and broad utility in mass-market products. Despite growing interest in natural alternatives, synthetic compounds like parabens, silicones, and sulfates remain widely used in conventional offerings.

By Price:

The economy segment holds the largest share, representing approximately 45%–50% of the market. Affordability, mass-market availability, and strong brand familiarity are key factors driving demand, particularly in price-sensitive and emerging markets. This segment continues to perform well across urban and rural consumer bases.

By Distribution Channel:

Specialty stores lead distribution, accounting for roughly 30%–35% of global sales. These outlets offer curated assortments, personalized consultations, and access to premium or exclusive brands. While brick-and-mortar retail remains vital, e-commerce is rapidly expanding, reshaping the consumer path to purchase and enabling omnichannel strategies.

Geographical Analysis

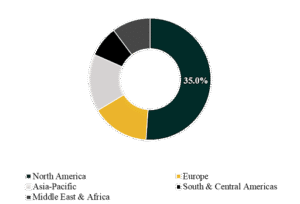

The global personal care market spans North America, Europe, Asia-Pacific, South & Central America, and the Middle East & Africa.

North America leads in market share, accounting for approximately 35% of global revenue. The region benefits from high per capita spending on skincare, cosmetics, and grooming, along with the presence of established global brands and mature retail and online infrastructure. Innovation in natural formulations and premium self-care products continues to drive regional demand.

Asia-Pacific is projected to register the fastest growth, with a CAGR of 6.5%–7.5%. Rising incomes, rapid urbanization, and growing beauty awareness across China, India, South Korea, and Japan are fueling this expansion. The region’s strong e-commerce platforms and rising demand for K-beauty and clean-label products are further accelerating momentum.

Competition Landscape

The competitive environment is marked by a mix of multinational giants, regional leaders, and fast-growing natural and organic brands. Companies are differentiating through innovation in formulation, brand positioning, sustainability, and omnichannel distribution. The rise of clean beauty, AI-driven customization, and digital-first marketing is reshaping how players compete globally.

Key players profiled in this report include:

Procter & Gamble (P&G), Unilever, Johnson & Johnson, L’Oréal Group, Colgate-Palmolive, The Estée Lauder Companies Inc., Beiersdorf AG, Kao Corporation, Reckitt Benckiser, and Shiseido Company, Limited.

Recent Developments

- In March 2025, L’Oréal Group acquired Korean dermocosmetic brand Dr.G, enhancing its presence in Asia’s fast-growing skincare market. This move strengthens its footprint in the region’s dermocosmetics category and supports further innovation in skin health-focused product lines.

- On June 25, 2025, Kao Corporation announced the launch of two Curél carbonated foam skincare products in Japan, scheduled for release in September. Targeting the sensitive skin segment, these texture-focused innovations are expected to enhance Kao’s premium skincare portfolio and drive consumer engagement in Japan’s competitive market.

Segmentation:

By Type:

- Skincare

- Moisturizers

- Cleansers & face washes

- Anti-aging creams

- Body Oils & Serums

- Lotions

- Face Masks

- Others

- Haircare

- Shampoos

- Conditioners

- Hair oils & serums

- Scalp and Hair Masks

- Others

- Oral Care

- Toothpaste

- Toothbrushes

- Mouthwash

- Dental floss

- Men’s Grooming

- Razors

- Blade

- Shaving/Foaming creams

- Others

- Female Hygiene

- Sanitary pads

- Tampons

- Intimate wash

- Baby Care

- Others

By Ingredients:

- Synthetic-

- Parabens

- Sulfates

- Alcohols

- Others

- Natural-

- Aloe vera

- Coconut oil

- Rose Water

- Essential Oils

- Others

By Price:

- Economy

- Mid-Range

- Premium

By Distribution Channel:

- Hypermarkets & Supermarkets

- Specialty Stores

- E-commerce

- Others

Companies included in the report:

- Procter & Gamble (P&G)

- Unilever

- Johnson & Johnson

- L’Oréal Group

- Colgate-Palmolive

- The Estée Lauder Companies Inc.

- Beiersdorf AG

- Kao Corporation

- Reckitt Benckiser

- Shiseido Company, Limited

Need Deeper Insights or Custom Analysis?

Contact Blackwater Business Consulting to explore how this data can drive your strategic goals.