Global Remote Patient Monitoring (RPM) Market

The Global Remote Patient Monitoring (RPM) Market is analyzed in this report across component, connectivity type, data delivery platform, application, end-user, and region, highlighting major trends and growth forecasts for each segment.

Let's Get You Started!

Fill out the quick form below and our academic advisor will connect with you shortly.

- 15/01/2024

- Healthcare

Introduction

Remote Patient Monitoring (RPM) is rapidly emerging as a transformative pillar in the global healthcare landscape. By enabling real-time, continuous monitoring beyond clinical settings, RPM is redefining care delivery, particularly for aging populations and individuals with chronic conditions. The convergence of wearable technologies, mobile health platforms, and cloud-based analytics is empowering healthcare providers to proactively manage patient health, lower readmission rates, and improve clinical outcomes. Core use cases span chronic disease management, post-acute care, eldercare, and personalized health tracking.

In 2024, the global RPM market was valued at approximately USD 26.5 billion. Propelled by rising rates of chronic illness, escalating healthcare costs, a growing focus on preventive care, and widespread digital health adoption, the market is on track to reach USD 55.2 billion by 2030. With a projected CAGR of 18%, RPM is positioned as a cornerstone of the connected healthcare future.

Market Dynamics

The RPM market is advancing swiftly, shaped by critical trends in healthcare delivery and system efficiency. Key growth drivers include the global burden of chronic diseases, a rising preference for home-based care, and growing pressure to cut healthcare costs through proactive monitoring. RPM solutions provide continuous, remote access to vital health data, enabling timely clinical interventions, improving patient engagement, and reducing hospitalization rates. Widespread use of smart wearables, mobile applications, and wireless medical devices is further accelerating adoption worldwide.

Major players are capitalizing on this momentum through advanced platforms and integrated care solutions. For instance, Medtronic’s CareLink™ network exemplifies the synergy between RPM and telehealth for chronic disease management. Furthermore, Philips Healthcare’s platform supports aging-in-place initiatives, while GE Healthcare incorporates AI and analytics to optimize patient monitoring. Additionally, Abbott’s FreeStyle Libre continues to innovate real-time diabetes tracking, and Boston Scientific’s connected cardiac devices are enhancing cardiovascular care through remote oversight.

The RPM landscape is also being reshaped by the integration of AI, predictive analytics, and cloud-based infrastructure. Trends include the evolution of multi-parameter wearables, the emergence of RPM-as-a-Service, and heightened emphasis on data security and interoperability with EHRs. Solutions like Masimo’s SafetyNet™ platform—blending AI, cloud monitoring, and personalized care—highlight the shift toward decentralized, real-time health management. These innovations are setting the stage for a smarter, more responsive healthcare ecosystem.

Segment Highlights and Performance Overview

By Component

Devices lead the component segment, capturing 55% to 60% of the market. These are the foundational elements for data collection in RPM systems. The rising demand for advanced wearables, implantable monitors, and connected sensors is fueling growth, driven by the need for accurate, real-time physiological tracking.

By Connectivity Type

Wireless RPM devices dominate this segment, accounting for approximately 70% to 75% of market share. Their strong uptake is driven by seamless, real-time monitoring capabilities that offer patients greater mobility and eliminate the need for physical connections, critical for home-based and ambulatory care.

By Data Delivery Platform

Integrated RPM platforms hold the largest share at 65% to 70%, offering comprehensive, end-to-end solutions that combine data capture, analytics, and care coordination. These platforms streamline clinical workflows, enhance provider insights, and enable seamless care transitions between settings.

By Application

Chronic Disease Monitoring is the leading application, addressing long-term conditions like diabetes, cardiovascular disease, and hypertension. Continuous monitoring in these cases is essential for early intervention and personalized treatment, making this segment a cornerstone of the RPM market.

By End-User

Home Care Settings account for 65% of the RPM market. The strong preference for in-home care, particularly among elderly patients and those with mobility challenges, continues to drive adoption of RPM technologies designed for non-clinical environments.

Geographical Analysis

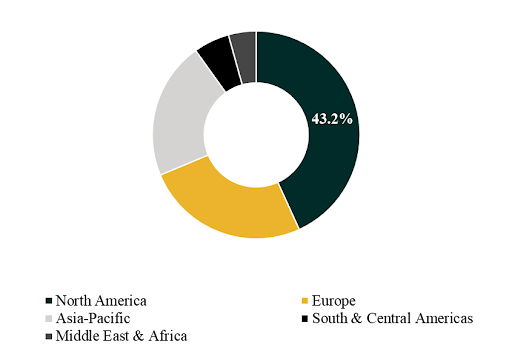

The RPM market is segmented across key regions: North America, Europe, Asia-Pacific, South & Central America, and the Middle East & Africa.

North America leads with the largest market share, supported by advanced healthcare infrastructure, favorable reimbursement policies, and early adoption of digital health innovations. The region’s high prevalence of chronic conditions and strong demand for decentralized care are accelerating RPM growth.

Asia-Pacific is projected to register the highest CAGR, estimated between 18% and 22%. Factors such as an aging population, expanding healthcare investments, and rapid digital transformation in countries like China, India, Japan, and South Korea are driving adoption. Government-led telehealth initiatives and increased mobile connectivity are further strengthening RPM deployment across the region.

Competition Landscape

The global RPM market is highly competitive, with a strong mix of established medical device manufacturers, digital health leaders, and agile healthtech startups. Key players are prioritizing innovation, partnerships, and integration of next-gen technologies such as AI, IoT, and cloud computing to expand their capabilities and enhance market positioning.

Prominent companies in this space include Medtronic plc, Philips Healthcare, GE Healthcare, Abbott Laboratories, Boston Scientific Corporation, Siemens Healthineers AG, Nihon Kohden Corporation, Masimo Corporation, Omron Healthcare, ResMed Inc., and CoachCare. These firms are driving the evolution of RPM through cutting-edge platforms and scalable care delivery models.

Recent Developments

- In May 2025, Medtronic announced its intention to spin off its diabetes division into an independent publicly traded entity. Generating $2.8 billion annually, the division focuses on wearable insulin pumps and smart pens, and is partnering with Abbott to develop a next-generation glucose sensor. This move is expected to heighten competition and innovation in diabetes-focused RPM solutions, drawing strong investor interest.

- In February 2024, GE Healthcare partnered with Biofourmis to expand patient monitoring capabilities beyond traditional hospital settings. The collaboration leverages AI-driven analytics and virtual care platforms to deliver personalized, in-home healthcare solutions. This marks a significant step in the shift toward decentralized care, enabling healthcare systems to scale RPM adoption and improve patient experiences.

Segmentation:

By Component:

- Devices

- Vital Sign Monitors

- Specialized Monitors

- Implantable Monitors

- Software

- Services

- Installation & Training Services

- Device Management & Maintenance Services

- Data Collection & Analysis Services

- Patient Engagement & Compliance Management Services

- Remote Clinical Consultations Services

By Connectivity Type:

- Wired RPM Devices

- Wireless RPM Devices

Data Delivery Platform:

- Device-Only Platforms

- Integrated RPM Platforms

- AI-Powered Predictive Monitoring Platforms

- Others

By Application:

- Chronic Disease Monitoring

- Post-Acute & Surgical Care Monitoring

- Geriatric & Elderly Monitoring

- Pregnancy & Neonatal Monitoring

- Weight Management & Fitness Monitoring

By End-User:

- Hospitals and Clinics

- Home Care Settings

- Ambulatory Care Centers

- Long-Term Care Centers

- Others

Companies included in the report:

- Medtronic plc

- Philips Healthcare

- GE Healthcare

- Abbott Laboratories

- Boston Scientific Corporation

- Siemens Healthineers AG

- Nihon Kohden Corporation

- Masimo Corporation

- Omron Healthcare

- ResMed Inc

- CoachCare

Need Deeper Insights or Custom Analysis?

Contact Blackwater Business Consulting to explore how this data can drive your strategic goals.