Global Space Cybersecurity Market: Transformations, Emerging Growth Avenues, and Competitive Trends 2025–2030

The Global Space Cybersecurity Market is analyzed in this report across offerings, deployment mode, application, end-user, and region, highlighting major trends and growth forecasts for each segment.

Let's Get You Started!

Fill out the quick form below and our academic advisor will connect with you shortly.

- Aerospace & Defense

The Global Space Cybersecurity Market is analyzed in this report across offerings, deployment mode, application, end-user, and region, highlighting major trends and growth forecasts for each segment.

Introduction:

Space cybersecurity is rapidly emerging as a critical component within the aerospace and defense ecosystem, designed to protect satellites, ground systems, and space-based communication networks from escalating cyber threats. With its role in safeguarding mission-critical data, preventing unauthorized access, and ensuring operational continuity, the domain is undergoing a technological transformation. Innovations such as AI, machine learning, and quantum encryption are being deployed to enhance threat detection, response, and resilience across space systems.

The global space cybersecurity market is witnessing strong growth, projected to reach USD 8.34 billion by 2030. Key growth drivers include the proliferation of satellite constellations, increasing geopolitical volatility, and heightened reliance on space infrastructure across defense and commercial domains. The growing sophistication of cyberattacks and advancements in digital security technologies are further accelerating adoption. Valued at approximately USD 4.52 billion in 2024, the market is forecast to expand at a CAGR of 10.65% during the forecast period.

Market Dynamics:

The space cybersecurity market is being shaped by a confluence of strategic imperatives and technological developments. A surge in reliance on space-based assets, coupled with an increase in satellite constellations, has intensified the need for advanced cybersecurity solutions. These systems now play a pivotal role in ensuring secure communications, resilient operations, and real-time threat detection for both government and commercial missions.

Adoption of AI, machine learning, and quantum encryption is accelerating as stakeholders seek proactive defenses against increasingly sophisticated cyber intrusions. Notably, solutions enabling predictive analytics, automated incident response, and secure satellite communication protocols are gaining traction. For instance, the U.S. GPS III satellite upgrade and Japan’s formation of the Space Operations Group highlight growing national efforts to enhance security across space-based systems.

The market is also witnessing a shift toward decentralized, zero-trust architectures and blockchain-enabled communication frameworks. This evolution reflects a broader move from reactive to predictive cybersecurity. As constellations grow in scale and complexity, solutions are expanding to include inter-satellite link protection, anomaly detection, and cyber-physical asset defense.

Segment Highlights and Performance Overview:

By Offerings:

Solutions lead the offerings segment, capturing approximately 65% to 70% of market share. These solutions form the backbone of space asset protection, covering satellites, ground control infrastructure, and communication networks. Their dominance is reinforced by rising adoption of advanced tools such as AI-driven threat analytics, quantum-safe encryption, and zero-trust frameworks. As space networks expand in complexity and scale, the demand for integrated, intelligent cybersecurity solutions continues to grow.

By Deployment Mode:

Cloud-based / SaaS deployments hold the highest share, accounting for roughly 55% to 60% of the market. Their scalability, centralized control, and real-time visibility make them ideal for operators managing dispersed satellite systems and ground stations. Cloud-native cybersecurity platforms also support rapid updates and analytics, enabling quicker threat response across space-based operations.

By Application:

Communication Security is the leading application segment, contributing between 35% and 40% of total market share. The critical importance of secure satellite links for military, commercial, and civil operations is driving adoption of end-to-end encryption, anti-jamming protocols, and AI-powered intrusion detection. As cyber threats evolve, ensuring secure transmission across orbital and terrestrial networks remains a top priority.

By End User:

The Defense & Aerospace segment commands the largest share, estimated at 45% to 50% of the market. National security considerations, the expansion of defense satellite programs, and growing investments in space-based ISR (intelligence, surveillance, and reconnaissance) have made this segment the primary driver of cybersecurity demand. Advanced defense programs increasingly require bespoke security architectures to protect both classified data and mission-critical communications.

Geographical Analysis:

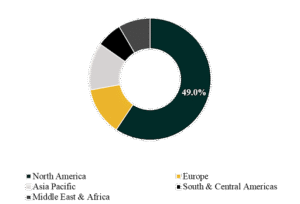

The global space cybersecurity market is examined across key regions, including North America, Europe, Asia-Pacific, South & Central America, and the Middle East & Africa.

North America dominates the global space cybersecurity market with an estimated 49% share. The region’s leadership stems from robust aerospace and defense infrastructure, significant government investments in space technologies, and a high concentration of commercial satellite operators. U.S. federal agencies, including the DoD, NASA, and Space Force, continue to prioritize space asset protection through strategic contracts and innovation funding.

Asia-Pacific is poised to post the highest compound annual growth rate (CAGR), projected between 11% and 13%. Rising satellite deployments across China, India, Japan, and South Korea, along with heightened awareness of cyber vulnerabilities, are driving regional demand. Ongoing military modernization, increasing commercial space activity, and government-backed cybersecurity programs are accelerating adoption throughout the region.

Competition Landscape:

The competitive environment in the global space cybersecurity market is defined by a mix of defense contractors, aerospace leaders, cybersecurity specialists, and next-gen tech firms. Leading players are competing on the strength of technological innovation, strategic acquisitions, and deep integration with space defense programs.

Firms such as Lockheed Martin, Northrop Grumman, Raytheon Technologies, BAE Systems, and Airbus Defence and Space are actively expanding their cybersecurity capabilities through internal R&D and partnerships. Emerging players like Xage Security and established cybersecurity providers like Check Point are also gaining ground by offering space-hardened, cloud-native, and AI-powered solutions tailored to satellite ecosystems.

Recent Developments:

- March 2024 – Lockheed Martin launched Pony Express 2, a pair of 12U small satellites equipped with four secure payloads for tactical communications. This launch enhances Lockheed’s capabilities in encrypted space communications and reflects increasing demand for protected smallsat constellations.

- September 2024 – Airbus Defence and Space completed its acquisition of Infodas, a German cybersecurity firm serving the public sector. The move strengthens Airbus’s cybersecurity portfolio, especially within the defense domain, and positions it for further growth in the space cybersecurity market.

Segmentation included in the report:

By Offerings:

- Solutions

- Network Security

- Data Security & Encryption

- Endpoint Security

- Identity & Access Management (IAM)

- Threat Intelligence & Security Monitoring

- Others

- Services

- Managed Security Services

- Consulting & Integration Services

- Training & Support Services

By Deployment Mode:

- Cloud-based / SaaS

- On-premises

By Application:

- Communication Security

- Surveillance & Monitoring Security

- Navigation & Positioning Security

- Space Asset Protection

- Others

By End User:

- Defense & Aerospace

- Government & Civil Space Agencies

- Commercial Space Operators

- Telecommunications

- Critical Infrastructure

Companies:

- Lockheed Martin

- Northrop Grumman

- Raytheon Technologies (RTX)

- Thales Group

- BAE Systems

- L3Harris Technologies

- Airbus Defence and Space

- Boeing

- Xage Security

- Check Point Software Technologies

Need Deeper Insights or Custom Analysis?

Contact Blackwater Business Consulting to explore how this data can drive your strategic goals.