Global Surface Radars Market: Transformations, Emerging Growth Avenues, and Competitive Trends 2025–2030

The Global Surface Radars Market is analyzed in this report across technology, platform, range, application, and region, highlighting major trends and growth forecasts for each segment.

Let's Get You Started!

Fill out the quick form below and our academic advisor will connect with you shortly.

- Aerospace & Defense

The Global Surface Radars Market is analyzed in this report across technology, platform, range, application, and region, highlighting major trends and growth forecasts for each segment.

Introduction:

Surface radar systems are indispensable assets across defense, security, maritime, and air traffic domains, offering high-precision detection, tracking, and monitoring capabilities. These technologies are foundational to situational awareness, enabling proactive threat identification and strategic decision-making in both civilian and military contexts. Core applications span coastal surveillance, border protection, vessel traffic management, weather observation, and ground-based air defense.

The global surface radars market is undergoing accelerated expansion, projected to reach USD 24.31 billion by 2030. This momentum is fueled by intensifying geopolitical risks, sustained investment in defense upgrades, and the growing imperative for maritime domain control. Breakthroughs in radar capabilities such as digital beamforming, AESA (active electronically scanned arrays), and AI-driven signal analytics are significantly enhancing system accuracy and efficiency. With the market valued at approximately USD 17.5 billion in 2024, it is expected to grow at a compound annual growth rate of 5.5% through the forecast period.

Market Dynamics:

The surface radars market is advancing on the strength of multiple converging forces technological innovation, strategic imperatives, and expanding mission demands. Rising demand for advanced surveillance capabilities, heightened border and coastal security concerns, and ongoing enhancements in radar processing and detection are primary growth enablers. Radar systems now play a central role across defense, maritime safety, and air traffic management ecosystems, delivering real-time intelligence, accurate tracking, and mission-critical support. Their increasing role in weather monitoring and airspace control further underscores their value across both civil and military sectors. Additionally, growing reliance on networked radar infrastructures and the deployment of systems in remote or contested environments are amplifying demand across global markets.

Substantial opportunities exist for market players in next-generation radar adoption. These include the proliferation of AESA and solid-state radar systems, integration into multi-layered border surveillance frameworks, and rising deployment in autonomous maritime platforms and UAV-based monitoring. Defense agencies worldwide are prioritizing radar modernization, with a clear focus on enhanced range, improved multi-target tracking, and resistance to electronic warfare. India’s DRDO, through its LRDE division, exemplifies this trend, advancing indigenous radar innovations for defense and coastal applications. Beyond traditional defense uses, surface radar systems are also seeing increased uptake in disaster response, environmental monitoring, and offshore infrastructure security broadening the market landscape.

Key technology shifts are reshaping radar system capabilities. AI and machine learning are being embedded for real-time automated threat identification, while radar miniaturization is enabling deployment on smaller, more agile platforms. Demand for versatile, multi-mission radar systems is rising sharply, as customers seek flexible solutions for varied operating environments. Notable innovations such as Japan’s ultra-compact high-precision radar systems highlight this shift. Meanwhile, breakthroughs in cognitive radar design, digital beamforming, and advanced data fusion are elevating performance standards, reinforcing the shift toward dual-use systems that combine military-grade precision with civilian utility.

Segment Highlights and Performance Overview:

By Technology:

Pulsed radars represent the leading technology segment, capturing approximately 35–40% of the market share. Their dominance is attributed to their superior range, accuracy, and adaptability across a wide spectrum of military and civilian applications. These systems are extensively deployed in surveillance, air defense, and navigation, driving sustained global demand.

By Platform:

Ground-based radars account for the largest share of the platform segment, holding roughly 40–45%. These systems form the core of critical infrastructure for border control, airspace defense, and coastal monitoring. Ongoing modernization efforts aimed at upgrading terrestrial radar networks continue to reinforce their market leadership.

By Range:

Medium-range radars lead the range category with a 30–35% market share, offering a compelling balance between operational coverage, cost efficiency, and mission effectiveness. Their widespread use in surveillance, counter-drone operations, and meteorological applications underscores their strategic value.

By Application:

Surveillance remains the dominant application area, comprising about 35–40% of the market. The rising emphasis on maritime domain awareness, urban security, and national border protection is driving sustained investment in radar-based surveillance solutions worldwide.

Geographical Analysis:

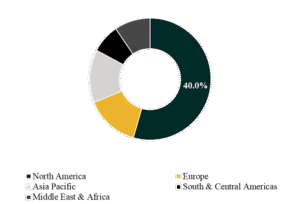

The global surface radars market is examined across key regions, including North America, Europe, Asia-Pacific, South & Central America, and the Middle East & Africa.

Regional dynamics reveal strategic contrasts in adoption and growth trajectories. North America leads the global surface radar market, holding approximately 35–40% share. This leadership is underpinned by advanced defense infrastructure, expansive maritime and aerial surveillance frameworks, and steady investment from the U.S. and Canadian governments in radar modernization efforts.

Asia-Pacific, meanwhile, is poised for the fastest growth, with a projected CAGR between 6.5% and 7.5%. Defense transformation programs, swift integration of radar solutions across naval and coastal domains, and rising investments in aerospace and industrial radar applications are key accelerators. Countries such as China, India, Japan, and South Korea are at the forefront of this regional expansion, positioning Asia-Pacific as the primary engine of future market growth.

Competition Landscape:

The global surface radar industry is defined by intense competition among top-tier defense firms, specialized radar developers, and strategic integrators. Companies are pursuing technological leadership through product innovation, broadening portfolios, and forging key partnerships. Securing long-term defense contracts remains a critical growth strategy. Leading players in this market include Lockheed Martin Corporation, RTX, BAE Systems plc, Thales Group, Northrop Grumman Corporation, Leonardo S.p.A., Saab AB, L3Harris Technologies, Inc., Israel Aerospace Industries (IAI), and Elbit Systems Ltd. Each is advancing radar capabilities through investments in long-range performance, electronic warfare resistance, and multi-domain functionality.

Recent Developments:

- April 7, 2025: Lockheed Martin delivered the first TPY-4 radar to the U.S. Air Force, marking a major milestone for the 3DELRR (Three-Dimensional Expeditionary Long-Range Radar) program. Designed to enhance air surveillance and threat detection, the TPY-4 radar underscores Lockheed Martin’s leadership in advanced radar solutions and is expected to boost market confidence in high-performance, long-range systems.

- February 24, 2025: RTX showcased the world’s first AI/ML-enabled radar warning receiver. This advancement significantly enhances aircrew survivability while accelerating AI integration across radar systems. The demonstration positions RTX at the forefront of intelligent radar innovation, setting the stage for increased demand for AI-powered radar systems in defense and aerospace sectors.

Segmentation included in the report:

By Technology:

- Pulsed

- Continuous Wave (CW)

- Frequency-Modulated Continuous Wave (FMCW)

- Synthetic Aperture

- Others

By Platform:

- Ground-Based

- Naval

- Airborne

By Range:

- Very Short Range (< 10 km)

- Short Range (10–50 km)

- Medium Range (50–200 km)

- Long Range (> 200 km)

By Application:

- Surveillance

- Counter-UAS (C-UAS)

- Air Traffic Control

- Weapons Tracking

- Meteorological

- Navigation

- Others

Companies:

- Lockheed Martin Corporation

- RTX

- BAE Systems plc

- Thales Group

- Northrop Grumman Corporation

- Leonardo S.p.A.

- Saab AB

- L3Harris Technologies, Inc.

- Israel Aerospace Industries (IAI)

- Elbit Systems Ltd.

Need Deeper Insights or Custom Analysis?

Contact Blackwater Business Consulting to explore how this data can drive your strategic goals.