Global Sustainable Aviation Fuel Market: Emerging Innovations, Growth Prospects, and Market Dynamics 2025–2030

The Global Sustainable Aviation Fuel Market is analyzed in this report across fuel type, blending capacity, aviation type, and region, highlighting major trends and growth forecasts for each segment

Let's Get You Started!

Fill out the quick form below and our academic advisor will connect with you shortly.

- Aerospace & Defense

The Global Sustainable Aviation Fuel Market is analyzed in this report across fuel type, blending capacity, aviation type, and region, highlighting major trends and growth forecasts for each segment

Introduction

Sustainable Aviation Fuel (SAF) is rapidly emerging as a critical enabler in aviation’s transition toward net-zero emissions and long-term environmental responsibility. Developed from renewable feedstocks—including used cooking oil, agricultural waste, municipal solid waste, and captured carbon—SAF significantly reduces lifecycle greenhouse gas emissions while enhancing fuel security. As a drop-in replacement for conventional jet fuel, SAF supports seamless integration into existing aircraft and fueling infrastructure, making it a scalable and impactful decarbonization solution.

Valued at approximately USD 2.5 billion in 2024, the global SAF market is projected to reach USD 27.8 billion by 2030, expanding at a CAGR of 6.2%. The market is gaining momentum as regulatory mandates tighten, pressure mounts to cut aviation emissions, and airlines intensify their commitments to climate targets.

Market Dynamics

The SAF market is advancing rapidly, underpinned by a convergence of policy, technology, and market forces reshaping the aviation fuel landscape.

Core drivers include rising international pressure to decarbonize aviation, increasing regulatory support, and growing airline commitments to net-zero goals. As traditional jet fuel prices remain volatile and long-term energy security becomes a strategic imperative, SAF is gaining favor as a resilient and sustainable alternative. Technological innovations in production pathways—such as HEFA (Hydroprocessed Esters and Fatty Acids), Fischer–Tropsch, and alcohol-to-jet (ATJ)—are improving output efficiency and commercial viability.

The market also benefits from growing public-private partnerships and significant investment from energy majors, airlines, and infrastructure players. These alliances are accelerating the scale-up of SAF facilities and unlocking new production capacity across geographies.

Opportunities are broadening across the SAF value chain—from modular biorefineries and new feedstock sources to long-term offtake agreements with global airlines. Emerging business models such as Book & Claim are enabling SAF adoption even in regions with limited local production. At the same time, ESG-driven capital flows are incentivizing aviation stakeholders to embed SAF into decarbonization roadmaps across both commercial and military aviation sectors.

Several trends are shaping the next phase of market evolution. These include the development of Power-to-Liquid (PtL) synthetic fuels, the integration of carbon capture and utilization (CCU) in SAF production, and the shift toward full lifecycle carbon accounting in procurement strategies. For example, in May 2025, LanzaJet announced a partnership with BioD to explore Colombia’s first ATJ SAF plant, demonstrating the global expansion of advanced SAF technologies. Meanwhile, BP led a UK Ministry of Defence task force to update SAF co-processing standards—aligning military and commercial aviation toward harmonized emissions frameworks.

International standards such as CORSIA and ASTM approvals are also accelerating adoption by creating a consistent regulatory foundation. As decarbonization becomes a non-negotiable objective for the aviation industry, SAF is emerging not only as a compliance tool but as a competitive differentiator—reshaping the global fuel ecosystem.

Segment Highlights and Performance Overview

By Fuel Type

Biofuel accounts for approximately 79% of the SAF market and remains the dominant fuel type. Technologies such as HEFA are commercially mature and benefit from abundant feedstocks like used cooking oil and animal fats. These biofuels are compatible with current aircraft engines and fueling systems, making them the most widely adopted SAF option globally.

By Blending Capacity

SAF with blending ratios below 30% leads the segment, representing around 74% of total usage. These blends require no modifications to existing aircraft or infrastructure, offering a practical path to adoption. Airlines and fuel providers prefer lower blend ratios due to ease of certification under existing standards such as ASTM D7566 and reduced logistical complexity.

By Aviation Type

Commercial aviation dominates end-use, accounting for approximately 73% of market demand. The sector’s high fuel consumption, regulatory scrutiny, and public visibility are driving strong SAF uptake. Leading airlines are securing multi-year SAF supply agreements to meet emissions targets and future-proof their operations against tightening sustainability regulations.

Geographical Analysis

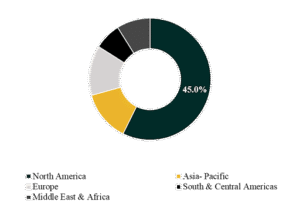

The global sustainable aviation fuel market is examined across key regions, including North America, Europe, Asia-Pacific, South & Central America, and the Middle East & Africa.

North America holds the largest share of the global SAF market, contributing roughly 45% of global production. Strong policy incentives—including the U.S. Inflation Reduction Act and California’s Low Carbon Fuel Standard—alongside major airline investments and a mature SAF producer base are sustaining this leadership.

Asia-Pacific is expected to post the highest CAGR, estimated at approximately 64% over the forecast period. Governments in China, India, Japan, and Singapore are backing large-scale investments in SAF infrastructure, while rising demand for low-emission aviation solutions is accelerating regional adoption. The convergence of policy, demand, and production capacity is positioning Asia-Pacific as the next major growth engine for SAF globally.

Competition Landscape

The global SAF market is defined by a competitive mix of oil & gas multinationals, renewable fuel producers, and aviation supply chain stakeholders. Companies are investing in feedstock innovation, expanding production capacity, and forming strategic alliances to secure long-term market share.

Key players include Neste Oyj, World Energy, Gevo Inc., Velocys plc, Fulcrum BioEnergy, Aemetis Inc., SkyNRG, LanzaJet Inc., LanzaTech Inc., BP, Shell plc, and TotalEnergies SE. These firms are leveraging their technical capabilities and global partnerships to drive commercialization and scale.

Recent Developments

- April 9, 2025 – Neste Oyj launched SAF production at its Rotterdam refinery with a 500,000 tpa capacity, bringing its total global SAF output to 1.5 million tons annually. This expansion significantly improves supply availability and cost efficiency, reinforcing Europe’s leadership in SAF deployment.

- February 14, 2025 – Aemetis Inc. achieved a $2 billion revenue milestone and announced a new energy efficiency initiative to reduce the carbon intensity of its ethanol plant. This development signals growing commercial viability and investor confidence in SAF as a long-term fuel solution.

Segmentations

By Fuel Type:

- Biofuel

- Hydrogen Fuel

- Electrofuels

By Blending Capacity:

- Below 30%

- 30%–50%

- Above 50%

Aviation Type:

- Commercial

- Cargo

- Military

Companies:

- Neste Oyj

- World Energy

- Gevo Inc.

- Velocys plc

- Fulcrum BioEnergy

- Aemetis, Inc.

- SkyNRG

- LanzaJet, Inc.

- LanzaTech Inc.

- BP (British Petroleum)

- Shell plc

- TotalEnergies SE

Need Deeper Insights or Custom Analysis?

Contact Blackwater Business Consulting to explore how this data can drive your strategic goals.