Global Urban Air Mobility Market: Innovations, Growth Avenues, and Industry Dynamics 2025–2030

The Global Urban Air Mobility Market is analyzed in this report across mobility type, platform, mode of operation, and region, highlighting major trends and growth forecasts for each segment.

Let's Get You Started!

Fill out the quick form below and our academic advisor will connect with you shortly.

- Aerospace & Defense

The Global Urban Air Mobility Market is analyzed in this report across mobility type, platform, mode of operation, and region, highlighting major trends and growth forecasts for each segment.

Introduction

Urban Air Mobility (UAM) is transforming the landscape of urban and suburban transit by introducing aerial mobility solutions that alleviate ground level congestion. At the heart of this transformation are electric vertical takeoff and landing (eVTOL) aircraft designed for rapid, clean, and efficient transport of passengers and goods within densely populated corridors. Applications range from on demand air taxis to critical services like emergency medical transport and rapid logistics, positioning UAM as a cornerstone of next generation smart city infrastructure.

The global UAM market is expanding rapidly and is expected to reach USD 35.8 billion by 2030. Key drivers include rising urbanization, worsening traffic congestion, technological advances in propulsion and automation, and increasing awareness of environmental sustainability. Strong momentum is also being driven by significant public and private sector investment, alongside growing consumer demand for faster, greener transport alternatives. From a 2024 base of USD 4.2 billion, the market is projected to grow at a robust CAGR of 15% through the forecast period.

Market Dynamics

The UAM sector is advancing rapidly, shaped by technology breakthroughs, supportive regulation, and evolving urban transportation priorities. A primary catalyst is the growing demand for faster, congestion free alternatives to traditional ground mobility. In response, public and private sectors are ramping up investments in eVTOL aircraft and the enabling infrastructure. Developments in electric propulsion, next gen battery technology, and autonomous flight systems are fast tracking commercialization. Environmental sustainability and the need for urban decarbonization are reinforcing the sector’s relevance, with city planners and regulators increasingly integrating UAM into long term mobility strategies. Strategic collaborations across aerospace manufacturers, technology providers, and urban authorities are accelerating pilot programs, ecosystem readiness, and commercialization timelines.

The market offers substantial opportunities across multiple fronts. Vertiport development, AI based air traffic management, and commercialization of air taxi services are among the most promising areas. Emerging use cases in logistics, emergency response, and surveillance are creating additional demand channels. Companies are investing heavily in scalable architectures, autonomous navigation, and airspace integration systems to accommodate anticipated growth.

Key trends are redefining the competitive and operational environment. These include the use of artificial intelligence and digital twin models in aircraft development, the emergence of hybrid electric propulsion for greater range, and urban planning tailored to UAM infrastructure. Industry milestones such as Wisk Aero’s partnership with NASA and EHang’s regulatory certification in China highlight growing maturity in autonomous flight and policy frameworks. As the sector evolves, public acceptance, noise mitigation, and safety standards are becoming central to commercial viability. Partnerships with ride hailing and logistics providers are also gaining momentum, positioning UAM as a practical component of integrated urban mobility over the next decade.

Segment Highlights and Performance Overview

By Mobility Type

Air taxis dominate the mobility segment, representing approximately 44% of the market. Their appeal lies in the potential to revolutionize short range intra city travel by offering faster, congestion free alternatives. Significant investments from major players in vehicle development and certification are supporting this growth, particularly in high density metro areas. Strategic partnerships between aircraft manufacturers and ride hailing platforms are advancing commercialization efforts.

By Platform

Rotary wing platforms lead the market with about 70% share, thanks to their ability to perform VTOL operations without requiring conventional runways. Their mechanical simplicity, agility, and proven aerodynamic performance make them ideal for urban environments. These characteristics position rotary wing platforms as the current backbone of early stage UAM deployments.

By Mode of Operation

Piloted aircraft currently dominate, holding around 56% of the market. Regulatory conservatism and safety considerations continue to favor piloted operations over autonomous ones in the short term. Human oversight offers greater assurance in early deployments, particularly for passenger applications. While autonomous UAM is expected to grow, piloted models remain the default approach for gaining regulatory and public trust during initial commercialization phases.

Geographical Analysis

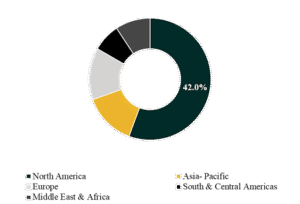

The global urban air mobility market is examined across key regions, including North America, Europe, Asia Pacific, South & Central America, and the Middle East & Africa.

North America currently leads the global UAM market, capturing between 41% and 42.5% of overall market share. This position is supported by a robust aerospace industry, progressive regulatory frameworks, and strong participation from leading eVTOL developers. Early adoption initiatives, coupled with urban mobility partnerships, are catalyzing the region’s leadership in commercial trials and infrastructure deployment.

Asia Pacific is projected to experience the fastest growth, with a forecasted CAGR between 36% and 40%. Rapid urban expansion, significant investment in smart city frameworks, and government backed UAM initiatives are fueling demand across countries like China, Japan, South Korea, and India. The region’s focus on innovation and infrastructure modernization positions it as a critical driver of global UAM adoption.

Competition Landscape

The UAM industry is highly dynamic, marked by a mix of traditional aerospace firms, emerging eVTOL manufacturers, infrastructure developers, and mobility service providers. Players are competing through technology innovation, strategic alliances, and rapid regulatory alignment to secure early market leadership.

Notable companies shaping the market include Joby Aviation, Archer Aviation, Lilium GmbH, Vertical Aerospace, Volocopter GmbH, EHang Holdings, Wisk Aero, Beta Technologies, Overair, and SkyDrive Inc. These firms are focusing on aircraft certification, operational readiness, and infrastructure partnerships to build scalable UAM ecosystems.

Recent Developments

- On June 19, 2025, Archer Aviation announced a partnership with Palantir to integrate AI and large language models (LLMs) into emergency flight manuals and air traffic control (ATC) route planning. This development reflects a strategic move toward AI enhanced flight safety and operational efficiency, reinforcing Archer’s leadership in intelligent aviation systems and strengthening investor confidence.

- In February 2025, Vertical Aerospace completed Phase 2 of flight testing for its VX4 tiltrotor prototype. This milestone advances the program toward piloted wingborne operations and targets a commercial launch by 2028. The progress signals growing engineering maturity within the eVTOL sector and highlights the viability of tiltrotor architectures for urban air transport.

Segmentation included in the report:

By Mobility Type:

- Air Taxi

- Personal Air Vehicles

- Cargo Air Vehicle

- Air Shuttles & Metros

By Platform:

- Rotary Wings

- Fixed Wings

By Mode of Operation:

- Piloted

- Autonomous

Companies:

- Joby Aviation

- Archer Aviation

- Lilium GmbH

- Vertical Aerospace

- Volocopter GmbH

- EHang Holdings

- Wisk Aero

- Beta Technologies

- Overair

- SkyDrive Inc.

Need Deeper Insights or Custom Analysis?

Contact Blackwater Business Consulting to explore how this data can drive your strategic goals.