Global VSAT (Very Small Aperture Terminal) Market: Disruptive Innovations, Growth Pathways, and Strategic Industry Insights 2025–2030

The Global VSAT (Very Small Aperture Terminal) Market is analyzed in this report across type, platform, frequency band, end-use industry, and region, highlighting major trends and growth forecasts for each segment

Let's Get You Started!

Fill out the quick form below and our academic advisor will connect with you shortly.

- Aerospace & Defense

The Global VSAT (Very Small Aperture Terminal) Market is analyzed in this report across type, platform, frequency band, end-use industry, and region, highlighting major trends and growth forecasts for each segment

Introduction

VSAT (Very Small Aperture Terminal) technology plays a pivotal role in delivering high-speed, reliable satellite communications, especially in remote and mobile environments. It has become a foundational solution for enabling seamless data, voice, and video transmission across land, sea, and air. By enhancing connectivity in challenging locations, VSAT is driving progress in sectors such as maritime and aviation communications, defense and government operations, remote enterprise networking, and emergency response systems.

The global VSAT market is expanding rapidly, with projections indicating it will reach USD 20.06 billion by 2030. Growth is being fueled by rising demand for uninterrupted broadband in underserved and offshore regions, increased global trade and mobility, and continued innovation in satellite constellations. Additionally, heightened requirements for secure, high-bandwidth communications in defense, government, and industrial settings are accelerating adoption. With a market value of approximately USD 10.10 billion in 2024, the sector is expected to grow at a CAGR of 11.7% over the forecast period.

Market Dynamics

The VSAT market is experiencing strong momentum, underpinned by several key growth drivers. The demand for dependable broadband access in remote and rural areas continues to rise, while satellite-based communication is becoming essential across maritime, aviation, and defense use cases. Technological advancements—particularly in high-throughput satellites (HTS) and low Earth orbit (LEO) constellations—are significantly improving network capacity and coverage. As a result, VSAT is becoming integral to enterprise and government networks, offering secure, real-time data exchange that boosts operational performance.

Critical sectors such as oil & gas, mining, and disaster management are increasingly dependent on VSAT solutions where terrestrial infrastructure is limited or nonexistent. The growing need for connectivity on the move, particularly in maritime vessels and aircraft, is being amplified by expanding global trade and logistics. In India, government frameworks such as the Department of Telecommunications’ Captive VSAT CUG licensing have supported the deployment of secure, private satellite communications for enterprise and public applications. Meanwhile, heightened cybersecurity awareness has prompted agencies like the U.S. National Security Agency to issue best-practice guidelines for safeguarding VSAT systems—reinforcing the importance of encryption, secure configurations, and continuous network monitoring in high-stakes environments.

The market presents strong opportunities across multiple verticals. Maritime and in-flight connectivity services are rapidly scaling, while defense and emergency response agencies are increasing their reliance on VSAT for mission-critical operations. The growing adoption of satellite-based IoT and machine-to-machine (M2M) applications is unlocking additional use cases in industrial automation. Service providers are advancing their capabilities through technologies such as electronically steerable antennas, adaptive coding, and bandwidth optimization to enhance efficiency and reduce costs—broadening access to VSAT solutions across customer segments. At the same time, governments and NGOs are leveraging the technology to bridge digital divides, enabling remote education, healthcare, and e-governance in underserved regions.

Key industry trends are shaping the next phase of growth. These include the convergence of satellite and terrestrial networks, the deployment of software-defined satellites for dynamic bandwidth allocation, and rising demand for portable, flat-panel VSAT terminals. The transition toward Ka-band and hybrid-orbit architectures is enabling higher speeds and broader coverage, while cloud-based network management tools are streamlining service delivery and scalability. Increasingly, VSAT systems are also being used for intelligent applications such as real-time analytics, asset tracking, and autonomous monitoring—signaling a broader shift toward smarter, more resilient communication networks.

Segment Highlights and Performance Overview

By Type

Fixed VSAT systems represent the largest share of the market, accounting for over 60% of the type segment. These systems are widely deployed in static, remote locations where stable, high-capacity satellite communication is essential. Their dependability and scalability make them the preferred solution for sectors such as oil & gas, defense, and telecommunications, where continuous uptime is critical to operations.

By Platform

Land-based VSAT platforms dominate the market with approximately 47.8% share, driven by their extensive deployment across enterprise networks, government infrastructure, and public service applications. Increased investment in rural broadband initiatives and disaster recovery systems has further reinforced demand for terrestrial VSAT deployments around the world.

By Frequency Band

Ku-band leads the frequency band segment, holding around 41.6% of the market share. Its balanced offering of high bandwidth and broad coverage, along with compatibility across a wide range of VSAT terminals, makes it a versatile choice. The frequency is widely used across maritime, aviation, and enterprise networks due to its reliability and cost-effectiveness.

By End-Use Industry

The oil & gas industry is the largest end-use segment, driven by the need for robust, uninterrupted communications on offshore rigs and remote exploration sites. VSAT enables real-time operational monitoring, supports crew welfare, and ensures reliable safety communications in harsh environments—making it indispensable to this sector.

Geographical Analysis

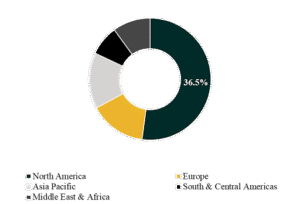

The global VSAT market spans key regions, including North America, Europe, Asia-Pacific, South & Central America, and the Middle East & Africa.

North America leads the market with a share of approximately 36.5%, supported by advanced satellite infrastructure, strong public sector investment, and a high concentration of leading satellite communication providers. Meanwhile, the Asia-Pacific region is expected to register the fastest growth, with a projected CAGR of 8% to 10%. This acceleration is driven by ongoing broadband rollout programs, rising demand for maritime and aviation connectivity, and increasing deployment of VSAT systems in remote regions across China, India, and Japan.

Competition Landscape

The competitive landscape of the VSAT market is defined by the presence of established satellite operators, hardware manufacturers, and network service providers. These players are focused on enhancing technological capabilities, expanding network capacity, and forming strategic alliances to solidify their market positions.

Key companies profiled in this report include Hughes Network Systems, LLC, Viasat Inc., Gilat Satellite Networks Ltd., Comtech Telecommunications Corp., SES S.A., Intelsat S.A., Inmarsat Global Ltd., KVH Industries, Inc., Advantech Wireless Technologies Inc., and ST Engineering iDirect. These firms are leveraging R&D, system integration, and global partnerships to meet the growing demand for secure and high-performance satellite communications.

Recent Developments

- On June 26, 2025, Hughes announced its use of Microsoft Azure AI Foundry to develop 12 new production applications, including tools for automated sales call auditing, customer retention analytics, and field service automation. This initiative strengthens Hughes’ competitive positioning by integrating AI to improve operational efficiency and enhance service delivery—signaling a broader industry shift toward intelligent satellite network management.

- On July 1, 2025, Viasat’s Inmarsat Maritime division reported over 1,000 orders for its NexusWave connectivity service within six months of launch. This rapid adoption underscores growing demand for reliable, high-speed satellite connectivity in maritime operations. The strong market response reinforces Viasat’s leadership in the sector and highlights a clear trend toward digital transformation in global shipping and offshore industries.

Segmentations:

By Type:

- Fixed VSAT

- Mobile VSAT

- Portable VSAT

By Platform:

- Land VSAT

- Maritime VSAT

- Airborne VSAT

By Frequency Band:

- C-Band

- Ku-Band

- Ka-Band

- Others

By End-Use Industry:

- Maritime

- Aviation

- Oil & Gas

- Mining

- Government & Defense

- Telecom

- Banking, Financial Services & Insurance (BFSI)

- Retail

- Others

Companies:

- Hughes Network Systems, LLC

- Viasat Inc.

- Gilat Satellite Networks Ltd.

- Comtech Telecommunications Corp.

- SES S.A.

- Intelsat S.A.

- Inmarsat Global Ltd.

- KVH Industries, Inc.

- Advantech Wireless Technologies Inc.

- ST Engineering iDirect

Need Deeper Insights or Custom Analysis?

Contact Blackwater Business Consulting to explore how this data can drive your strategic goals.